Adnoc L&S Posts Record Nine-Month Results As Q3 Profit Jumps 20%

Adnoc Logistics & Services (Adnoc L&S) has reported its strongest nine-month performance since listing, buoyed by a surge in third-quarter earnings and robust growth across all business segments.

For the first nine months of 2025, revenue climbed 39 per cent year-on-year to $3.7 billion (Dh13.6 billion), while Ebitda rose 30 per cent to $1.12 billion (Dh4.1 billion), maintaining a healthy margin of 30 per cent. Net profit for the period reached $631 million (Dh2.3 billion), up 9 per cent from a year earlier, underscoring the company's resilience amid global market volatility.

Recommended For YouThe third quarter delivered standout results, with revenue up 36 per cent to $1.27 billion (Dh4.65 billion), Ebitda increasing 38 per cent to $379 million (Dh1.39 billion), and net profit jumping 20 per cent to $211 million (Dh773 million). Adnoc L&S attributed the performance to disciplined execution of its growth strategy and strong demand across its integrated logistics, shipping, and services businesses.

“This is our strongest nine-month performance since listing, alongside outstanding quarterly results,” said Captain Abdulkareem Al Masabi, CEO of Adnoc L&S.“Our diversified platform, long-term contracts and operational excellence continue to drive sustainable growth. We are expanding capacity, capturing value-accretive opportunities and reinforcing Adnoc L&S's position as a global leader in energy maritime logistics.”

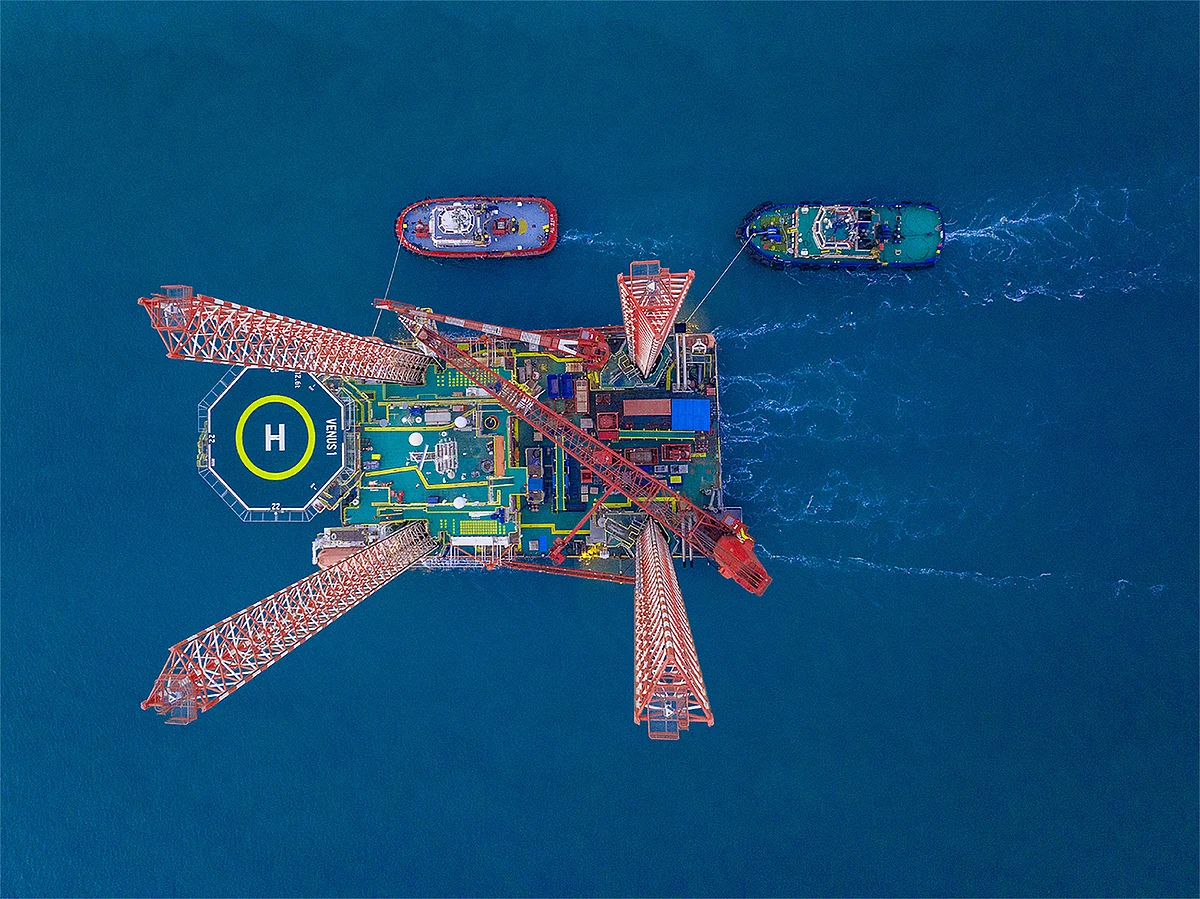

Integrated Logistics remained the largest contributor, with revenue rising 17 per cent to $1.96 billion (Dh7.18 billion) and Ebitda up 26 per cent to $635 million (Dh2.33 billion). Growth was fueled by high utilization of Jack-Up Barges, improved margins across the Integrated Logistics Solution Platform, and increased chartering activity. EPC projects, including G-Island, also supported revenue expansion.

Shipping delivered the sharpest gains, with revenue nearly doubling to $1.48 billion (Dh5.44 billion), driven by the consolidation of Navig8's tanker fleet. Ebitda for the segment grew 39 per cent to $438 million (Dh1.61 billion), reflecting strong operational execution despite challenging market conditions.

The Services segment posted steady growth, with revenue up 7 per cent to $269 million (Dh986 million) and Ebitda rising 12 per cent to $51 million (Dh188 million), supported by higher volumes at the Borouge Container Terminal and profits from Navig8's bunkering business.

Adnoc L&S continued to advance its transformation strategy, securing a $531 million (Dh1.95 billion) 15-year logistics agreement with Borouge and a landmark 50-year deal to develop the UAE's first dedicated chemicals port at TA'ZIZ Industrial Chemicals Zone. Fleet expansion also accelerated with the delivery of LNG carriers Al Rahba and Al Reef and two Very Large Ethane Carriers under long-term charters expected to generate $4 billion in revenue.

The company will join the MSCI Emerging Markets Index on November 25, a move expected to attract over $200 million in passive capital inflows following Adnoc's $317 million share placement.

Adnoc L&S reaffirmed its 2025 guidance, projecting revenue growth in the high 20 per cent range and Ebitda gains in the mid-20s. The full-year dividend is set to rise about 20 per cent to $325 million, with quarterly payouts and a planned 5 per cent annual increase through 2030.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment