403

Sorry!!

Error! We're sorry, but the page you were looking for doesn't exist.

XRP Price Jumps 10% After Trump's $2K Tariff Pledge

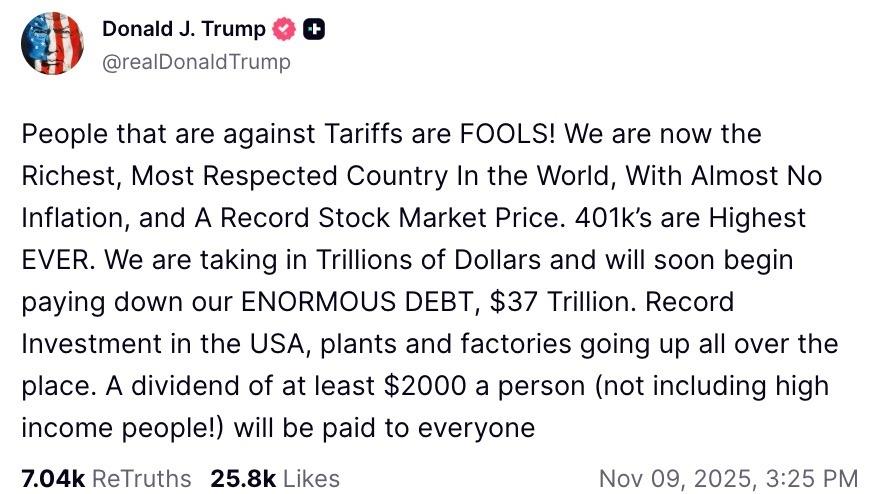

(MENAFN- Daily Forex) Ripple is now trading near $2.45, and the rally raises hopes of holding above $2 amid conflicting signals's Tariff Dividend Announcement Crypto RecoveryOn Sunday, President Trump announced that most Americans will receive a $2,000“dividend” from the tariff revenue and criticized the opposition to his sweeping tariff policies.“A dividend of at least $2000 a person, not including high-income people, will be paid to everyone,” Trump said on Truth Social. Source: Donald J. TrumpThis is expected to inject approximately $400 billion into the economy by early 2026.Treasury Secretary Scott Bessent confirmed the plan could include tax cuts on tips and overtime, framing tariffs as a tool to rebalance trade and reward domestic production.“With tariffs, President Trump is rebalancing trade and bringing back U.S. manufacturing after decades of decline,” Bessent said in an X post on Sunday, adding:“Factories are reopening, high-paying jobs are returning, and America is winning again.”The proposal, which requires congressional approval, echoes past stimulus efforts but on a grander scale.Crypto markets reacted instantly, with the total market cap rising 4.7% over the last 24 hours to $3.58 trillion.Bitcoin (BTC) led the gains, up 4% to trade at $106,200 and Ether (ETH) gained 5/8% to $3,600. XRP gained the most among the top 10 cryptocurrencies, rising as much as 10% from a low of $2.23 on Sunday to an intra-day high of $2.47 on Monday. Its trading volume jumped 55% to $4.3 billion, reinforcing the intensity of the sell-side activity.24-hour performance of top cryptocurrencies. Source: Coin360Analysts link the move to XRP's strength in cross-border payments, which could gain from tariff-driven shifts in global trade flows Bullish Swell Announcement to Boost XRP PriceAt Swell 2025 in New York, Ripple announced a $500 million funding round, pushing its valuation to $40 billion. Led by Fortress and Citadel affiliates, with participation from Pantera, Galaxy, Brevan Howard, and Marshall Wace, the capital will fuel expansion in custody, stablecoins, and prime brokerage.Source: RippleCEO Brad Garlinghouse called it“validation of our long-term vision,” following a $125 million SEC settlement and $95 billion in payment volume this year.RLUSD, Ripple's stablecoin, surpassed $1 billion in market cap and now anchors the Ripple Prime platform. A Mastercard-WebBank-Gemini pilot enables onchain fiat card settlements via XRPL-a regulatory breakthrough. BlackRock's Maxwell Stein praised Ripple's infrastructure, positioning XRP as a core liquidity layer for tokenized assets.For XRP, the implications are strong. ISO 20022 compliance and On-Demand Liquidity align with tariff-induced remittance growth. A $1.5 trillion cross-border market could shift toward XRPL if trade policies favor efficiency. 21Shares' updated ETF filing on Nov. 8 starts a 20-day SEC review, with approvals pending for several other spot XRP ETFs.These, together with whale accumulation and RLUSD demand, back XRP's case for a sustained rally above $3 Profit-Taking Divergence Signals WeaknessDespite the rally, onchain data reveals growing overhead pressure from whales and long-term holders. Data from the onchain data provider Glassnode reveals that Long-term holders- those who have held XRP for more than 155 days - have increased profit-taking from $65 million daily in September to $220 million now-a 240% jump. This profit-realization accompanied a 25% drop in XRP price from $3.09 to $2.30.This“distribution into weakness” contrasts with past cycles and has pushed unrealized profits to 2024 lows, according to Glassnode.“This divergence underscores distribution into weakness, not strength.”XRP realized profit margin. Source: GlassnodeFrom a technical perspective, XRP's latest recovery has invalidated a classic bear flag continuation setup, further reinforced by the break above the flag's upper boundary at $2.42.The bear flag pattern projected a drop toward $1.69, but it appears bulls had other plans and could avoid this scenario if they keep the price above $2.50.XRP/USD daily chart. Source: TradingViewThe next major hurdle for XRP lies between $2.6 and $2.80, areas defined by all the major moving averages. This is where millions in XRP have recently been acquired, according to the Glassnode Cost Basis Distribution Heatmap.Overcoming this would signal strength among the bulls, clearing the path for a return toward the $3 psychological level or to the seven-year high above $3.66.Ready to trade our analysis of Ripple? Here's our list of the best MT4 crypto brokers worth reviewing.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment