403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

Red Biotechnology Market to Reach USD 1,172.3 Billion by 2030

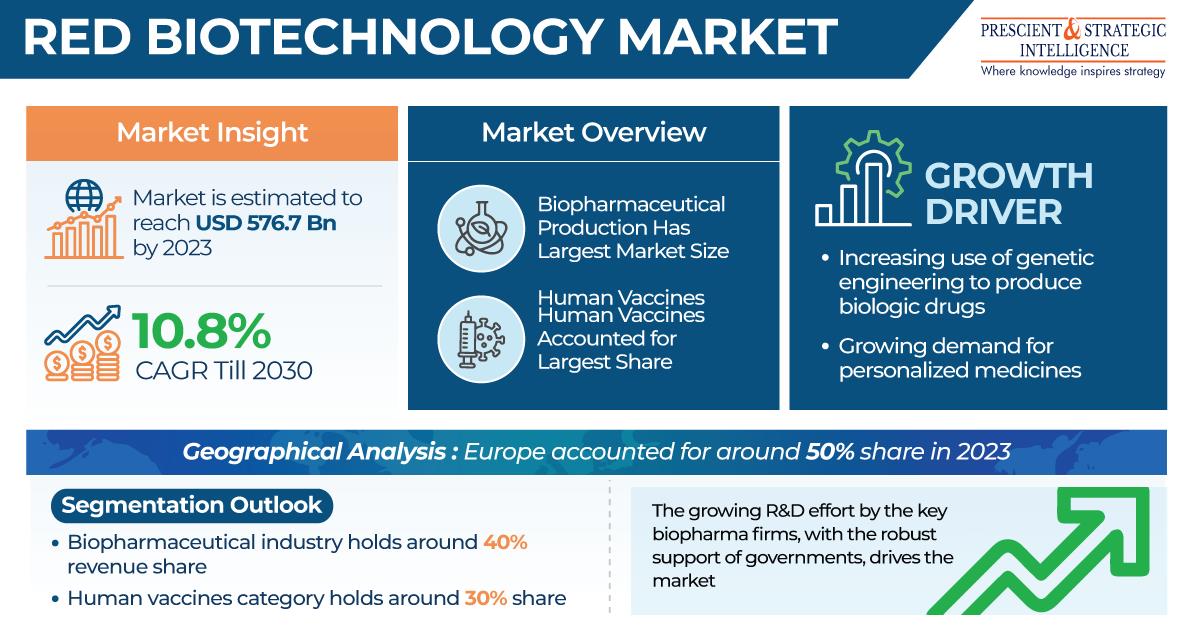

(MENAFN- P&S Intelligence) In 2023, the red biotechnology market was valued at USD 576.7 billion and is projected to grow to USD 1,172.3 billion by 2030, with a compound annual growth rate exceeding 10.5%.

The market's expansion is driven by its increasing application in clinical trials, drug discovery, carrier screening, and diagnostics, alongside the rising prevalence of genetic disorders.

Key benefits of red biotechnology include the development of effective products and genetic engineering for new drugs targeting life-threatening diseases.

Technological advancements in gene sequencing platforms, rising investments from private and government sectors in large-scale biotechnology projects, and the broad acceptance of red biotechnology in fields like veterinary sciences, tissue engineering, and poultry farming are significant factors contributing to market growth.

The growing incidence of cancer and the expanding use of red biotechnology in cancer research and diagnostics are major industry drivers.

This technology is also utilized in the production of combination vaccines that target diseases such as Hepatitis A, Hepatitis B, polio, and diphtheria simultaneously.

A notable trend is the increasing number of R&D initiatives by major players, particularly in stem cell research.

The COVID-19 pandemic has also spurred numerous research studies exploring the use of red biotechnology for developing medicines, vaccines, and diagnostic tools, further aiding industry growth.

Key Insights

Biopharmaceutical Production: This segment dominated the market in 2023 with a 25.0% share and is expected to maintain its lead throughout the decade, driven by the growing demand for proteins, antibodies, antisense oligonucleotides, RNA, and DNA for diagnostic and therapeutic purposes.

Gene Therapy: This segment is expected to grow at the fastest compound annual growth rate in the coming years, fueled by the increasing incidence of genetic disorders and cancers.

Human Vaccines: Leading the market in 2023 with a 30.0% share, this segment's growth is attributed to the rising occurrence of infectious disease outbreaks and the prevalence of chronic ailments.

Biopharmaceutical Industry: Holding a 40.0% share in 2023, this segment is projected to remain the largest contributor, driven by the global enhancement of biopharmaceutical production infrastructure and R&D efforts to discover new molecular entities and vaccines against infectious diseases.

North America: This region led the market in 2023 with approximately 55% share and is expected to continue its robust growth due to the high incidence of rare, genetic, and chronic illnesses, rapid technological advancements in healthcare, and increasing R&D initiatives.

APAC: This region is advancing at the fastest rate, driven by rising investments from both international and domestic biotech firms and a large patient pool with infectious and chronic ailments.

Market Structure: The red biotechnology industry is fragmented, with significant participation from large-scale companies engaged in product launches, new product development, agreements, mergers, partnerships, and product approvals to enhance their market presence.

The market's expansion is driven by its increasing application in clinical trials, drug discovery, carrier screening, and diagnostics, alongside the rising prevalence of genetic disorders.

Key benefits of red biotechnology include the development of effective products and genetic engineering for new drugs targeting life-threatening diseases.

Technological advancements in gene sequencing platforms, rising investments from private and government sectors in large-scale biotechnology projects, and the broad acceptance of red biotechnology in fields like veterinary sciences, tissue engineering, and poultry farming are significant factors contributing to market growth.

The growing incidence of cancer and the expanding use of red biotechnology in cancer research and diagnostics are major industry drivers.

This technology is also utilized in the production of combination vaccines that target diseases such as Hepatitis A, Hepatitis B, polio, and diphtheria simultaneously.

A notable trend is the increasing number of R&D initiatives by major players, particularly in stem cell research.

The COVID-19 pandemic has also spurred numerous research studies exploring the use of red biotechnology for developing medicines, vaccines, and diagnostic tools, further aiding industry growth.

Key Insights

Biopharmaceutical Production: This segment dominated the market in 2023 with a 25.0% share and is expected to maintain its lead throughout the decade, driven by the growing demand for proteins, antibodies, antisense oligonucleotides, RNA, and DNA for diagnostic and therapeutic purposes.

Gene Therapy: This segment is expected to grow at the fastest compound annual growth rate in the coming years, fueled by the increasing incidence of genetic disorders and cancers.

Human Vaccines: Leading the market in 2023 with a 30.0% share, this segment's growth is attributed to the rising occurrence of infectious disease outbreaks and the prevalence of chronic ailments.

Biopharmaceutical Industry: Holding a 40.0% share in 2023, this segment is projected to remain the largest contributor, driven by the global enhancement of biopharmaceutical production infrastructure and R&D efforts to discover new molecular entities and vaccines against infectious diseases.

North America: This region led the market in 2023 with approximately 55% share and is expected to continue its robust growth due to the high incidence of rare, genetic, and chronic illnesses, rapid technological advancements in healthcare, and increasing R&D initiatives.

APAC: This region is advancing at the fastest rate, driven by rising investments from both international and domestic biotech firms and a large patient pool with infectious and chronic ailments.

Market Structure: The red biotechnology industry is fragmented, with significant participation from large-scale companies engaged in product launches, new product development, agreements, mergers, partnerships, and product approvals to enhance their market presence.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment