NEW GOLD ANNOUNCES CONTINUED GROWTH AT NEW AFTON's K-ZONE AND HW ZONE

| 1All gold and copper grades are reported uncapped. It has yet to be determined whether further exploration will result in the target being delineated as a mineral resource. Additional data and further interpretation work are expected to better define the geometry and extent of the mineralized zones. |

| 2Indicative copper equivalent (CuEq) grades are included for context, estimated using price assumptions of US$3.50 per pound of copper, US$1,500 per ounce of gold, and US$21.00 per ounce of silver. |

High-Grade Copper-Gold Mineralization Intersected Within HW Zone

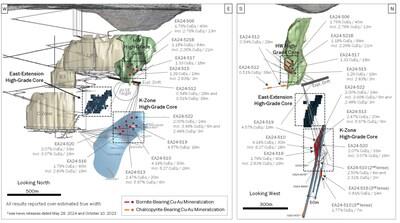

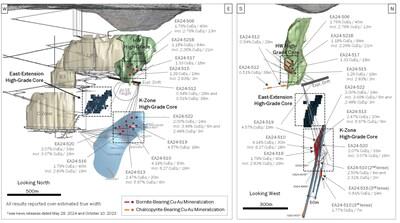

The exploration drift also provides a drilling platform for expanding and defining the HW Zone and testing the extents of the AI-Southeast target, which until recently were difficult to drill at favorable orientations. New drilling intersected high-grade copper-gold mineralization within the lower part of the HW Zone (Figure 1).

-

HW Zone drilling highlights1,2:

-

1.05% copper mineralization and 1.08 g/t gold and (1.76 CuEq%) over 51 metres core length (40 metres estimated true width) in Borehole EA24-506 including:

-

1.75% copper mineralization and 1.49 g/t gold (2.76 CuEq%) over 16 metres core length (13 metres estimated true width) in bornite-bearing zone

-

0.90% copper mineralization and 2.12 g/t gold (2.26 CuEq%) over 24 metres core length (21 metres estimated true width) in bornite-bearing zone

| 1All gold and copper grades are reported uncapped. It has yet to be determined whether further exploration will result in the target being delineated as a mineral resource. Additional data and further interpretation work are expected to better define the geometry and extent of the mineralized zones. |

| 2Indicative copper equivalent (CuEq) grades are included for context, estimated using price assumptions of US$3.50 per pound of copper, US$1,500 per ounce of gold, and US$21.00 per ounce of silver. |

Exploration Budget Increased by $3 Million to the End of 2024

Based on the exploration successes to date, the Company intends to allocate an additional $3 million to the 2024 New Afton exploration program which will provide approximately 10,000 metres of additional drilling to continue defining the footprint of the eastern high-grade zones from the exploration drift.

"Similar to Rainy River, the exploration successes at New Afton support the Company's approach to optimize net asset value with modest investment and leveraging the existing infrastructure," added Mr. Godin. "With the completion of the underground exploration drift in the second quarter, we are well positioned to grow and define the eastern high-grade zones, with an objective to report initial mineral resources at K-Zone for year-end 2024."

Table 1: New Afton Notable Exploration Drilling Results from Exploration Drift1,2

| Zone |

Drill Hole |

|

From |

To |

Interval |

Estimated |

Cu |

Au |

Ag |

CuEq |

AuEq |

| K-Zone |

EA24-510 |

|

405.0 |

489.0 |

84.0 |

30 |

2.83 |

1.90 |

14.15 |

4.14 |

6.63 |

| including (bornite zone) |

419.9 |

469.5 |

49.5 |

18 |

4.18 |

3.03 |

22.58 |

6.27 |

10.03 |

||

| EA24-510 |

|

543.0 |

599.0 |

56.0 |

18 |

1.22 |

0.30 |

1.78 |

1.42 |

2.28 |

|

| including (bornite zone) |

545.5 |

557.1 |

11.7 |

4 |

2.47 |

0.02 |

1.62 |

2.50 |

3.99 |

||

| including (bornite zone) |

574.0 |

579.0 |

5.0 |

2 |

1.71 |

0.91 |

3.77 |

2.31 |

3.70 |

||

| EA24-510 |

|

623.0 |

642.0 |

19.0 |

7 |

0.76 |

1.58 |

2.21 |

1.77 |

2.83 |

|

| EA24-513 |

|

389.2 |

425.0 |

35.9 |

20 |

1.70 |

1.11 |

9.05 |

2.47 |

3.96 |

|

| including (bornite zone) |

389.2 |

401.5 |

12.3 |

6 |

3.48 |

3.16 |

24.77 |

5.67 |

9.07 |

||

| EA24-516 |

|

451.0 |

620.0 |

169.0 |

40 |

0.99 |

1.23 |

3.89 |

1.79 |

2.87 |

|

| including (bornite zone) |

472.0 |

548.0 |

76.0 |

19 |

1.60 |

1.87 |

6.85 |

2.83 |

4.53 |

||

| EA24-516 |

|

630.0 |

676.0 |

46.0 |

14 |

0.35 |

0.72 |

0.96 |

0.81 |

1.29 |

|

| EA24-516 |

|

704.0 |

718.0 |

14.0 |

6 |

0.44 |

0.58 |

0.42 |

0.81 |

1.29 |

|

| EA24-519 |

Bornite zone |

385.0 |

421.0 |

36.0 |

19 |

3.25 |

1.91 |

14.72 |

4.57 |

7.32 |

|

| EA24-520 |

|

424.0 |

517.1 |

93.1 |

33 |

1.13 |

1.43 |

5.21 |

2.07 |

3.31 |

|

| including (bornite zone) |

442.0 |

496.0 |

54.0 |

19 |

1.66 |

2.14 |

8.55 |

3.07 |

4.92 |

||

| EA24-522 |

|

343.0 |

381.0 |

38.0 |

24 |

1.67 |

0.47 |

4.50 |

2.00 |

3.20 |

|

| including (bornite zone) |

343.0 |

357.0 |

14.0 |

6 |

2.74 |

1.07 |

9.46 |

3.49 |

5.59 |

||

| including (bornite zone) |

371.0 |

377.0 |

6.0 |

3 |

2.21 |

0.41 |

1.87 |

2.48 |

3.97 |

||

| HW Zone |

EA24-506 |

|

105.8 |

118.0 |

12.2 |

10 |

0.37 |

0.48 |

0.92 |

0.68 |

1.09 |

| EA24-506 |

|

125.7 |

136.0 |

10.3 |

8 |

0.43 |

0.57 |

1.27 |

0.79 |

1.27 |

|

| EA24-506 |

|

202.0 |

252.9 |

50.9 |

40 |

1.05 |

1.08 |

4.04 |

1.76 |

2.82 |

|

| including (bornite zone) |

215.1 |

231.5 |

16.5 |

13 |

1.75 |

1.49 |

8.57 |

2.76 |

4.41 |

||

| EA24-506 |

|

263.2 |

271.7 |

8.5 |

7 |

0.15 |

0.69 |

0.63 |

0.59 |

0.94 |

|

| EA24-507 |

|

167.3 |

175.0 |

7.7 |

6 |

0.30 |

0.13 |

0.45 |

0.38 |

0.61 |

|

| EA24-515 |

|

68.0 |

94.0 |

26.0 |

23 |

0.28 |

0.35 |

2.21 |

0.52 |

0.83 |

|

| EA24-515 |

|

114.0 |

136.0 |

22.0 |

19 |

0.61 |

1.07 |

1.56 |

1.29 |

2.07 |

|

| including (bornite zone) |

124.0 |

128.0 |

4.0 |

3 |

1.48 |

2.11 |

3.55 |

2.83 |

4.53 |

||

| EA24-515 |

|

182.0 |

208.0 |

26.0 |

23 |

0.42 |

0.55 |

1.57 |

0.78 |

1.24 |

|

| EA24-517 |

|

154.0 |

176.0 |

22.0 |

18 |

0.55 |

1.23 |

1.27 |

1.33 |

2.13 |

|

| EA24-521B |

|

121.0 |

215.0 |

94.0 |

84 |

0.49 |

1.08 |

1.90 |

1.18 |

1.89 |

|

| including (bornite zone) |

167.0 |

191.0 |

24.0 |

21 |

0.90 |

2.12 |

3.58 |

2.26 |

3.61 |

||

| AI-Southeast |

EA24-512 |

|

152.2 |

182.0 |

29.8 |

28 |

0.30 |

0.36 |

1.95 |

0.54 |

0.87 |

| EA24-512 |

|

226.8 |

266.9 |

40.1 |

38 |

0.29 |

0.34 |

0.58 |

0.51 |

0.81 |

| 1Notable drilling intervals are defined with average grade above mining cut-off grade of 0.4% CuEq. |

| 2Indicative gold equivalent (AuEq) grades are included for context, estimated using price assumptions of US$3.50 per pound of copper, US$1,500 per ounce of gold and US$21.00 per ounce of silver. |

New Afton Exploration Drilling Results

Exploration efforts at New Afton remain focused on potential near-mine mineralized zones located near the C-Zone extraction level to minimize capital investment and maximize free cash flow generation. Earlier this year (see May 29, 2024 news release), the Company reported the discovery of high-grade copper-gold porphyry mineralization at K-Zone over strike lengths exceeding 200 metres and estimated true widths up to 40 metres. Completion of the underground exploration drift in the second quarter allows the Company to drill K-Zone from a better angle. The exploration drift provides a better platform to define and extend other zones to the east of the existing mine, including HW Zone and AI-Southeast target.

At K-Zone, boreholes drilled from the exploration drift support the estimated true widths of previously disclosed intercepts with grades locally exceeding past mineralized intervals. Additionally, the new boreholes from the exploration drift extend beyond the footwall of the main zone and intersect additional sub-parallel high-grade zones forming an overall system reaching 50 metres in width and over 300 metres in strike length. K-Zone remains open in all directions and drilling is ongoing to define the size of the K-Zone system.

At HW Zone, Boreholes EA24-506 and EA24-521B intersected high-grade bornite-bearing copper-gold mineralization interpreted as a high-grade core. The ongoing drilling program targets both the continuation of the high-grade HW Zone to the east and the down-dip extension of the mineralized zone previously intersected in Borehole EA21-302 (see October 10, 2023 news release) which constitutes the AI-Southeast target.

All new notable K-Zone, HW Zone, and AI-Southeast drilling intercepts are summarized in Table 1 and Figure 1 below. Locations and orientations of all drilling are listed in Table 2. Indicative copper equivalent (CuEq) and gold equivalent (AuEq) grades are included for context, estimated using price assumptions of US$3.50 per pound of copper, US$1,500 per ounce of gold, and US$21.00 per ounce of silver.

Figure 1: New Afton Notable Drill Intercepts from Exploration Drift

Table 2: All New Exploration Diamond Drilling Location and Orientation from Exploration Drift at New Afton

| Drill Hole |

Azimuth |

Dip |

Length (m) |

UTM Easting (m) |

UTM Northing (m) |

Elevation (m) |

| EA24-506 |

165 |

+34 |

341 |

675,595 |

5,614,949 |

-12 |

| EA24-507 |

191 |

+28 |

305 |

675,596 |

5,614,949 |

-12 |

| EA24-508 |

174 |

+14 |

299 |

675,597 |

5,614,946 |

-13 |

| EA24-509 |

211 |

-48 |

405 |

675,597 |

5,614,947 |

-11 |

| EA24-510 |

314 |

-73 |

642 |

675,763 |

5,615,015 |

-36 |

| EA24-511 |

210 |

-7 |

200 |

675,695 |

5,614,980 |

-26 |

| EA24-512 |

174 |

-8 |

308 |

675,695 |

5,614,980 |

-26 |

| EA24-513 |

313 |

-65 |

608 |

675,763 |

5,615,015 |

-36 |

| EA24-514 |

193 |

-30 |

281 |

675,696 |

5,614,977 |

-23 |

| EA24-515 |

192 |

+29 |

269 |

675,697 |

5,614,978 |

-23 |

| EA24-516 |

302 |

-68 |

768 |

675,767 |

5,615,017 |

-39 |

| EA24-517 |

109 |

+37 |

296 |

675,698 |

5,614,978 |

-23 |

| EA24-518 |

95 |

+24 |

398 |

675,696 |

5,614,977 |

-23 |

| EA24-519 |

279 |

-74 |

686 |

675,763 |

5,615,016 |

-38 |

| EA24-520 |

251 |

-63 |

641 |

675,759 |

5,615,015 |

-39 |

| EA24-521B |

125 |

+39 |

366 |

675,696 |

5,614,977 |

-23 |

| EA24-522 |

280 |

-67 |

567 |

675,763 |

5,615,016 |

-38 |

About New Gold

New Gold is a Canadian-focused intermediate mining company with a portfolio of two core producing assets in Canada, the Rainy River gold mine and the New Afton copper-gold mine. The Company also holds other Canadian-focused investments. New Gold's vision is to build a leading diversified intermediate gold company based in Canada that is committed to the environment and social responsibility. For further information on the Company, visit .

Cautionary Note Regarding Forward-Looking Statements

Certain information contained in this news release, including any information relating to New Gold's future financial or operating performance are "forward-looking". All statements in this news release, other than statements of historical fact, which address events, results, outcomes or developments that New Gold expects to occur are "forward-looking statements". Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the use of forward-looking terminology such as "plans", "expects", "is expected", "budget", "scheduled", "targeted", "estimates", "forecasts", "intends", "anticipates", "projects", "potential", "believes" or variations of such words and phrases or statements that certain actions, events or results "may", "could", "would", "should", "might" or "will be taken", "occur" or "be achieved" or the negative connotation of such terms. Forward-looking statements in this news release include, among others, statements with respect to: expectations regarding the anticipated exploration upside around the New Afton mine and the eastern sector of the mine successfully developing into a promising opportunity for a new high-grade mineralized area; accuracy of expectations regarding the minimized capital and time required to bring the eastern high-grade zones into production; the potential for finding and taking advantage of additional mining opportunities at New Afton; intentions to allocate additional funds to the 2024 New Afton exploration program and expected use of and benefit of funds; successfully growing and defining the eastern high-grade zones and reporting initial mineral resources at K-Zone for year-end 2024; anticipated focus areas and priorities for the Company's exploration program and planned exploration activities; and successfully advancing the Company's strategic opportunities for mine life extension.

All forward-looking statements in this news release are based on the opinions and estimates of management that, while considered reasonable as at the date of this press release in light of management's experience and perception of current conditions and expected developments, are inherently subject to important risk factors and uncertainties, many of which are beyond New Gold's ability to control or predict. Certain material assumptions regarding such forward-looking statements are discussed in this news release, New Gold's latest annual MD&A, its most recent annual information form and technical reports on the New Afton Mine filed on SEDAR+ at and on EDGAR at . In addition to, and subject to, such assumptions discussed in more detail elsewhere, the forward-looking statements in this news release are also subject to the following assumptions: (1) there being no significant disruptions affecting New Gold's operations, including material disruptions to the Company's supply chain, workforce or otherwise; (2) political and legal developments in jurisdictions where New Gold operates, or may in the future operate, being consistent with New Gold's current expectations; (3) the accuracy of New Gold's current Mineral Reserve and Mineral Resource estimates and the grade of gold, silver and copper expected to be mined and the grade of gold, copper and silver expected to be mined; (4) the exchange rate between the Canadian dollar and U.S. dollar, and commodity prices being approximately consistent with current levels and expectations for the purposes of 2024 guidance and otherwise; (5) prices for diesel, natural gas, fuel oil, electricity and other key supplies being approximately consistent with current levels; (6) equipment, labour and materials costs increasing on a basis consistent with New Gold's current expectations; (7) arrangements with First Nations and other Indigenous groups in respect of the New Afton Mine being consistent with New Gold's current expectations; (8) all required permits, licenses and authorizations being obtained from the relevant governments and other relevant stakeholders within the expected timelines and the absence of material negative comments or obstacles during any applicable regulatory processes; and (9) the results of the life of mine plan for the New Afton Mine described herein being realized.

Forward-looking statements are necessarily based on estimates and assumptions that are inherently subject to known and unknown risks, uncertainties and other factors that may cause actual results, level of activity, performance or achievements to be materially different from those expressed or implied by such forward-looking statements. Such factors include, without limitation: price volatility in the spot and forward markets for metals and other commodities; discrepancies between actual and estimated production, between actual and estimated costs, between actual and estimated Mineral Reserves and Mineral Resources and between actual and estimated metallurgical recoveries; equipment malfunction, failure or unavailability; accidents; risks related to early production at the Rainy River Mine, including failure of equipment, machinery, the process circuit or other processes to perform as designed or intended; the speculative nature of mineral exploration and development, including the risks of obtaining and maintaining the validity and enforceability of the necessary licenses and permits and complying with the permitting requirements of each jurisdiction in which New Gold operates, including, but not limited to: uncertainties and unanticipated delays associated with obtaining and maintaining necessary licenses, permits and authorizations and complying with permitting requirements; changes in project parameters as plans continue to be refined; changing costs, timelines and development schedules as it relates to construction; the Company not being able to complete its construction projects at the Rainy River Mine or the New Afton Mine on the anticipated timeline or at all; volatility in the market price of the Company's securities; changes in national and local government legislation in the countries in which New Gold does or may in the future carry on business; compliance with public company disclosure obligations; controls, regulations and political or economic developments in the countries in which New Gold does or may in the future carry on business; the Company's dependence on the Rainy River Mine and New Afton Mine; the Company not being able to complete its exploration drilling programs on the anticipated timeline or at all; inadequate water management and stewardship; tailings storage facilities and structure failures; failing to complete stabilization projects according to plan; geotechnical instability and conditions; disruptions to the Company's workforce at either the Rainy River Mine or the New Afton Mine, or both; significant capital requirements and the availability and management of capital resources; additional funding requirements; diminishing quantities or grades of Mineral Reserves and Mineral Resources; actual results of current exploration or reclamation activities; uncertainties inherent to mining economic studies including the Technical Reports for the Rainy River Mine and New Afton Mine; impairment; unexpected delays and costs inherent to consulting and accommodating rights of First Nations and other Indigenous groups; climate change, environmental risks and hazards and the Company's response thereto; ability to obtain and maintain sufficient insurance; actual results of current exploration or reclamation activities; fluctuations in the international currency markets and in the rates of exchange of the currencies of Canada, the United States and, to a lesser extent, Mexico; global economic and financial conditions and any global or local natural events that may impede the economy or New Gold's ability to carry on business in the normal course; inflation; compliance with debt obligations and maintaining sufficient liquidity; the responses of the relevant governments to any disease, epidemic or pandemic outbreak not being sufficient to contain the impact of such outbreak; disruptions to the Company's supply chain and workforce due to any disease, epidemic or pandemic outbreak; an economic recession or downturn as a result of any disease, epidemic or pandemic outbreak that materially adversely affects the Company's operations or liquidity position; taxation; fluctuation in treatment and refining charges; transportation and processing of unrefined products; rising costs or availability of labour, supplies, fuel and equipment; adequate infrastructure; relationships with communities, governments and other stakeholders; labour disputes; effectiveness of supply chain due diligence; the uncertainties inherent in current and future legal challenges to which New Gold is or may become a party; defective title to mineral claims or property or contests over claims to mineral properties; competition; loss of, or inability to attract, key employees; use of derivative products and hedging transactions; reliance on third-party contractors; counterparty risk and the performance of third party service providers; investment risks and uncertainty relating to the value of equity investments in public companies held by the Company from time to time; the adequacy of internal and disclosure controls; conflicts of interest; the lack of certainty with respect to foreign operations and legal systems, which may not be immune from the influence of political pressure, corruption or other factors that are inconsistent with the rule of law; the successful acquisitions and integration of business arrangements and realizing the intended benefits therefrom; and information systems security threats. In addition, there are risks and hazards associated with the business of mineral exploration, development, construction, operation and mining, including environmental events and hazards, industrial accidents, unusual or unexpected formations, pressures, cave-ins, flooding and gold bullion losses (and the risk of inadequate insurance or inability to obtain insurance to cover these risks) as well as "Risk Factors" included in New Gold's Annual Information Form and other disclosure documents filed on and available on SEDAR+ at and on EDGAR at . Forward-looking statements are not guarantees of future performance, and actual results and future events could materially differ from those anticipated in such statements. All of the forward-looking statements contained in this news release are qualified by these cautionary statements. New Gold expressly disclaims any intention or obligation to update or revise any forward-looking statements whether as a result of new information, events or otherwise, except in accordance with applicable securities laws.

QA/QC Procedure

New Gold maintains a Quality Assurance / Quality Control ("QA/QC") program at its New Afton Mine operation using industry best practices and is consistent with the QA/QC protocols in use at all of the Company's exploration and development projects. Key elements of New Gold's QA/QC program include chain of custody of samples, regular insertion of certified reference standards and blanks, and duplicate check assays. Drill core is sampled at regular two metre intervals, halved and shipped in sealed bags to Activation Laboratories Ltd. in Kamloops, British Columbia. Additional information regarding the Company's data verification and quality assurance processes is set out in the February 28, 2020 New Afton National Instrument 43-101 Technical Report titled "Technical Report on the New Afton Mine, British Columbia, Canada" available on SEDAR+ at

.

Technical Information

The scientific and technical information relating to the drilling update on New Afton has been reviewed and approved by Dr. Jean-François Ravenelle, Vice President, Geology for the Company. All other scientific and technical information contained in this news release has been reviewed and approved by Yohann Bouchard, Executive Vice President and Chief Operating Officer of New Gold. Dr. Ravenelle is a Professional Geologist and a member of the Association of Professional Geoscientists of Ontario and the Ordre des Géologues du Québec. Mr. Bouchard is a Professional Engineer and member of the Professional Engineers of Ontario. Dr. Ravenelle and Mr. Bouchard are each a "Qualified Person" for the purposes of National Instrument 43-101 –

Standards of Disclosure for Mineral Projects.

For additional technical information on New Gold's material properties, including a detailed breakdown of Mineral Reserves and Mineral Resources by category, as well as key assumptions, parameters, and risks, refer to New Gold's Annual Information Form for the year ended December 31, 2023 dated February 21, 2024 filed and available on SEDAR+ at

and on EDGAR at

.

SOURCE New Gold Inc.

WANT YOUR COMPANY'S NEWS FEATURED ON PRNEWSWIRE? 440k+Newsrooms &

Influencers 9k+

Digital Media

Outlets 270k+

Journalists

Opted In GET STARTED

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.

Comments

No comment