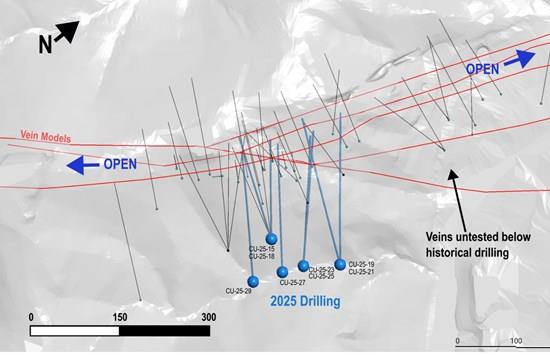

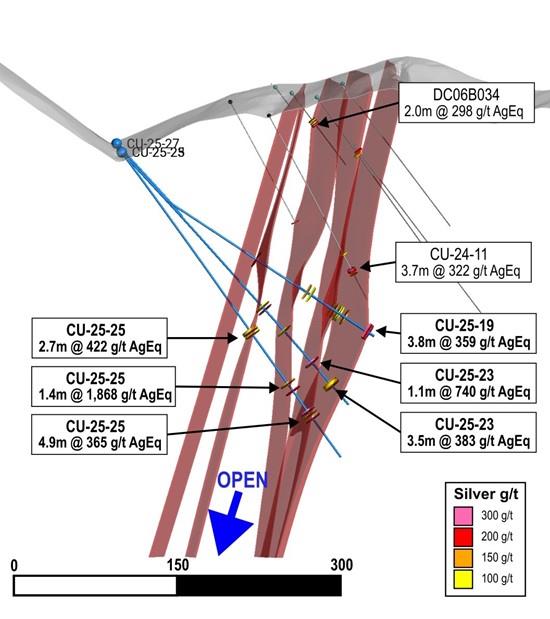

Silverco Mining Expands On San Miguel Target, Drilling 8.6M Grading 250 G/T Ageq And 2.1M Grading 1,042 G/T Ageq At The Cusi Property, Chihuahua, Mexico

| Hole ID | Zone | From (m) | To (m) | Length (m)(2) | Au g/t | Ag g/t | Pb % | Zn % | AgEq g/t(1) |

| CU-25-15 | San Miguel | 206.9 | 208.6 | 1.8 | 0.13 | 198 | 0.09 | 0.05 | 186 |

| CU-25-16 | Promontorio | No Significant intercept | |||||||

| CU-25-17 | Promontorio | No Significant intercept | |||||||

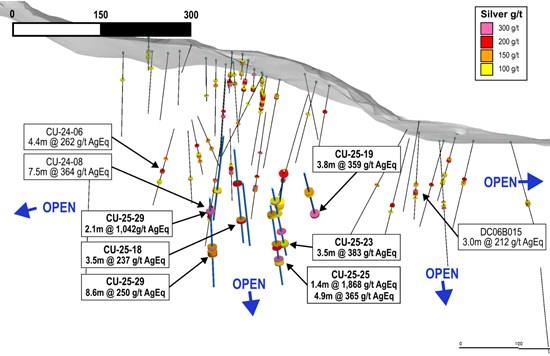

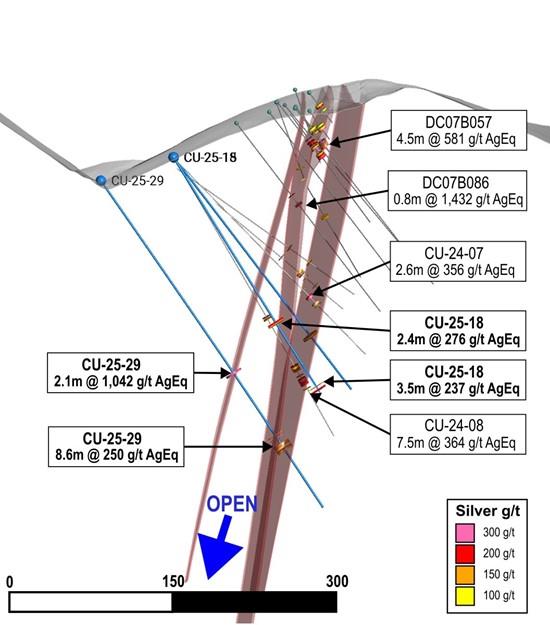

| CU-25-18 | San Miguel | 177.0 | 179.5 | 2.4 | 0.11 | 229 | 1.49 | 1.87 | 276 |

| CU-25-18 | San Miguel | 249.9 | 253.3 | 3.5 | 0.17 | 139 | 2.20 | 3.22 | 237 |

| CU-25-19 | San Miguel | 168.5 | 169.5 | 1.0 | 0.10 | 97 | 1.93 | 4.97 | 223 |

| CU-25-19 | San Miguel | 214.5 | 216.0 | 1.5 | 0.08 | 101 | 1.56 | 1.93 | 162 |

| CU-25-19 | San Miguel | 276.0 | 279.8 | 3.8 | 0.08 | 351 | 1.48 | 0.48 | 359 |

| CU-25-20 | Promontorio | No Significant intercept | |||||||

| CU-25-21 | San Miguel | 155.5 | 156.1 | 0.7 | 0.25 | 231 | 3.93 | 18.60 | 643 |

| CU-25-21 | San Miguel | 241.1 | 242.4 | 1.3 | 0.03 | 148 | 1.06 | 3.37 | 219 |

| CU-25-21 | San Miguel | 252.0 | 254.2 | 2.2 | 0.49 | 109 | 0.76 | 1.38 | 159 |

| CU-25-22 | Promontorio | 319.6 | 320.6 | 1.1 | 0.76 | 741 | 0.24 | 0.44 | 710 |

| CU-25-23 | San Miguel | 261.4 | 262.5 | 1.1 | 0.31 | 658 | 2.00 | 5.09 | 740 |

| CU-25-23 | San Miguel | 287.4 | 290.9 | 3.5 | 0.23 | 156 | 7.59 | 4.18 | 383 |

| CU-25-24 | Promontorio | No Significant intercept | |||||||

| CU-25-25 | San Miguel | 201.0 | 203.7 | 2.7 | 0.57 | 245 | 4.43 | 4.73 | 422 |

| CU-25-25 | San Miguel | 292.3 | 293.6 | 1.4 | 1.98 | 1,830 | 3.48 | 3.77 | 1,868 |

| CU-25-25 | San Miguel | 296.6 | 301.5 | 4.9 | 0.28 | 145 | 5.86 | 6.56 | 365 |

| CU-25-26 | Matulera | No Significant intercept | |||||||

| CU-25-27 | San Miguel | No Significant intercept | |||||||

| CU-25-28 | Matulera | No Significant intercept | |||||||

| CU-25-29 | San Miguel | 212.8 | 214.9 | 2.1 | 0.43 | 817 | 7.43 | 7.40 | 1,042 |

| CU-25-29 | San Miguel | 281.9 | 285.2 | 3.3 | 0.14 | 206 | 0.72 | 1.38 | 231 |

| incl. | | 284.7 | 285.2 | 0.4 | 0.41 | 898 | 0.67 | 4.02 | 913 |

| CU-25-29 | San Miguel | 291.0 | 299.6 | 8.6 | 0.21 | 240 | 0.64 | 0.70 | 250 |

Notes

AgEq = Ag g/t x Ag Recovery + [(Au g/t x Au Rec x Au price/gram)+(Pb% x Pb rec. X Pb price/t) + (Zn% x Zn rec. X Zn price/t)]/Ag price/gram. Metal price assumptions are: $30.00/oz silver, $2400/oz gold, $1.00/lb lead, 1.35/lb zinc. Metallurgical recovery assumptions are 90% for silver, 50% for gold, 90% for lead, and 60% for zinc. Metallurgical recoveries used in this release are based on historical operational results on the Cusi project. Reported intervals are downhole core lengths. True widths are estimated at ~70-80% based on vein orientation observed in drill core; however, actual true widths may vary with additional drilling.Table 2: Drill Collar Location

| Hole ID | Easting | Northing | Elevation | Azimuth | Dip | Length |

| CU-25-15 | 320,462 | 3,123,425 | 2,063 | 291 | -51 | 270.0 |

| CU-25-16 | 318,689 | 3,125,817 | 2,031 | 221 | -29 | 96.0 |

| CU-25-17 | 318,778 | 3,125,988 | 2,051 | 233 | -33 | 246.0 |

| CU-25-18 | 320,462 | 3,123,425 | 2,063 | 309 | -58 | 292.5 |

| CU-25-19 | 320,566 | 3,123,486 | 2,013 | 310 | -33 | 285.0 |

| CU-25-20 | 318,869 | 3,126,003 | 2,036 | 230 | -38 | 327.0 |

| CU-25-21 | 320,566 | 3,123,486 | 2,013 | 295 | -33 | 285.0 |

| CU-25-22 | 318,869 | 3,126,003 | 2,036 | 223 | -46 | 378.0 |

| CU-25-23 | 320,529 | 3,123,438 | 2,025 | 314 | -47 | 313.5 |

| CU-25-24 | 318,451 | 3,126,206 | 2,042 | 191 | -31 | 181.5 |

| CU-25-25 | 320,529 | 3,123,438 | 2,025 | 313 | -54 | 345.0 |

| CU-25-26 | 317,265 | 3,126,367 | 2,228 | 270 | -49 | 190.0 |

| CU-25-27 | 320,514 | 3,123,405 | 2,033 | 307 | -48 | 300.0 |

| CU-25-28 | 317,350 | 3,126,353 | 2,211 | 277 | -47 | 288.0 |

| CU-25-29 | 320,496 | 3,123,358 | 2,042 | 304 | -56 | 361.5 |

Notes

Hole azimuths and dips are based on average of surveyed intervalsQuality Assurance/Quality Control and Sampling Procedures

All diamond drill core from the 2025 program at the Cusi Project was logged, photographed, and sawn in half using a diamond blade core saw. One half of the core was submitted for geochemical analysis, while the other half was retained in secure storage for reference. Sampling intervals were determined based on geological boundaries and typically ranged from 0.3- 1.5 metres. Control samples comprised approximately 18% of all samples submitted, including certified reference standards, analytical blanks, field duplicates, preparation duplicates and analytical duplicates. QA/QC results were reviewed in real time, and all data have been verified as meeting acceptable thresholds for accuracy, precision, and contamination before inclusion in this release.

Drill core and rock samples were sent to ALS Minerals for analysis with sample preparation in Chihuahua, Mexico and analysis in North Vancouver, British Columbia. Samples remained under Company custody until delivery to ALS; sealed bags were transported by Company personnel to ALS Chihuahua. The ALS Chihuahua and North Vancouver facilities are ISO/IEC 17025 certified. Samples are dried, weighed, and crushed to at least 70% passing 2mm, and a 250 g split is pulverized to at least 85% passing 75 μm (PREP-31). Silver and base metals are analyzed using a four-acid digestion and ICP-AES. Over-limit analyses for silver (>100 ppm), lead (>10,000 ppm), and zinc (>10,000 ppm) are re-assayed using an ore-grade four-acid digestion and ICP-AES (ME-OG62). Samples with over-limit silver assays > 1500 ppm are analyzed by 30-gram fire assay with a gravimetric finish (Ag-GRA21). Gold is assayed by 30-gram fire assay and AAS (Au-AA23)

Technical Disclosure

The scientific and technical information contained in this news release has been reviewed and approved by Nico Harvey, P.Eng., Vice President Project Development of Silverco, a Qualified Person as defined in National Instrument 43-101. Mr. Harvey is not independent of the Company. Mr. Harvey has reviewed the sampling, analytical and QA/QC data underlying the technical information disclosed herein.

No production decision has been made at Cusi. Any decision to restart operations will follow completion of the requisite technical, financial and permitting milestones.

About Silverco Mining Ltd.

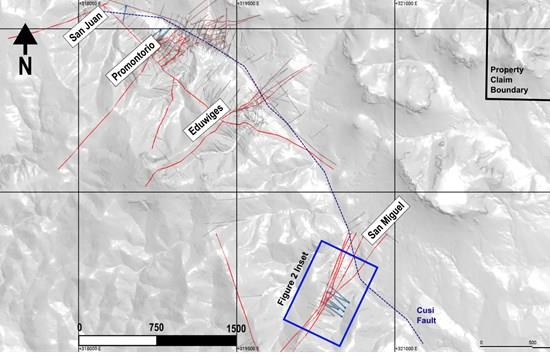

The Company owns a 100% interest in the 11,665-hectare Cusi Project located in Chihuahua State, Mexico (the "Cusi Property"). It lies within the prolific Sierra Madre Occidental gold-silver belt. There is an existing 1,200 ton per day mill with tailings capacity at the Cusi Property.

The Cusi Property is a past-producing underground silver-lead-zinc-gold project approximately 135 kilometres west of Chihuahua City. The Cusi Property boasts excellent infrastructure, including paved highway access and connection to the national power grid.

The Cusi Property hosts multiple historical Ag-Au-Pb-Zn producing mines each developed along multiple vein structures. The Cusi Property hosts several significant exploration targets, including the extension of a newly identified downthrown mineralized geological block and additional potential through claim consolidation.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment