403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

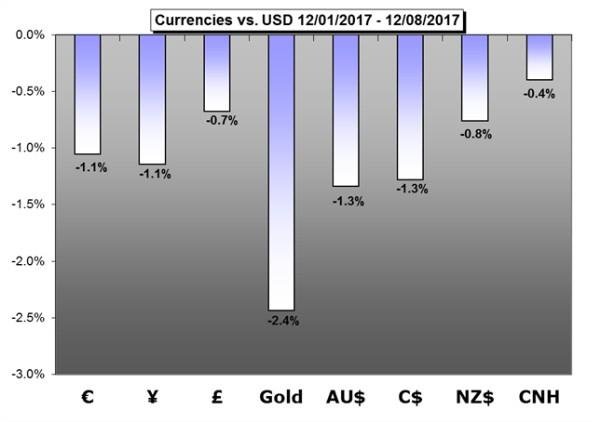

Weekly Trading Forecast: Fed, ECB, BOE Meetings Promise Fireworks

(MENAFN- DailyFX) Financial markets look set for fireworks as the Federal Reserve, the European Central Bank and the Bank of England deliver monetary policy announcements in the week ahead.

Forecast:

The US Dollar may rise as the Federal Reserve projects a more aggressive 2018 interest rate hike outlook than what is already priced into financial markets.Forecast:

The British Pound is set to push higher after the EU said sufficient progress has been made for Brexit negotiations to enter the second stage, including future trade agreements.Forecast:

The Federal Open Market Committee's (FOMC) last rate decision for 2017 may rattle the near-term recovery in should the central bank implement a dovish rate-hike.Forecast:

The Australian Dollar will have to face the long-anticipated fact of complete yield erosion against its US cousin this week. In these yield hungry times that will be uncomfortableCanadian Dollar Forecast:

The past couple of weeks have brought some key pieces of Canadian data, all seemingly pointing to a positive backdrop. But the Bank of Canada remains cautious, and this could impact price action in as we move into next year.Forecast:

Most commodities had a horrible week, but no one told Oil traders to be worried. Prices currently remain below November highs, but fundamental support is coming from multiple angles.Equities Forecast:

This coming week highlights three central bank meetings, with the expected to raise rates on Wednesday, while we'll hear from the ECB and BoE on Thursday.Gold Forecast:

are testing a major technical support with all eyes on next week's Fed policy meeting. Here are the updated targets & invalidation levels that matter.See what live coverage is scheduled to cover key event risk for the FX and capital markets on the .

See how retail traders are positioning in the majors using the .

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment