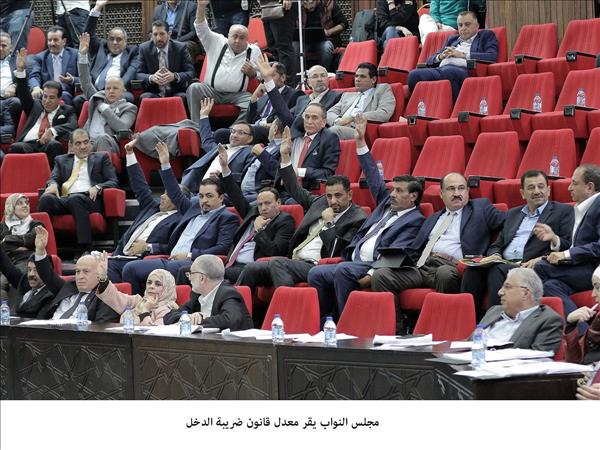

Jordan- Lawmakers pass income tax draft law

Amman, Nov. 18 (Petra) -- The Lower House of Parliament on Sunday endorsed the 2018 amendments to the Income Tax Law following extensive deliberations over the bill, which the government described a "first step towards devising a new economic approach focusing on growth rather than fiscal policy".

Under the new law, the household non-taxable income threshold was set at JD20,000 for 2019 (to go down to 18,000 in 2020) in addition to JD2,000 in exemptions applicable upon the delivery of receipts and invoices.

The tax threshold for individuals was set at JD10,000 for 2019 (to go down to JD9,000 in 2020) in addition to JD1,000 in exemptions. In anyway, the non-taxable income for the household must not exceed JD23,000, according to the new law, which must also be endorsed by the Senate before forwarding it to His Majesty the King.

According to the bill, the tax will be collected from those whose annual income is less than JD300,000 according to the following ratios: The first JD5,000 of the taxable income will be subject to a 5-percent tax; the second JD5,000 (10 percent); the third JD5,000 (15 percent); the fourth JD5,000 (20 percent) and 25 percent for any amount exceeding the JD300,000-JD1 million threshold.

Those whose income annual income exceeds JD1 million are subject to a 35-percent income tax.

The income tax for the industrial sector was set at 14 percent; 35 percent for the banking sector and 24 percent for telecom, electricity, mining, insurance, reinsurance and financial brokerage firms as well as legal persons practicing lease business. Other legal persons will be subject to a 20-percent tax.

A JD1-million in sales coming from a natural person's Jordan-based agricultural activity is exempt from the tax. Additionally, the first JD50,000 of the legal person's agriculture-generated net profit shall be exempt from the tax.

Earlier, Prime Minister Omar Razzaz told the lawmakers that the bill should be passed, otherwise, the Kingdom will have to pay more interest on its debt, adding the 2018 income tax law pursues equality and will not impact those with limited or low income.

He said his government will in the future look into the blanket taxation system (called indirect taxes which include the sales tax), adding that no one can raise prices after the bill goes into effect because the income tax targets the net income.

Deputy Prime Minister Raja'i Mu'asher said only 9 percent of the overall income tax will come from individuals and households while 76 percent will be collected from corporations. He indicated that the law is a first step towards building a new economic approach that focuses on growth instead the fiscal policy-centered approach, which proved unsuccessful.

AA

18/11/2018 20:01:06

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment