Yen At 125 Less Black Swan Than Gray Under Ishiba

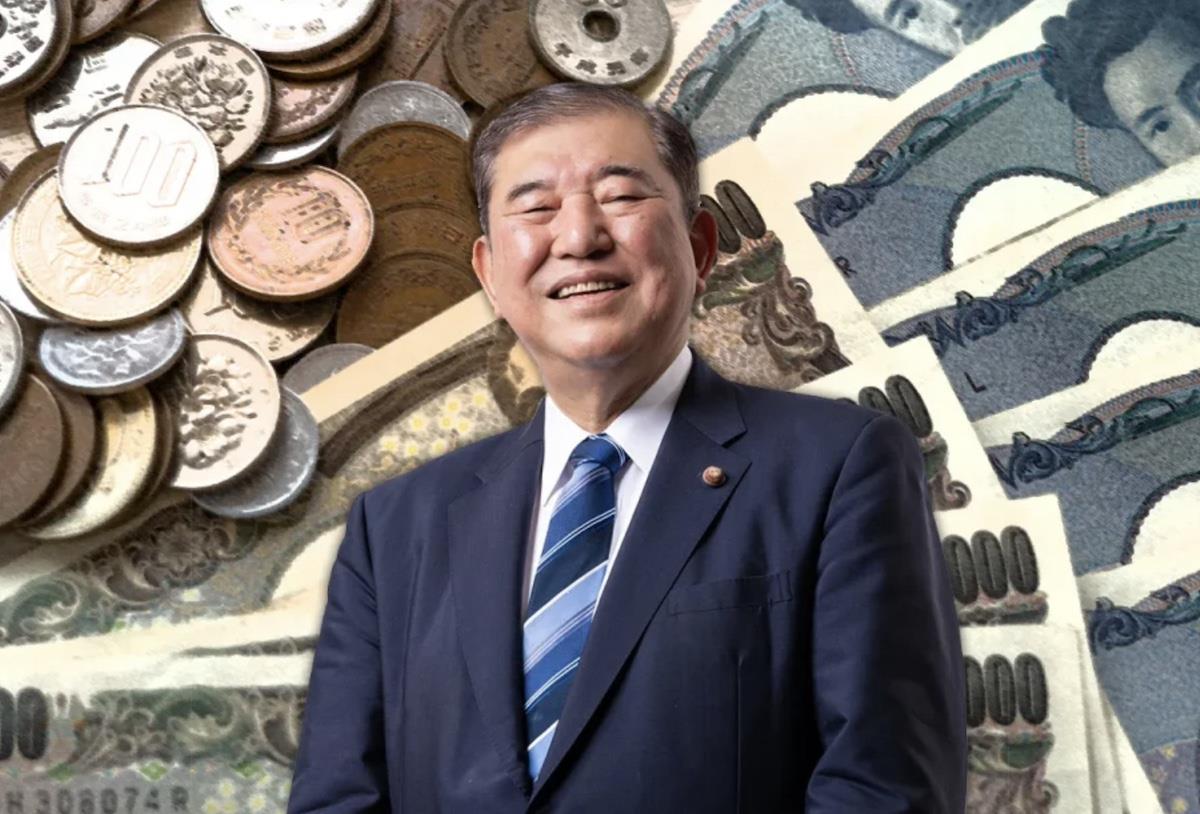

The reference here, of course, is to the surprise election of Shigeru Ishiba as Japan's likely next prime minister. The veteran lawmaker, a self-described“lone wolf,” seemed to come out of nowhere last week to best eight other candidates for the ruling Liberal Democratic Party's leadership.

Yet the real surprise may be how Ishiba's long-held views set the stage for an epic yen rally.

For now, Ishiba, 67, is downplaying his preference for Bank of Japan rate hikes and a stronger yen. The yen is sliding this week as traders bet Ishiba might not be the monetary hawk they feared. They're likely wrong.

Clearly, Ishiba's advisors warned him that even BOJ Governor Kazuo Ueda is sheepish about more tightening. Odds are, too, Ishiba's inner circle is looking at slowing economic conditions

- and China's downshift - and realizing now might not be the time for further increases in borrowing costs .

But Ishiba's predilections for higher rates and a rising yen probably won't be held at bay for long. Since

July 31, when the BOJ hiked short-term rates to their highest level since 2008, the yen has given up its sharp 2024 losses. In late June, it passed the 161 to the US mark, the lowest in more than 37 years.

Since then, the currency has rallied more than 9%, trading on October 3 at around 147 to the greenback. And as Ishiba settles in as prime minister, odds are high that the yen rally will kick into an even higher gear. Could it go to 125 or higher? Hence the worries about a coming“Ishiba shock.”

First, Ishiba's LDP must prevail at the September 27 snap election, the odds of which are good given the enduring disarray among opposition parties. Once Ishiba settles in, BOJ officials are likely to feel he has their backs as they seek to put zero rates in the rearview mirror.

It's Ishiba's long-held belief that the ultra-weak yen is doing more harm than good. As recently as August, he told Reuters that“the Bank of Japan is on the right policy track to gradually align with a world with positive interest rates.”

Ishiba went on to say that“the negative aspects of rate hikes, such as a stock market rout, have been the focus right now, but we must recognize their merits as higher interest rates can lower costs of imports and make industry more competitive.”

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment