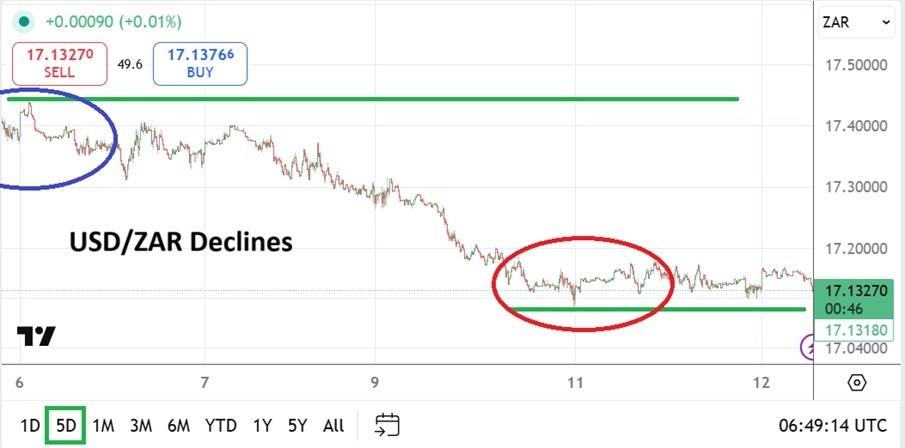

USD/ZAR Analysis 12/11: Sharp Decline (Chart)

Certainly the USD/ZAR has seen positive lower momentum regarding the stronger value of the South African Rand, but within its current depths financial institutions might begin to question fair market value based on mid-term outlooks economically. The U.S Federal Reserve has not given a clear indication if it is going to lower its Federal Funds Rate in December and big players do not seem to be in a hurry to wager on the Fed's decision.

EURUSD Chart by TradingViewSolid Move Lower in the USD/ZAR and PotentialSpeculators need to be careful in the current USD/ZAR terrain. Looking for more momentum lower via the existing trend may seem worthwhile and logical, but perhaps another round of positive impetus is needed.- The U.S will vote on the current government shutdown later today in Congress. If the shutdown is ended, this could fuel additional risk appetite in the broad markets. Until vote results are counted however, it may be wise to believe choppy action in the USD/ZAR is going to continue that tests current tight values being exhibited. The USD/ZAR has certainly shown an ability to trend lower, but can greater depths be attained? Conservative speculators may want to wait for some upside to develop and then look for selling opportunities. In the wake of the U.S government shutdown vote results later today, the USD/ZAR is likely to become volatile.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment