G10 FX Outlook 2026: Looking Beyond The Dollar

| Spot | Year ahead bias | 4Q25 | 1Q26 | 2Q26 | 3Q26 | 4Q26 | |

|---|---|---|---|---|---|---|---|

| EUR/USD | 1.16 | Bullish | 1.18 | 1.19 | 1.20 | 1.21 | 1.22 |

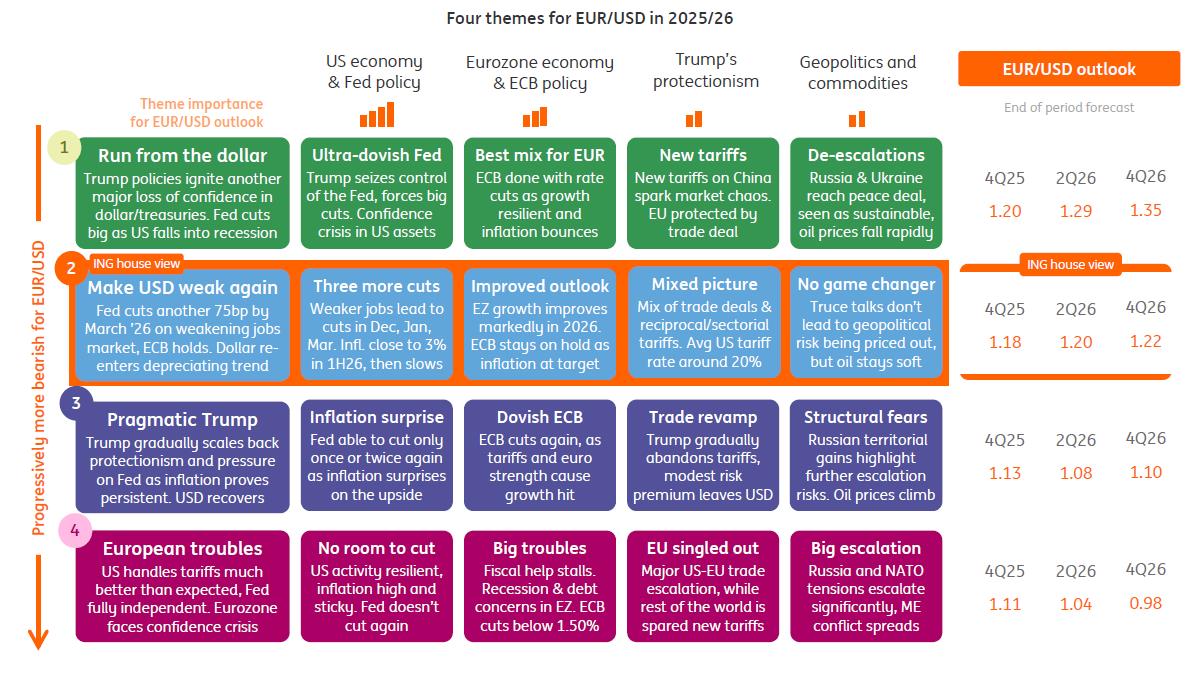

Fed story is crucial: At the heart of our call for a mildly weaker dollar is the Federal Reserve story. Our team is confident that abating wage and housing pressure means that the Fed will not be preoccupied with inflation next year. A further 75bp of Fed rate cuts, bringing the policy rate to a neutral 3.00-3.25%, is our call. If we're right with that, dollar hedging costs will drop further and the buy-side will be raising their hedge ratios on positions in US bond markets. Looking back at April's price action, the dollar sell-off was largely driven by the buy-side quickly adjusting under-hedged positions in US asset markets in the face of Liberation Day tariffs. In addition, there remains sufficient uncertainty around Fed policy to demand a risk premium in the dollar. Changes on the Fed board early next year and potential political pressure on the central bank ahead of the November midterms warn that US dollar real rates drift towards neutral and weigh on the dollar.

Accelerating eurozone growth: It may not feel like it today, but we're looking for the eurozone economy to accelerate through 2026. The region has the savings to be put to work, and we are looking for German fiscal stimulus to register in 2026. Industry is lagging, but business confidence is picking up, and a little more certainty in the global trading environment should see eurozone momentum build throughout the year. Our call is that the European Central Bank has finished cutting rates at 2.00% and the next move is up. Indeed, longer-dated eurozone interest rates should start moving higher later in 2026 as they consider a 2027 ECB hike. The region should also benefit from lower energy prices in 2026 as the glut of crude and LNG weighs and pushes the eurozone's terms of trade higher. A move through 1.20 may well spark outcry from ECB doves, but the pace of EUR/USD gains should be slow and manageable.

Stablecoins and global euros: There has been scant evidence of de-dollarisation in 2025. The foreign private sector has remained a keen buyer of US asset markets, and even the central banks have not made any noticeable changes in the dollar share of their FX reserves. And over recent months, the siren call of the 'stablecoin' has strengthened. Here, the value of USD-backed stablecoins is now around $300bn with predictions of growth to $2tr by 2028. As corporates explore stablecoins for B2B payments and investors look at it as an alternative asset, the growth of stablecoins could delay the multi-decade de-dollarisation trend. At the same time, European politicians are trying to accelerate the status of the global euro. Though glacial, there is some progress on the EU's Savings and Investment union. And while the prospect of more joint euro debt issuance – beyond the €150bn for defence spending – looks remote, more German issuance will mean that Bunds increasingly challenge Treasuries as the world's safe asset.

USD/JPY: Reconnection with fundamentals delayed| Spot | Year ahead bias | 4Q25 | 1Q26 | 2Q26 | 3Q26 | 4Q26 | |

|---|---|---|---|---|---|---|---|

| USD/JPY | 154.00 | Mildly Bearish | 152.00 | 152.00 | 150.00 | 150.00 | 148.00 |

Yen undervaluation continues: By our calculations, the yen remains over 20% undervalued against the dollar on a medium-term (two to three-year) view. The problem is that the catalysts for it to reconnect with its fair value simply are not strong enough. Firstly, Japanese Prime Minister Sanae Takaichi's victory in October's Liberal Democratic Party (LDP) leadership election questions the future path of policy. Investors presume her new premiership will pursue Abe-like policies of ultra-loose fiscal and monetary policy. Those fears might be a little overblown in that the LDP now has to work more closely with a coalition partner, yet the realpolitik means that the Bank of Japan will not be in a rush to normalise policy. Here, ING expects one BoJ hike this December and perhaps another one in late 2026. That would put the policy rate at 1.00% – hardly restrictive or yen supportive. That said, if we're right with our Fed call, USD/JPY hedging costs could be falling 100-125bp for Japanese investors and should prove a mild USD/JPY negative.

US-Japan trade commitments: As part of the deal to see its US tariff rate drop to 15%, Japan had to make a commitment to invest up to $550bn into the US. Somewhat surprisingly, there is quite a lot of detail on the nature of these investments, which are concentrated in the critical energy, AI and mineral space. An important focus is small nuclear reactors, presumably to support AI energy demands. Japan has said that this commitment will not impact FX markets, in that the deal is composed of equity, loans and guarantees. Remember, Japan already has some $1.2tr of FX reserves – largely in USD. Washington would no doubt be pleased were some of these to be used in funding these investments, since it believes those reserves were acquired in the process of keeping the yen undervalued for trade gain.

160 probably remains the line in the sand: Neither Japan nor the US want a sharply weaker yen. The LDP has been doing poorly in elections largely because of the cost-of-living crisis. Estimates suggest that a 10% fall in the yen could add 0.3-0.5% to headline CPI over a 12-month period. Equally, Washington wants to attract higher-paid manufacturing jobs back to the US with a weaker dollar. We expect verbal intervention from Japanese policymakers to become louder should USD/JPY make it above 155. And we would expect Japan to again intervene and sell USD/JPY should it ever make it to 160 – effectively a repeat of 2024. The problem is that what should be a low volatility environment in 2026 will only add to interest in yen-funded carry, and until the investment environment turns around, USD/JPY is going to stay relatively well supported.

GBP/USD: Tight fiscal, loose monetary policy incoming| Spot | Year ahead bias | 4Q25 | 1Q26 | 2Q26 | 3Q26 | 4Q26 | |

|---|---|---|---|---|---|---|---|

| GBP/USD | 1.32 | Mildly Bullish | 1.34 | 1.35 | 1.35 | 1.36 | 1.36 |

0.5-1.0% of GDP fiscal tightening on the way: UK Chancellor Rachel Reeves will present the annual budget on 26 November. Combined with structural adjustments next year and the amount of fiscal headroom she wants to create, the fiscal tightening could be worth 0.5-1.0% of GDP. While a larger fiscal hike could take a little more of the risk premium out of the UK Gilt market, it could well see the market pricing the BoE policy rate under the 3.25% neutral rate next year and weighing on sterling. In all, we see the event risk of the UK budget as a neutral to negative one for sterling on the view that: a) the Chancellor will protect the Gilt market and b) will avoid any inflationary tax hikes, such as last year's National Insurance increase for employers. We find it highly unlikely that Chancellor Reeves would misread the mood of the bond market and deliver a budget which prompts a 'Sell UK' mentality.

Governor Bailey to pull the trigger on easing: The BoE looks nearly ready to cut. November saw a 5-4 vote in favour of an unchanged Bank Rate at 4.00%, but Governor Andrew Bailey sounds like he will vote for a cut in December after he has seen a couple more CPI prints and the Autumn Budget. Our team expects further BoE cuts in the first and second quarters next year to set the policy rate near neutral at 3.25% next summer. At the same time, the BoE is slowing its quantitative tightening programme and, judging from some tightness in money markets – e.g., Sonia occasionally trading over the Bank Rate – might look at ways to further soften liquidity conditions. Even though the market already prices the BoE's terminal rate at 3.25%, we expect the easing to weigh on sterling as hedging costs dip and deposit rates drop into the middle of the G10 pack.

Politics as a low probability, high impact event risk: The first 15 months in office have been tough for this error-prone Labour government. While it does sit on a large majority, it is finding itself exposed to attacks from both the right (Reform riding high in the polls) and the left (left-wingers wanting higher social spending and higher taxation). Local elections next May could prove a lightning rod for these frustrations, with a poor result forcing the exit of Prime Minister Keir Starmer – plus Chancellor Reeves, were Starmer to be ousted. The threat of Labour moving more to the left and the departure of Reeves in particular would not be welcomed by the Gilt market. Clearly, the government has a lot riding on the November budget and will be praying for some slightly stronger growth in 2026. We forecast growth to nudge up to 1.1-1.2% quarter-on-quarter annualised growth next year as layoffs slow down and consumption remains supportive.

EUR/JPY: Hard to fight the trend| Spot | Year ahead bias | 4Q25 | 1Q26 | 2Q26 | 3Q26 | 4Q26 | |

|---|---|---|---|---|---|---|---|

| EUR/JPY | 178.00 | Neutral | 179.00 | 181.00 | 180.00 | 182.00 | 181.00 |

180 here we come: Recent political developments in Japan have seen EUR/JPY push to its highest levels since the 1990s. While Japanese authorities will be wary of what the weak yen means for inflation, they'll no doubt welcome these levels for their export community. This is especially the case as Japanese exporters fight for market share in countries outside of the US. Given what could well be a year of low/lower market volatility in 2026, we expect the yen to become increasingly attractive as the preferred funding currency. With direct Japanese investment into the US already picking up even before the trade deal, we suspect that USD/JPY will at some stage explore the 155-160 area – even if for a brief period. That could see EUR/JPY press the 180 area and will probably make Japanese intervention more likely.

The 2026 risks to the euro: We're a little bullish on the euro in 2026 as eurozone activity picks up. Risks remain, of course. On the macro side, those stem from German fiscal stimulus never fully being delivered and savings ratios for both businesses and consumers staying high. There is also the issue of the unresolved French budget. Our take assumes another muddle-through here, while recent upgrades for sovereign ratings in southern Europe serve as a reminder that France is something of an outlier. On geopolitics, clearly a substantial change in the Ukraine-Russian war will have a say on the euro. But barring a major change in Washington's position, it's hard to see substantial changes in this grinding conflict in 2026. And another risk for the euro is further ECB easing. The market eagerly awaits the ECB's next forecast round in December. Any 2028 CPI forecast below, say, 1.8%, could open the door to potentially 50bp of rate cuts. That's not our house call.

Let's talk about equities: The AI boom has taken the Shiller Cyclically Adjusted Price Earnings ratio to above 40. That's extreme and is not far from the peak Dot Com level (43) reached in early 2000. Most CEOs are now warning of a 10% correction sometime over the next year or two. How and when that correction materialises is far from clear, but it would weigh heavily on AUD/JPY (probably the most correlated pair) and EUR/JPY. There is much focus on the extremely narrow breadth of the current rally and how it is just the revised earnings estimates for the magnificent seven which are powering the gains. Analyst earnings estimates for the remaining 493 stocks in the S&P 500n have been revised down this year. A short, sharp equity correction is probably the most likely route to a lower EUR/JPY in 2026.

EUR/GBP: Not as expensive as it looks| Spot | Year ahead bias | 4Q25 | 1Q26 | 2Q26 | 3Q26 | 4Q26 | |

|---|---|---|---|---|---|---|---|

| EUR/GBP | 0.88 | Mildly Bullish | 0.88 | 0.88 | 0.89 | 0.89 | 0.90 |

Back to early 2023 highs: In trading back above 0.88, EUR/GBP has headed back to levels last seen in early 2023. The move is largely driven by this year's macro adjustment, where fiscal policy is being loosened in the eurozone (ex France) and the ECB has finished easing. Fiscal policy is being tightened in the UK, and the BoE looks like it has another 75bp of easing to deliver. Sterling also has a risk premium associated with its government bond market, where swap spreads trade at 50bp compared to near-flat swap spreads in Germany. Despite these high EUR/GBP levels, sterling is not particularly cheap. As recently as June, the inflation-adjusted UK exchange rate was trading back at levels last seen in early 2016. Stubbornly high UK inflation has contributed to this real sterling appreciation.

Grind higher is the view: Our baseline forecast assumes EUR/GBP edges higher through the year. The first half should be driven by the BoE easing cycle, but the second half may be more euro-driven. Here, we expect German fiscal stimulus to play an increasingly important role for growth throughout the year as interest rate markets start to consider a 2027 ECB hike. 0.90 looks a conservative upside target, which could be bettered should the UK domestic or external environment deteriorate. Remember, sterling normally underperforms in a crisis by nature of its twin deficits. Recall that EUR/GBP jumped 5% in early April when Liberation Day tariffs sank global equity markets.

Risks skewed to the upside: Most of the alternative views seem to favour higher outcomes for EUR/GBP next year – be they tighter fiscal/looser monetary policy or politics in the UK. On the downside, European politics is a risk. It's not our baseline call, but early French elections could once again upset the French bond market and force the ECB to take action should broader eurozone stability come into question. Currently, there seems to be no path to fiscal consolidation in France, and the stability of the French government remains one of the key risks. Another risk is that German politicians cannot agree on the implementation of fiscal stimulus. Concerns emerged this summer that infrastructure spending was going to be financed out of existing budgets. Failure to deliver new spending could unwind the optimism and the boost the euro received earlier this year.

EUR/CHF: Plus ca change| Spot | Year ahead bias | 4Q25 | 1Q26 | 2Q26 | 3Q26 | 4Q26 | |

|---|---|---|---|---|---|---|---|

| EUR/CHF | 0.93 | Neutral | 0.92 | 0.92 | 0.93 | 0.94 | 0.95 |

SNB can do little about CHF strength: EUR/CHF remains propped up at the lows of the year. Having been a seller of FX reserves in 2022 and 2023 to drive the Swiss franc higher to fight inflation, the Swiss National Bank has turned FX buyer again – to the tune of CHF5bn in the second quarter. With the policy rate now at 0.00%, the Swiss National Bank views monetary policy as expansionary, but at the same time is showing very little concern over deflation. CPI is expected to creep higher from its current 0.2% year-on-year level to 0.8% by 2028. Further Swiss franc strength is undoubtedly unwelcome. Some locals think the SNB would intervene more aggressively were it to make it to the 0.91 area. However, the central bank looks very reluctant to take the policy rate negative again. Swiss pension funds are already being charged 25bp on their CHF deposits, and most think the SNB would only go negative again if there was a major shock and QE were reintroduced by the ECB.

The real CHF is at 25-year highs: Actively managing the exchange rate as part of its monetary policy tool kit, the SNB now faces a real, inflation-adjusted Swiss franc at the highest levels seen this century. As above, however, the bar is very high for the SNB to take rates negative again. The political environment is also difficult for FX intervention, where sustained activity could see Switzerland labelled as a currency manipulator by the US Treasury. It already falls foul of two of the three criteria, and sustained FX intervention at 5% of GDP (around CHF40bn) over a 12-month period would seal the unwelcome deal. In turn, there's local resignation that the Swiss franc will continue to stay strong until we see recoveries in key trading partners – such as the eurozone. We are expecting a modest pick-up in eurozone activity next year as German fiscal stimulus starts to come through, which should be enough to lift EUR/CHF back to 0.95 through 2026.

The gold connection: One of the standout developments in financial markets this year has been the rally in gold. This cannot wholly be blamed on lower US real interest rates. Indeed, central bank reserve managers seem to be open about their concerns for both government debt and fiat currencies, creating a view that gold is one of the few safe assets. This theme has proved a tailwind for the Swiss franc this year. Presumably, any loss of confidence in the dollar – if, for instance, intense political pressure were to emerge on the Fed to cut rates – would only add to CHF gains. To repeat, however, Swiss franc gains remain unwelcome given high US tariffs (currently 39%) and 2026 growth forecasts of under 1.00%. The problem remains that options to counter Swiss franc strength remain sorely limited.

EUR/SEK: Still cheap, still promising| Spot | Year ahead bias | 4Q25 | 1Q26 | 2Q26 | 3Q26 | 4Q26 | |

|---|---|---|---|---|---|---|---|

| EUR/SEK | 10.99 | Mildly Bearish | 10.90 | 10.80 | 10.70 | 10.60 | 10.50 |

SEK is still cheap: A repeat of the Swedish krona's stellar 2025 performance looks unlikely next year, but we remain constructive. Our medium-term BEER model shows SEK is still 10–13% undervalued in real terms versus EUR and USD. That misvaluation persisted due to post-pandemic domestic concerns and excess savings flowing to the US. Now, conditions for further convergence to fair value look better. Higher USD hedging ratios, looser global financial conditions favouring rotation to high-beta currencies, and finally a more upbeat domestic backdrop all point to a more supportive environment for SEK in 2026. We see more upside for the krona against the dollar, but EUR/SEK should also stay on a multi-quarter downward trend.

Good growth outlook: One of our key calls for 2026 is that the end of global easing cycles and greater market tolerance for Trump's policy delivery will shift focus back to currency fundamentals. As discussed above, our BEER model tells us that those fundamentals are good and underpriced in SEK. And while SEK carry remains unattractive, a modest 25bp gap with euro rates doesn't justify sustained upward pressure on EUR/SEK. We forecast 1.2% Swedish growth next year, with room for upside surprises. Rate cuts tend to have a faster and stronger impact on Swedish households than elsewhere in the EU, and forward-looking indicators – PMIs, the Economic Tendency Survey, and consumer confidence – are all at or above pre-tariff levels. The fiscal stimulus package for 2026 (SEK 80bn) includes tax cuts that can support lagging consumption, and there is potential for more fiscal expansion promises ahead of the September 2026 election. Finally, our call for solid eurozone growth in 2026 is also supportive for SEK, which often shows a higher beta to eurozone performance than the euro itself.

The risks mostly come from abroad: We don't expect the Riksbank to amend its 1.75% policy rate throughout 2026. As the Bank itself has noted, any trigger for further easing is more likely to come from abroad – potentially via a sharp US equity market correction. That same risk lens should be applied to SEK. The krona tends to correlate with US tech sector selloffs, and in our view, elevated AI stock valuations pose the biggest threat to our bullish view on the currency, alongside geopolitical risks, particularly Russia-NATO tensions in Europe.

EUR/NOK: A bumpy downward path ahead| Spot | Year ahead bias | 4Q25 | 1Q26 | 2Q26 | 3Q26 | 4Q26 | |

|---|---|---|---|---|---|---|---|

| EUR/NOK | 11.68 | Mildly Bearish | 11.60 | 11.50 | 11.50 | 11.50 | 11.40 |

Three cuts in 2026: Norges Bank's latest projections point to just one rate cut over the next three years, reaching a terminal rate of 3.25% by 2028. While we agree with the terminal rate level, we expect all three cuts to come in 2026. The bar for dovish surprises from Norges Bank hasn't been high in 2025, and if underlying CPI sustainably dips below 3.0% – as we expect – there will be a stronger case for easing in the first half of the year. This would align with our Fed view, which includes two additional cuts next year following one in December. While we expect a slightly more front-loaded path, our call for 75bp of cuts is not far from the 50bp priced in over the next 12 months.

Calmer conditions are welcome: The Norwegian krone is the least liquid currency in G10 and will remain the most vulnerable to sharp selloffs in risk-off events. 2025 BIS data shows daily turnover of just $125bn for NOK, around 20% lower than SEK and even below some EM currencies like the Korean won and Mexican peso. As with SEK, key risks for NOK stem from equity market corrections and geopolitical tensions. That said, looser global financial conditions – as well as a low risk of a new increase in Norges Bank FX purchases given our bearish oil view - should help support a continued downward trend in EUR/NOK, albeit with short-term bumps along the way.

Valuation and carry versus oil risks: Our BEER model suggests EUR/NOK remains around 7% overvalued in real terms over the medium term. This supports our view of further NOK appreciation, with attractive carry helping smooth the recovery. As noted earlier, we expect rate cuts to be gradual, and the EUR-NOK policy rate gap should remain in the 150–200bp range through the first half of the year, keeping pressure on the pair. However, the outlook for oil partly tempers the upside potential for NOK. Our commodities team sees Brent prices falling steadily below $60/bbl from the first quarter of 2026, with a year-end target of $54.

EUR/DKK: Upside risks to linger| Spot | Year ahead bias | 4Q25 | 1Q26 | 2Q26 | 3Q26 | 4Q26 | |

|---|---|---|---|---|---|---|---|

| EUR/DKK | 7.47 | Neutral | 7.47 | 7.46 | 7.46 | 7.46 | 7.46 |

Interventions can return: The Danish central bank (DN) hasn't stepped into the FX market since January 2023, but we see rising odds that EUR/DKK strength will force action. Reserves have grown to a comfortable c.20% of GDP, giving the Bank ample room to respond. Denmark's current account is at risk of narrowing after the post-pandemic boom, and the EUR/DKK 30bp effective rate gap is now looking wide considering the pair's levels. While a frontier risk, territorial tensions with the US over Greenland could fuel intense bearish speculation on the krone.

If ECB cuts again, DN might hold: We still expect FX intervention to be the first line of defence for the central bank, as narrowing the DKK-EUR rate gap would require a hike now that the ECB easing cycle appears to be over. Should the ECB cut again, DN could deliver a smaller cut or even stay on hold.

Risks of devaluation or EUR-isation remain low: The large FX reserves buffer means EUR/DKK should not sustainably deviate from its 7.460 central rate. Volatility risks are, however, tilted to the upside, and we could see moves above 7.470. Denmark's central bank governor recently discussed the potential benefits of adopting the euro, but there is little to suggest a new referendum is being considered, and opinion polls still show a preference for keeping the krone.

USD/CAD: More trade headwinds ahead| Spot | Year ahead bias | 4Q25 | 1Q26 | 2Q26 | 3Q26 | 4Q26 | |

|---|---|---|---|---|---|---|---|

| USD/CAD | 1.40 | Mildly Bearish | 1.40 | 1.40 | 1.39 | 1.38 | 1.36 |

USMCA anxiety to grow: Even if Canada manages to fend off further US tariff hikes in the coming months, the looming USMCA renegotiations – scheduled for formal review in July 2026 – pose a significant risk. During his first term, Trump employed considerable brinkmanship in USMCA talks. This time, the narrative is even more aggressive, and US markets have become less reactive to his tactics, which arguably plays to his advantage. A complete scrapping of the agreement could become a recurring threat, and while the Canadian dollar has also shown reduced sensitivity to tariff risks, the broader implications of trade uncertainty – particularly for Canadian economic activity and unemployment – remain substantial. We expect most of these risks to be concentrated in the first half of the year. Our base case is that a USMCA extension will ultimately be agreed upon (albeit under less favourable terms for Canada), and less uncertainty could help a recovery in Canadian activity sentiment in the second half of 2026.

BoC can cut again: The Bank of Canada has signalled that it's close to neutral, though the risks remain tilted to the dovish side. Fiscal support is set to increase under the new budget, but highly indebted Canadian households tend to benefit more from rate cuts. Notably, monetary policy is not particularly accommodative by historical standards. The last time unemployment was at 7.1%, the real policy rate stood at -1.5% (vs both core and headline CPI), compared to the current -0.1% (vs headline) and -0.9% (vs core). Assuming inflation does not trend significantly higher from here, further easing would not be out of line – especially given the substantial risk of further deterioration in the labour market. We expect one additional 25bp cut in the first quarter of next year, bringing the terminal rate to 2.0%. Currently, markets are pricing in 15bp of easing by June 2026. Should USMCA negotiations collapse, further rate cuts would be a very tangible possibility.

Hard to love the loonie: While our forecast for broad-based USD weakness suggests some downside potential for USD/CAD, the loonie faces more pronounced risks than most other currencies. The domestic headwinds outlined above are likely to continue weighing on the currency into the first half of the year, with USMCA-related uncertainty playing a particularly prominent role. Compounding this is CAD's higher sensitivity – more than any other non-USD G10 currency – to a deteriorating US labour market narrative and our call for oil price weakness in 2026. As a result, CAD stands out as our least preferred commodity currency in the G10 space for the year ahead. The second half of 2026 may offer a more supportive environment for CAD, as trade tensions may ease and domestic sentiment improves.

AUD/USD: A very solid outlook| Spot | Year ahead bias | 4Q25 | 1Q26 | 2Q26 | 3Q26 | 4Q26 | |

|---|---|---|---|---|---|---|---|

| AUD/USD | 0.65 | Bullish | 0.66 | 0.67 | 0.68 | 0.68 | 0.69 |

China risk to abate further: The Aussie dollar has been a laggard in the big USD decline of 2025, discounting its role as a proxy for China-related sentiment amid trade tensions. US tariffs on China aren't going away in 2026 for Australia's highly China-dependent export sector. Looking at the new year, China's economic outlook continues to face risks of slowdown in consumption, exports and investments linked to the property market downturn. But fiscal and monetary policy should offer continued support across all areas of the economy, and our economists forecast a respectable 4.6% growth for China in 2026.

Little room to cut: The Reserve Bank of Australia has gone through a series of hawkish adjustments in guidance during the second half of 2025. Inflation projections have been revised higher, with headline CPI expected to remain above the 2-3% target band until mid-2027, and trimmed mean inflation only dipping below 3% in the second half of 2026. If those projections hold, delivering any easing in 2026 will be difficult. Our assessment is slightly more dovish – also factoring in some deterioration in the labour market – and we still expect one final 25bp cut in the first quarter of 2026, bringing the terminal rate to 3.35%, broadly in line with market pricing. In our estimate, that would be the highest central bank rate in G10 by mid-2026.

Strong fundamental mix: Based on our key view that markets will increasingly scrutinise a broader range of currency fundamentals in the new year, we think AUD is well-positioned. Our assessment of Chinese resilience supports our call for solid 2.2% GDP growth in Australia in 2026, up from 1.8% in 2025. Our commodities team expects iron ore prices to moderate but bottom out at USD 90/t in the third quarter of 2026. We also expect the AUD/USD two-year swap rate gap to remain close to 40–50bp next year, a range that coincided with AUD/USD trading at 0.68–0.69 back in September–October 2024. As the China trade tension premium continues to fade, a convergence towards that area appears very plausible in 2026. AUD will remain highly sensitive to any renewed deterioration in US-China relations or equity market corrections, but at the same time can benefit from insulation against geopolitical risk flare-ups in Europe or the Middle East.

NZD/USD: Easing into stability| Spot | Year ahead bias | 4Q25 | 1Q26 | 2Q26 | 3Q26 | 4Q26 | |

|---|---|---|---|---|---|---|---|

| NZD/USD | 0.57 | Mildly Bullish | 0.57 | 0.58 | 0.58 | 0.58 | 0.59 |

RBNZ close to neutral: The Reserve Bank of New Zealand is, in our view, likely to deliver one final 25bp cut to 2.25% in November. Admittedly, the threshold for a follow-up reduction in early 2026 is not particularly high, given policymakers' clear inclination to err on the dovish side. Incoming Governor Anna Breman – who assumes office on 1 December – has historically leaned dovish during her tenure on the Riksbank board, reinforcing this bias. Markets continue to price in some probability of a 2.0% terminal rate. Our expectation for only one additional cut is primarily driven by the fact that both headline and non-tradable CPI remain well above target, and the disinflation process may face setbacks next year now that lending conditions have become more accommodative.

Stabilising growth: Also supporting our RBNZ call is the expectation that growth will stabilise in 2026. The 15% US tariff rate has had some impact, although total exports to the US are down a moderate 3% year-on-year. This decline has been driven primarily by a sharp contraction in wine exports, while dairy and meat exports appear to be holding up well. Crucially, exports to non-US markets are growing at an annual rate of 11%, more than offsetting the losses from the US. China remains a solid export destination, and the US-China trade deal should help reduce uncertainty in New Zealand by extension.

Moderately optimistic on NZD: The environment in 2026 should, in our view, be broadly supportive of high-beta commodity currencies. New Zealand's terms of trade remain strong, and dairy price forecasts are broadly optimistic for the coming year. This backdrop should contribute to a gradual increase in the NZD/USD medium-term fair value. However, the main headwind will continue to be the relatively unattractive interest rate, particularly when compared to Australia. This argues for a more cautious upward profile for NZD/USD and against any sustained reversal in AUD/NZD strength.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment