403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

'Qatar retail market growth to top Gulf'

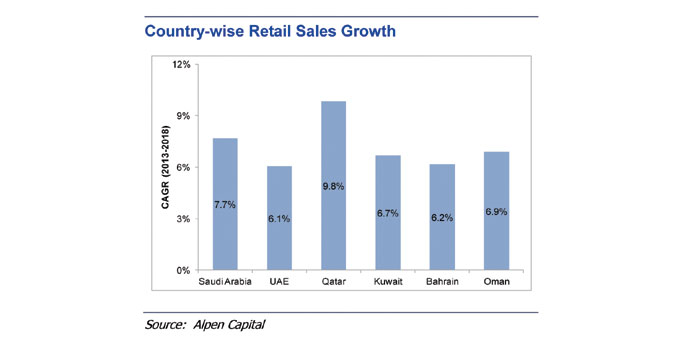

(MENAFN- Gulf Times) Qatari retail market is expected to grow at a compound annual growth rate (CAGR) of 9.8% in five years up to 2018, the fastest in the GCC region, a new study has shown.

According to Alpen Capital, the GCC (Gulf Cooperation Council) retail sales are expected to grow at a 7.3% CAGR between 2013 and 2018 to reach $284.5bn.

"While retails sales growth across all the GCC countries is expected to remain positive between 2013 and 2018, the outlook for Qatar is the most optimistic during the period," Alpen Capital said in its 'GCC retail industry report'.

"While Qatar's retail market is expected to register a CAGR of 9.8%, the other five GCC countries are seen registering an annual average growth rate of 6%-7% during the period," Alpen said.

Based on the moderate growth scenario for Alpen's supply-side estimates, occupied modern retail sales area in the GCC is projected to reach 6.6mn sq m in 2018, while expected growth in the supply of modern retail sales area over the forecast period is partially lower than the demand-side CAGR estimate for retail sales. The supply of new modern retail sales area is expected to adequately meet the increasing demand for retail space over the next five years.

The population base of the GCC region is one of the fastest growing, with 41% of its population in the age group between 15 and 34, having a strong preference towards international brands. The region also has one of the most attractive corporate tax regimes, which works as an "attraction" to retailers.

Over the years, the region has emerged as an international tourist hub, enjoying popularity among leisure travellers, international shoppers and pilgrims. A high influx of tourists presents an environment conducive for the growth of the retail industry.

The region's economy has emerged as one of the richest and fastest growing in the world, largely on the back of its proven crude oil reserves. The region is comparable to some of the strongest developed economies of the world, supported by its cash-rich governments, healthy credit ratings and strong currency reserves.

Dubai's successful bid to host the World Expo 2020 paves the way for further growth of its non-oil sector, lending momentum to the construction, tourism and hospitality sectors.

Qatar's non-oil sector increased by more than 10% in 2014, stimulated by

its major infrastructure projects such as the Doha Metro and the Hamad International Airport. Some countries in the region are, however, yet to reduce their dependence on the hydrocarbon sector to a meaningful degree.

Among other key driving factors of the industry are the increase of retail sales area, growing e-commerce segment, easy availability of credit and interest payment plans, increasing consumer confidence and government initiatives to promote infrastructure, hospitality and tourism sectors, Alpen said.

Alpen Capital managing director Sameena Ahmad said the retail industry continued to maintain a positive momentum attributed to key factors influencing the market like robust economic growth, rising purchasing power, growing population comprising a large proportion of expatriates, changing consumption patterns and increasing penetration of international retail players. The Gulf is also gearing to host events such as the World Expo 2020 and FIFA 2022, leading to a growing influx of tourists and creating immense opportunities for existing and new retailers in the region."

Mahboob Murshed, Alpen Capital managing director said, "Socio-political stability coupled with the government initiatives directed at increasing economic diversification is creating a positive environment for investors in the GCC. The M&A activity in the sector has picked up pace in recent times. In recent years, several deals have taken place in the sector that involved some of the region's leading retailers including the Savola Group, Damas International, LuLu Group and Al Meera Consumer Goods Company."

According to Alpen Capital, the GCC (Gulf Cooperation Council) retail sales are expected to grow at a 7.3% CAGR between 2013 and 2018 to reach $284.5bn.

"While retails sales growth across all the GCC countries is expected to remain positive between 2013 and 2018, the outlook for Qatar is the most optimistic during the period," Alpen Capital said in its 'GCC retail industry report'.

"While Qatar's retail market is expected to register a CAGR of 9.8%, the other five GCC countries are seen registering an annual average growth rate of 6%-7% during the period," Alpen said.

Based on the moderate growth scenario for Alpen's supply-side estimates, occupied modern retail sales area in the GCC is projected to reach 6.6mn sq m in 2018, while expected growth in the supply of modern retail sales area over the forecast period is partially lower than the demand-side CAGR estimate for retail sales. The supply of new modern retail sales area is expected to adequately meet the increasing demand for retail space over the next five years.

The population base of the GCC region is one of the fastest growing, with 41% of its population in the age group between 15 and 34, having a strong preference towards international brands. The region also has one of the most attractive corporate tax regimes, which works as an "attraction" to retailers.

Over the years, the region has emerged as an international tourist hub, enjoying popularity among leisure travellers, international shoppers and pilgrims. A high influx of tourists presents an environment conducive for the growth of the retail industry.

The region's economy has emerged as one of the richest and fastest growing in the world, largely on the back of its proven crude oil reserves. The region is comparable to some of the strongest developed economies of the world, supported by its cash-rich governments, healthy credit ratings and strong currency reserves.

Dubai's successful bid to host the World Expo 2020 paves the way for further growth of its non-oil sector, lending momentum to the construction, tourism and hospitality sectors.

Qatar's non-oil sector increased by more than 10% in 2014, stimulated by

its major infrastructure projects such as the Doha Metro and the Hamad International Airport. Some countries in the region are, however, yet to reduce their dependence on the hydrocarbon sector to a meaningful degree.

Among other key driving factors of the industry are the increase of retail sales area, growing e-commerce segment, easy availability of credit and interest payment plans, increasing consumer confidence and government initiatives to promote infrastructure, hospitality and tourism sectors, Alpen said.

Alpen Capital managing director Sameena Ahmad said the retail industry continued to maintain a positive momentum attributed to key factors influencing the market like robust economic growth, rising purchasing power, growing population comprising a large proportion of expatriates, changing consumption patterns and increasing penetration of international retail players. The Gulf is also gearing to host events such as the World Expo 2020 and FIFA 2022, leading to a growing influx of tourists and creating immense opportunities for existing and new retailers in the region."

Mahboob Murshed, Alpen Capital managing director said, "Socio-political stability coupled with the government initiatives directed at increasing economic diversification is creating a positive environment for investors in the GCC. The M&A activity in the sector has picked up pace in recent times. In recent years, several deals have taken place in the sector that involved some of the region's leading retailers including the Savola Group, Damas International, LuLu Group and Al Meera Consumer Goods Company."

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment