China's Trade Surplus Tops $1Tn Mark As Exports Rebound Despite Tariffs

| USD 111.7bn | China's November trade surplus |

| Higher than expected |

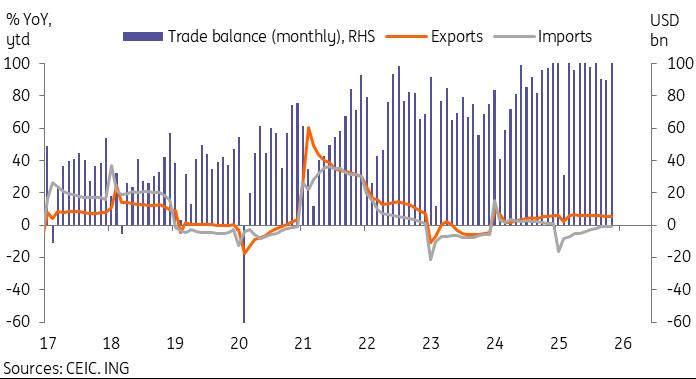

China's exports grew by 5.9% year on year in November, up from -1.1% in October, beating expectations for a smaller recovery. Through the first 11 months of the year, China's exports have grown 5.4% YoY year to date, exactly the same pace as the first 11 months of 2024.

By product, familiar categories continued to see the strongest growth. Ships (26.8%), semiconductors (24.7%), and autos (16.7%) all outperformed headline exports this year. In general, hi-tech exports (6.6%) also outperformed, an important signal of China's growing competitiveness in hi-tech fields. In contrast, categories that traditionally rely heavily on the US market -- such as toys (-12.1%), footwear (-10.7%), and furniture (-5.9%) -- heavily underperformed after the tariff hikes.

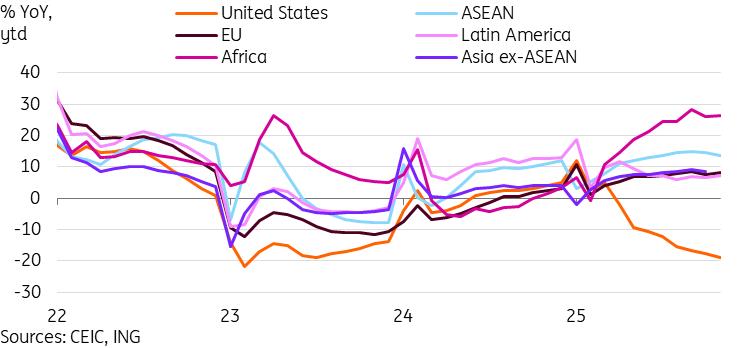

By destination, exports to the US continued to slow in November, despite the trade truce. November exports to the US were down -28.6% YoY, a three-month low, bringing the year-to-date growth to -18.9% YoY. It's likely that November exports have yet to fully reflect the tariff cut, which should feed through in the coming months. Also, the frontloading effect as US importers ramped up purchases ahead of tariffs will act as a headwind on trade in the coming months. Instead of the US, the beat in November's data came from an acceleration of exports to the EU. They were up 14.8% YoY in November to bring the ytd growth to 8.1% ytd. We also saw a rebound of exports to Japan, which rose 4.3% YoY in November for a ytd growth of 3.4%. Exports to ASEAN, which have in recent years been China's most important destination, fell to 8.2% YoY in November.

Export contraction to the US continued to widen despite trade truce

Imports continued to disappoint amid soft domestic demand

China's import growth picked up slightly in November, rising to 1.9% YoY from 1.0% in October. However, this uptick was smaller than market expectations. Year-to-date, import growth has been negative at -0.6% YoY.

While we've seen strong tech-related imports, with hi-tech imports up 8.7% YoY ytd, most other import categories have been very weak. There are generally clear explanations. For example, the continued malaise in the property market resulted in a sharp drop of demand in related imports, with lumber (-15.5%) and steel (-11.7%) all steeply in negative territory.

One structural shift in China's import structure is likely tied to the auto sector. As the domestic auto sector has seen increased dominance, this translated into a sharp -38.3% YoY ytd decline in auto imports. This trend could continue, especially as Chinese automakers improve competitiveness across a broader range of products.

China's soft imports have raised concerns among trading partners, such as the EU. French President Emmanuel Macron has warned that the EU might hike tariffs on China if these imbalances are not addressed in the coming months. Such a timeline would likely be too aggressive to resolve this issue. China's pivot to establishing domestic demand as a key driver of growth will take time, but it's essential for China to move into the next phase in its economic development.

Ultimately, we need to see what concrete measures are put in place to boost domestic consumption next year. The 15th Five-Year Plan mentioned plans to increase win-win external cooperation and establish international consumption centres, both of which sound positive for addressing trade imbalances. How soon these measures come through could impact how trading partners react in the coming months and years.

Beat in exports and miss in imports widened China's trade surplus in November

Ballooning trade surplus continues to support growth in 2025

Until then, China's ballooning trade surplus will help contribute to stronger growth in 2025. November's trade surplus rose to $100.7bn, marking a 5-month high. Over the first 11 months of the year, China's trade surplus has ballooned to $1.08tn, up 22.1% from the same period in 2024.

External demand has been an unexpected yet key factor in China's likely reaching its growth target of "around 5%" in 2025. Whether this resilience can last into 2026 will likely play a significant role in next year's outlook. We tackle this question and more in our recently released outlook.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment