Gold Price Forecast: Bitcoin Weakness Fueling XAU/USD Strength?

- continues to move higher despite post- rate bounce

- weakness may be driving flows into the yellow metal

- XAU/ targets next level of resistance at the 1,900 mark

Gold prices have driven higher over the past week as the yellow metal shifted back into the market's good graces. A wave of weakness in the has helped put spot gold prices to highs last seen in January and February. Speculation is also growing over the link between gold and Bitcoin, as institutional investors are supposedly ditching the crypto asset for the yellow metal.

Despite the recent strength in Gold prices, Wednesday’s Federal Open Market Committee (FOMC) Minutes appeared to slow inflows as a shift in language hinted to an environment where Treasury rates would likely be higher. The modest downward pressure on gold stemmed from the suggestion that if the economic recovery continues at the current pace, discussing a taper of the balance sheet would become appropriate. Pulling back the balance sheet would likely precede a hike in rates, hurting gold.

However, Randal K. Quarles, Federal Reserve Vice Chair for Supervision and Regulation, stated Wednesday that a premature reaction to rising prices in the economy could work against the Fed. Mr. Quarles was referring to a pickup in inflation seen in the CPI figures released last week. That language is in line with the broader Fed narrative, which sees the rise in prices as a temporary phenomenon. Still, rate traders pushed yields higher across the curve, although the 10-year yield remains below its April high.

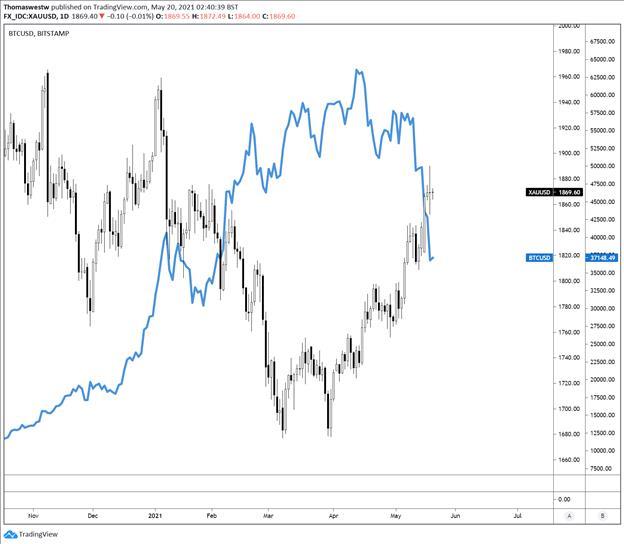

Another interesting narrative in gold markets – introduced to the mainstream thinking by analysts at JPMorgan – suggests institutional investors are moving into gold as they ditch the cryptocurrency. A correlation in price between the two assets appears to support that narrative to a degree. This could be, as some have mentioned previously, a fundamental shift where Bitcoin is replacing gold as a safe-haven store of value.

In fact, JPM remarked earlier this year that the scenario is possible, although it would be a process that takes years to achieve. Unlike gold, however, crypto assets still face potentially threatening regulatory risks. That risk appeared earlier this week when the Chinese government regulators warned against financial institutions using Bitcoin for transactions. The move by China is likely to remain a near-term headwind for Bitcoin, along with other potential regulations from global governments.

XAU/USD versus Bitcoin (blue line) Daily Chart

Gold Technical Breakdown

Gold is trending higher, with eyes on the next major potential barrier at the psychologically imposing 1,900 level. XAU/USD’s technical posture brightened after the precious metal broke above channel resistance that was in place from the August swing high. A break over 1,900 may inject further bullish momentum into the commodity. Alternatively, a turn lower would have traders eyeing the recently broken resistance level to turn into a possible area of support.

Gold Daily Chart

Chart created with TradingView

Gold TRADING RESOURCES- Just getting started? See our

- What is your trading personality? to find out

- and have your trading questions answered

- Subscribe to the for weekly market updates

--- Written by Thomas Westwater, Analyst for DailyFX.com

To contact Thomas, use the comments section below or on Twitter

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment