'It Will Work Out:' Did Michael Burry Just Say He's Not Wrong About His Big AI Short?

- Burry is credited with predicting the 2008 housing market collapse, which was caused by the subprime mortgage crisis. In a late October post, he flagged a bubble and said,“Sometimes, the only winning move is not to play.” Some social-media users believe Burry's call is early this time around.

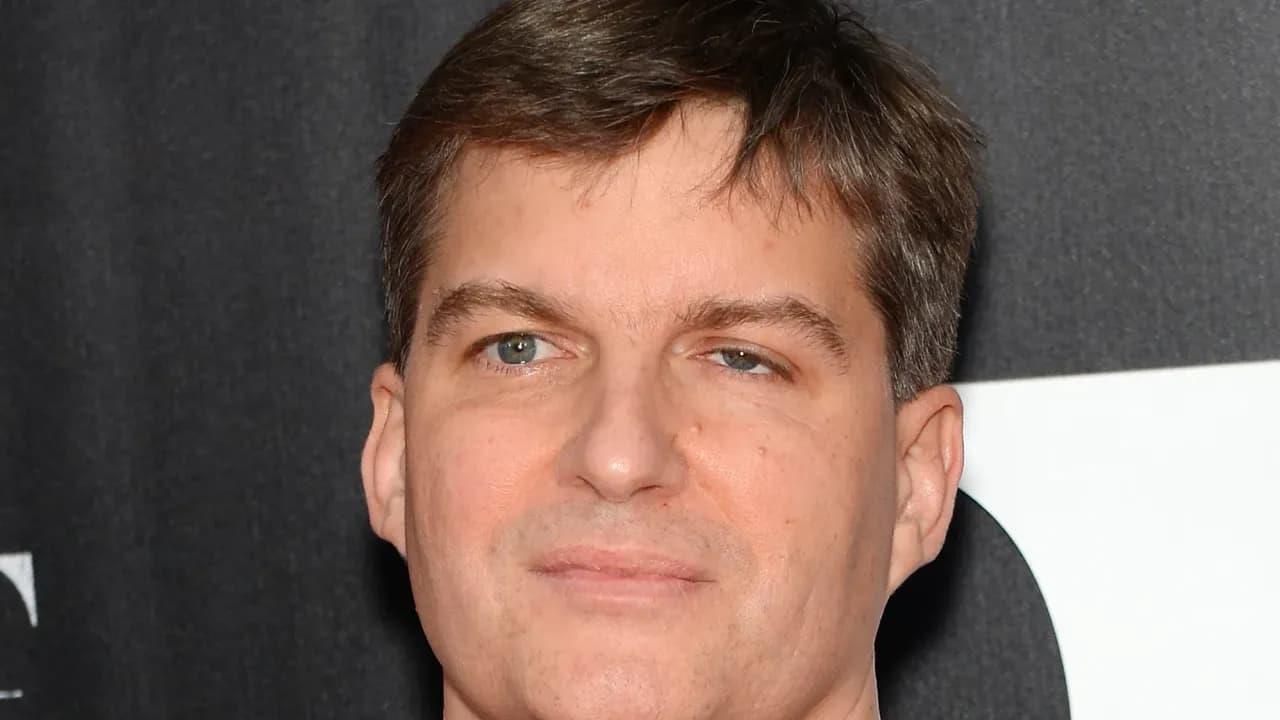

Michael Burry, the“Big Short” fame investor, who has been creating ripples with his comments on artificial intelligence (AI) spending since last week, offered more fodder to jittery investors late Tuesday.

The Scion Asset Management founder sent Nvidia stock down 4% last week when his firm disclosed a short position in the AI frontrunner.

Past Results Indicative Of Future?

Burry posted a picture of his character, played by Christian Bale in the 2015 American biographical comedy drama film“The Big Short”, lying down with sheaves of organized papers strewn around. Captioning the post, he said,“Me then, me now. Oh well.

It worked out. It will work out.”

The post has since been reposted 1,000 times and liked by nearly 10,000 followers, garnering 9,600 comments. The still is from a scene in which a troubled Burry grows restless over his short bet against subprime mortgages, a decision that eventually triggers the Great Financial Crisis, though its consequences unfold slowly.

Burry was likely referring to his past success in accurately predicting the 2008 housing market collapse, which was caused by the subprime mortgage crisis. Betting against the housing market, he made $100 million for himself and an additional $725 million for investors. He reportedly spotted the brewing crisis as early as 2003.

Can Burry Keep His Track Record Intact?

This time around, after a nearly two-year sabbatical, Burry began posting on X in late October. He flagged a bubble and said,“Sometimes, the only winning move is not to play.” He followed up with another post on Nov. 3, discussing how the telecom industry experienced a shakeout after the end of a capital cycle in the early 2000s.

Then came a more explicit post with illustrations comparing capital spending growth and revenue growth, as well as the circular AI deals that have begun to pick up pace. This Monday, he posted about hyperscalers, specifically naming Oracle and Meta, potentially inflating earnings by extending the useful life of assets. "More details coming November 25th. Stay tuned!" he said while ending the post.

Social-Media Reacts

While some social-media users opposed his views, others sided with him. One user noted that the housing crisis differs from the current AI bubble. "Homeowners that can't afford their house payments and banks failing is very different than deep-pocketed long-term tech investors making bets on the future.”

Another said the AI bubble hasn't even begun to inflate. They expect the AI bubble to inflate for several years, helped by the favorable macroeconomic environment.

Echoing a similar sentiment, another user said,“Democratization of markets and the general public having access to margin and derivatives has given the balloon more air.” A third user said, "Might be time to change from bubble to 'not wrong just early.'”

For updates and corrections, email newsroom[at]stocktwits[dot]com.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment