Markets adjust to inflation and it's going to hurt

(MENAFN- Asia Times) NEW YORK – We were inflation bears before inflation was cool ('Inflation Isn't Coming – It's Already Here ,' April 19). A month ago, the comedy team of Federal Reserve Chair Jerome Powell and Treasury Secretary Janet Yellen still had the public hypnotized by the idea that inflation hadn't yet bumped up against the Fed's 2% target.

Now we don't know about anything but inflation, and Bank of America is talking about 'transitory hyper-inflation.' For example:

- Mentions of inflation have soared in corporate reporting, and this is 'pointing to at the very least, 'transitory' hyper-inflation ahead. Higher mentions of pricing, coupled with a record net margin, suggest inflation so far has been positive for corporate earnings,' Bank of America strategists reported last week.

- Intel CEO Pat Gelsinger warned that the global chip shortage will last for years. That's important for inflation because it cuts deeply into auto production, forcing car rental agencies to buy used cars instead of new ones.

- 'Wholesale used vehicle prices (on a mix-, mileage-, and seasonally adjusted basis) increased 6.81% in the first 15 days of April compared to the month of March. This brought the mid-month Manheim Used Vehicle Value Index to 191.4, a 52.2% increase from April 2020,' Manheim reports.

- 'Shrinkflation' is raising the price of many basic items. Costco for example is selling rolls of paper towels at the same price with 20 fewer sheets than last month, an effective price hike of 14.5%.

- The Institute for Supply Management today reported that 89% of companies surveyed in April report higher input costs, the highest proportion since the 2009 Great Financial Crash. 'Extended lead times, wide-scale shortages of critical basic materials, rising commodities prices and difficulties in transporting products are all affecting segments of the manufacturing economy,' the Institute said.

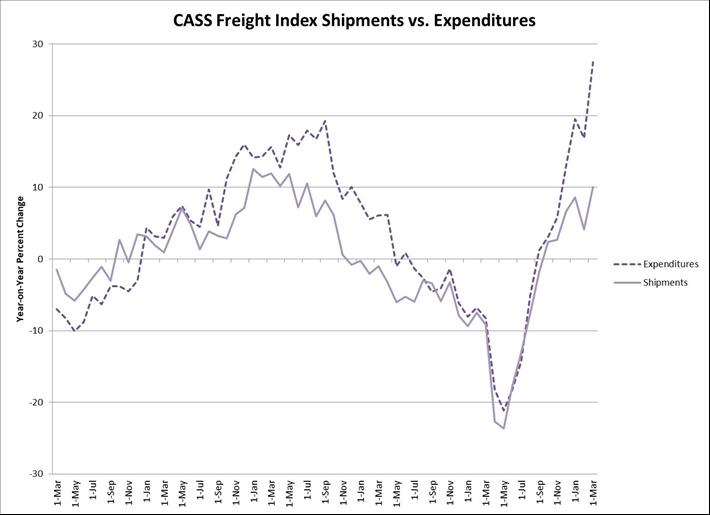

- Freight costs in the US are up 27% year on year while freight volume is up just 10%. That's a 17% price increase for transport that will feed into the price of most goods.

Something has to give. That could be one of three things:

None of these will be pleasant. The Chart of the Day shows that inflation expectations (the difference between the yield on ordinary coupon Treasuries and the yield on inflation-indexed Treasuries with a 10-year maturity) have been rising while the dollar has been falling.

We haven't yet seen a decline in output, although the Institute for Supply Management's purchasing managers' index published on May 3 came in considerably weaker than expected—although still showing expansion.

What to do? Buy European and Asian stocks, short Treasuries and concentrate US stock portfolios in companies that will do better in an inflationary environment. Banks and oil companies are my two favorite examples of the latter.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment