RBI To Introduce Unified Lending Interface To Transform Credit Sector

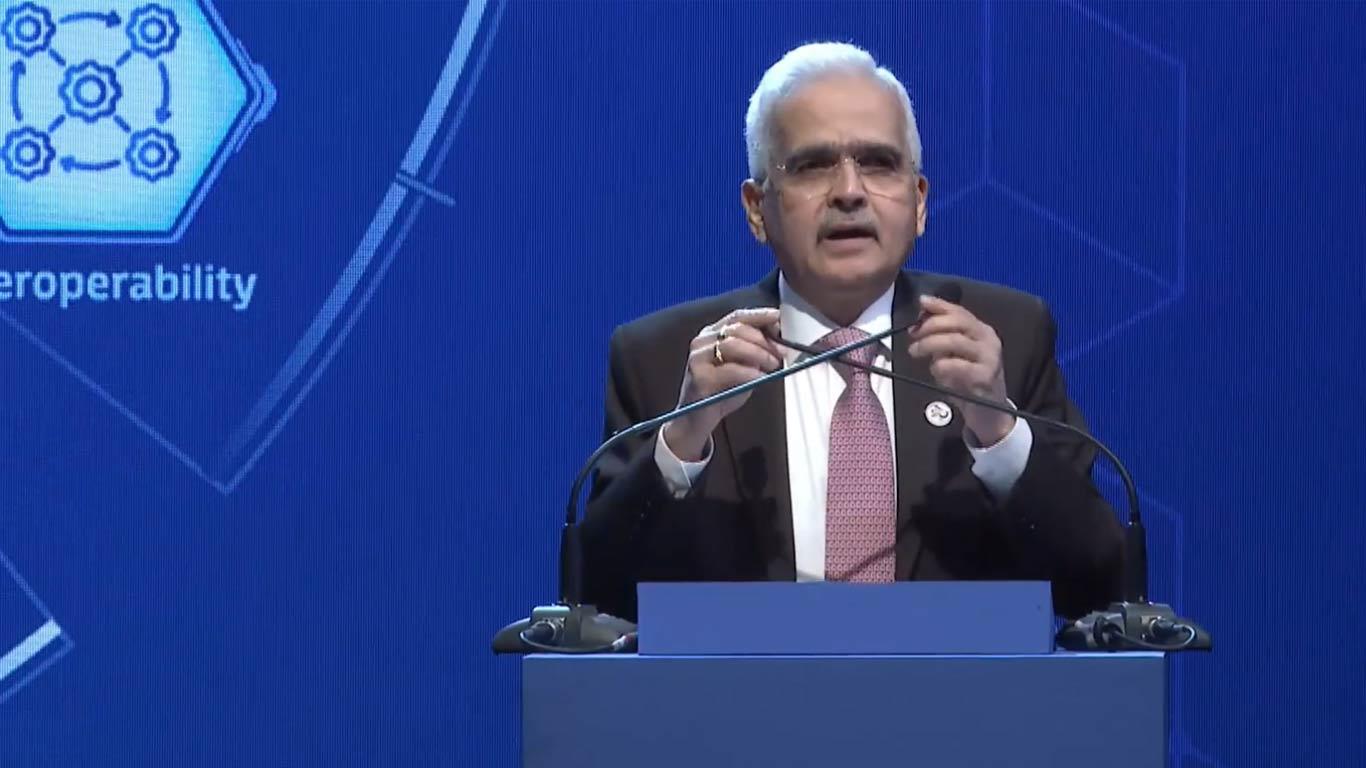

Announced by RBI Governor Shaktikanta Das on Monday in Bengaluru, the ULI is anticipated to have a transformative impact similar to the Unified Payments Interface (UPI) on the payments system.

Das highlighted that the ULI will build on a pilot technology platform launched last year, designed to streamline credit processes by enabling frictionless access to critical data.

The new system will facilitate the seamless, consent-based transfer of digital information, including PAN and Aadhaar records, lending history, income, credit records, and land records from multiple sources to lenders.

The ULI aims to reduce credit appraisal times, particularly benefiting smaller and rural borrowers by employing common, standardised Application Programming Interfaces (APIs). This 'plug and play' approach is expected to simplify digital access to information from various providers.

"The ULI will be introduced nationwide in due course," Das stated, emphasising that the initiative is expected to replicate the UPI's success in reshaping India's financial landscape.

The UPI, launched in 2016, has revolutionised payments by allowing transactions through Virtual Payment Addresses (VPAs), minimising the need to share sensitive banking details.

Das referred to the "new trinity" of JAM-UPI-ULI, where JAM stands for Jan Dhan, Aadhaar, and Mobile. The ULI is anticipated to enhance India's digital infrastructure by offering a user-friendly interface that reduces technical complexities and documentation requirements.

The RBI Governor also noted that by digitising and integrating disparate financial and non-financial data, the ULI will address significant credit demand across various sectors, especially benefiting agricultural and MSME borrowers.

This advancement is expected to facilitate quicker, more accessible credit delivery and address existing gaps in the lending market.

(KNN Bureau)

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment