403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Recent statistics highlights 79 percent increase in value of instant electronic payments

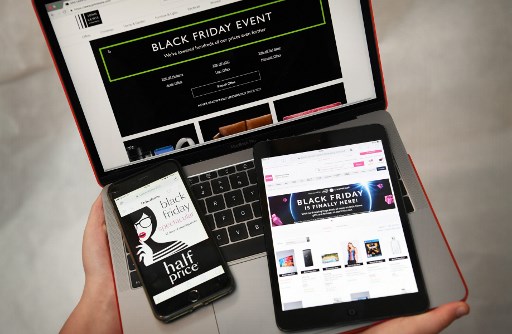

(MENAFN) Recent statistics have highlighted a significant 79percent increase in the value of instant electronic payments processed through the Jumobi system during the first eight months of this year compared to the same period last year. This surge illustrates a growing trend toward digital payment solutions among users.

Data reveals that the total value of instant digital payments via Jumobi surpassed an impressive 3.4 billion dinars by the end of August. The user base for this system expanded to approximately 2.3 million, indicating a strong uptick in adoption.

The monthly report from the Jordan Payment and Clearing Systems Company (Jopac) noted that the value of instant payments through Jumobi rose by 1.5 billion dinars compared to last year’s total of 1.9 billion dinars during the same timeframe.

Analyzing the types of payments made, the report showed that the "Money Transfer" service dominated, making up 86percent of the total payment value. Other services included withdrawals at 6.6%, deposits at 4.1%, and purchases at 3.5%. A notable portion of the money transfers was used to send funds to family and friends, underscoring the system’s importance in facilitating personal financial transactions.

Jumobi functions as an electronic platform enabling mobile payment services through e-wallets, which are registered within the system for smooth financial transactions between e-wallets and bank accounts. An e-wallet serves as a digital financial account accessible through a smartphone application and linked to a unique account number. In Jordan, each individual is allowed to open up to two e-wallets.

Furthermore, the figures indicate that users of the Jumobi system conducted around 34.4 million payment transactions during the first eight months of this year. This high transaction volume reflects the increasing trust and reliance on digital payment methods in the region, signaling a significant shift toward more modern financial practices. The continued growth of the Jumobi system may have far-reaching implications for the future of digital finance in Jordan, as more individuals recognize and embrace the convenience and efficiency offered by electronic payment solutions.

Data reveals that the total value of instant digital payments via Jumobi surpassed an impressive 3.4 billion dinars by the end of August. The user base for this system expanded to approximately 2.3 million, indicating a strong uptick in adoption.

The monthly report from the Jordan Payment and Clearing Systems Company (Jopac) noted that the value of instant payments through Jumobi rose by 1.5 billion dinars compared to last year’s total of 1.9 billion dinars during the same timeframe.

Analyzing the types of payments made, the report showed that the "Money Transfer" service dominated, making up 86percent of the total payment value. Other services included withdrawals at 6.6%, deposits at 4.1%, and purchases at 3.5%. A notable portion of the money transfers was used to send funds to family and friends, underscoring the system’s importance in facilitating personal financial transactions.

Jumobi functions as an electronic platform enabling mobile payment services through e-wallets, which are registered within the system for smooth financial transactions between e-wallets and bank accounts. An e-wallet serves as a digital financial account accessible through a smartphone application and linked to a unique account number. In Jordan, each individual is allowed to open up to two e-wallets.

Furthermore, the figures indicate that users of the Jumobi system conducted around 34.4 million payment transactions during the first eight months of this year. This high transaction volume reflects the increasing trust and reliance on digital payment methods in the region, signaling a significant shift toward more modern financial practices. The continued growth of the Jumobi system may have far-reaching implications for the future of digital finance in Jordan, as more individuals recognize and embrace the convenience and efficiency offered by electronic payment solutions.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment