Compelling Greenfields Copper-Gold Targets Highlight Potential For Major Discoveries

| Steve Parsons Managing Director FireFly Metals Ltd +61 8 9220 9030 | Jessie Liu-Ernsting Corp Dev & IR FireFly Metals Ltd +1 709 800 1929 | Media Paul Armstrong Read Corporate +61 8 9388 1474 |

ABOUT FIREFLY METALS

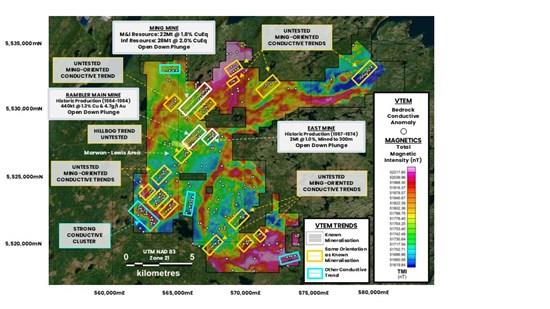

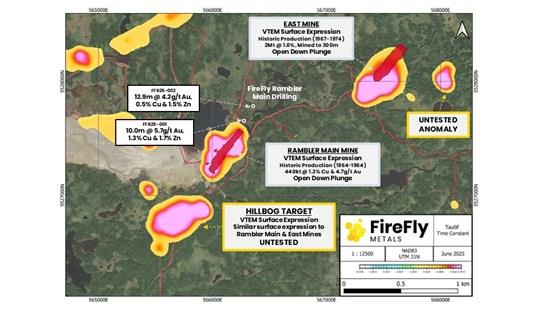

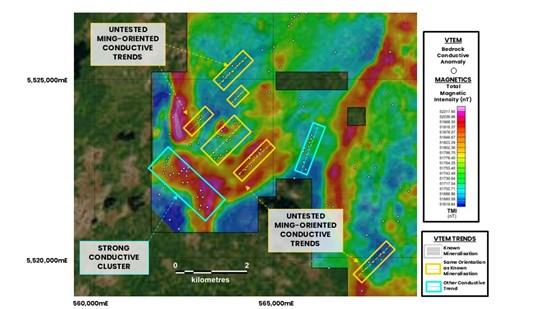

FireFly Metals Ltd (ASX: FFM) (TSX: FFM) is an emerging copper-gold company focused on advancing the high-grade Green Bay Copper-Gold Project in Newfoundland, Canada. The Green Bay Copper-Gold Project currently hosts a Mineral Resource prepared and disclosed in accordance with the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves ( JORC Code 2012 ) and Canadian National Instrument 43-101 - Standards of Disclosure for Mineral Projects ( NI 43-101 ) of 24.4Mt of Measured and Indicated Resources at 1.9% for 460Kt CuEq and 34.5Mt of Inferred Resources at 2% for 690Kt CuEq .

The Company has a clear strategy to rapidly grow the copper-gold Mineral Resource to demonstrate a globally significant copper-gold asset. FireFly has commenced a 130,000m diamond drilling program.

FireFly holds a 70% interest in the high-grade Pickle Crow Gold Project in Ontario. The current Inferred Resource stands at 11.9Mt at 7.2g/t for 2.8Moz gold , with exceptional discovery potential on the 500km2 tenement holding.

The Company also holds a 90% interest in the Limestone Well Vanadium-Titanium Project in Western Australia.

For further information regarding FireFly Metals Ltd please visit the ASX platform (ASX: FFM) or the Company's website or SEDAR+ at .

COMPLIANCE STATEMENTS

Mineral Resources Estimate – Green Bay Project

The Mineral Resource Estimate for the Green Bay Project referred to in this announcement and set out in Appendix A was first reported in the Company's ASX announcement dated 29 October 2024, titled "Resource increases 42% to 1.2Mt of contained metal at 2% Copper Eq" and is also set out in the Technical Reports for the Ming Copper Gold Mine titled "National Instrument 43-101 Technical Report, FireFly Metals Ltd., Ming Copper-Gold Project, Newfoundland" with an effective date of 29 November 2024 and the Little Deer Copper Project, titled "Technical Report and Updated Mineral Resource Estimate of the Little Deer Complex Copper Deposits, Newfoundland, Canada" with an effective date of 26 June 2024, each of which is available on SEDAR+ at .

The Company confirms that it is not aware of any new information or data that materially affects the information included in the original announcement and that all material assumptions and technical parameters underpinning the Mineral Resource Estimate in the original announcement continue to apply and have not materially changed.

Mineral Resources Estimate – Pickle Crow Project

The Mineral Resource Estimate for the Pickle Crow Project referred to in this announcement was first reported in the Company's ASX announcement dated 4 May 2023, titled "High-Grade Inferred Gold Resource Grows to 2.8Moz at 7.2g/t" and is also set out in the Technical Report for the Pickle Crow Project, titled "NI 43-101 Technical Report Mineral Resource Estimate Pickle Crow Gold Project, Ontario, Canada" with an effective date of 29 November 2024, as amended on 11 June 2025, available on SEDAR+ at .

The Company confirms that it is not aware of any new information or data that materially affects the information included in the original announcement and that all material assumptions and technical parameters underpinning the Mineral Resource Estimate in the original announcement continue to apply and have not materially changed.

Metal equivalents for Mineral Resource Estimates

Metal equivalents for the Mineral Resource Estimates have been calculated at a copper price of US$8,750/t, gold price of US$2,500/oz and silver price of US$25/oz. Individual Mineral Resource grades for the metals are set out in Appendix A of this announcement. Copper equivalent was calculated based on the formula CuEq(%) = Cu(%) + (Au(g/t) x 0.82190) + (Ag(g/t) x 0.00822).

Metallurgical factors have been applied to the metal equivalent calculation. Copper recovery used was 95%. Historical production at the Ming Mine has a documented copper recovery of ~96%. Precious metal (gold and silver) metallurgical recovery was assumed at 85% on the basis of historical recoveries achieved at the Ming Mine in addition to historical metallurgical test work to increase precious metal recoveries.

In the opinion of the Company, all elements included in the metal equivalent calculations have a reasonable potential to be sold and recovered based on current market conditions, metallurgical test work, the Company's operational experience and, where relevant, historical performance achieved at the Green Bay project whilst in operation.

Metal equivalents for Exploration Results

Metal equivalents for the Exploration Results have been calculated at a copper price of US$8,750/t, gold price of US$2,500/oz, silver price of US$25/oz and zinc price of US$2,500/t. Individual grades for the metals are set out in Appendix B of this announcement.

Metallurgical factors have been applied to the metal equivalent calculation. Copper recovery used was 95%. Historical production at the Ming Mine has a documented copper recovery of ~96%. Precious metal (gold and silver) metallurgical recovery was assumed at 85% based on historical recoveries achieved at the Ming Mine in addition to historical metallurgical test work to increase recoveries. Zinc recovery is applied at 50% based on historical processing and potential upgrades to the mineral processing facility.

In the opinion of the Company, all elements included in the metal equivalent calculation have a reasonable potential to be sold and recovered based on current market conditions, metallurgical test work, and the Company's operational experience.

Copper equivalent was calculated based on the formula CuEq(%) = Cu(%) + (Au(g/t) x 0.82190) + (Ag(g/t) x 0.00822) + (Zn(%) x 0.15038).

Exploration Results

Previously reported Exploration Results at the Green Bay Project referred to in this announcement were first reported in accordance with ASX Listing Rule 5.7 in the Company's ASX announcements dated 31 August 2023, 11 December 2023, 16 January 2024, 4 March 2024, 21 March 2024, 29 April 2024, 19 June 2024, 3 September 2024, 16 September 2024, 3 October 2024, 10 December 2024 and 12 February 2025.

Original announcements

FireFly confirms that it is not aware of any new information or data that materially affects the information included in the original announcements and that, in the case of estimates of Mineral Resources, all material assumptions and technical parameters underpinning the Mineral Resource Estimates in the original announcements continue to apply and have not materially changed. The Company confirms that the form and context in which the Competent Persons' and Qualified Persons' findings are presented have not been materially modified from the original market announcements.

COMPETENT PERSON AND QUALIFIED PERSON STATEMENTS

The information in this announcement that relates to new Exploration Results is based on and fairly represents information compiled by Mr Darren Cooke, a Competent Person who is a member of the Australasian Institute of Geoscientists. Mr Cooke is a full-time employee of FireFly Metals Ltd and holds securities in FireFly Metals Ltd. Mr Cooke has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the 'Australasian Code for the Reporting of Exploration Results, Mineral Resources and Ore Reserves'. Mr Cooke consents to the inclusion in this announcement of the matters based on his information in the form and context in which it appears.

All technical and scientific information in this announcement has been reviewed and approved by Group Chief Geologist, Mr Juan Gutierrez BSc, Geology (Masters), Geostatistics (Postgraduate Diploma), who is a Member and Chartered Professional of the Australasian Institute of Mining and Metallurgy and a Member of the Australian Institute of Geoscientists. Mr Gutierrez is a Qualified Person as defined in NI 43-101. Mr Gutierrez is a full-time employee of FireFly Metals Ltd and holds securities in FireFly Metals Ltd. Mr Gutierrez has sufficient experience that is relevant to the style of mineralisation and type of deposit under consideration and to the activity being undertaken to qualify as a Qualified Person as defined in NI 43-101. Mr Gutierrez consents to the inclusion in this announcement of the matters based on his information in the form and context in which it appears.

FORWARD-LOOKING INFORMATION

This announcement may contain certain forward-looking statements and projections, including statements regarding FireFly's plans, forecasts and projections with respect to its mineral properties and programs. Forward-looking statements may be identified by the use of words such as "may", "might", "could", "would", "will", "expect", "intend", "believe", "forecast", "milestone", "objective", "predict", "plan", "scheduled", "estimate", "anticipate", "continue", or other similar words and may include, without limitation, statements regarding plans, strategies and objectives.

Although the forward-looking statements contained in this announcement reflect management's current beliefs based upon information currently available to management and based upon what management believes to be reasonable assumptions, such forward-looking statements and projections are estimates only and should not be relied upon. They are not guarantees of future performance and involve known and unknown risks, uncertainties and other factors many of which are beyond the control of the Company, which may include changes in commodity prices, foreign exchange fluctuations, economic, social and political conditions, and changes to applicable regulation, and those risks outlined in the Company's public disclosures.

The forward-looking statements and projections are inherently uncertain and may therefore differ materially from results ultimately achieved. For example, there can be no assurance that FireFly will be able to confirm the presence of Mineral Resources or Ore Reserves, that FireFly's plans for development of its mineral properties will proceed, that any mineralisation will prove to be economic, or that a mine will be successfully developed on any of FireFly's mineral properties. The performance of FireFly may be influenced by a number of factors which are outside of the control of the Company, its directors, officers, employees and contractors. The Company does not make any representations and provides no warranties concerning the accuracy of any forward-looking statements or projections, and disclaims any obligation to update or revise any forward-looking statements or projections based on new information, future events or circumstances or otherwise, except to the extent required by applicable laws.

APPENDIX A

Green Bay Copper-Gold Project Mineral Resources

Ming Deposit Mineral Resource Estimate

| | TONNES | COPPER | GOLD | SILVER | CuEq | |||

| | (Mt) | Grade (%) | Metal ('000 t) | Grade (g/t) | Metal ('000 oz) | Grade (g/t) | Metal ('000 oz) | Grade (%) |

| Measured | 4.7 | 1.7 | 80 | 0.3 | 40 | 2.3 | 340 | 1.9 |

| Indicated | 16.8 | 1.6 | 270 | 0.3 | 150 | 2.4 | 1,300 | 1.8 |

| TOTAL M&I | 21.5 | 1.6 | 340 | 0.3 | 190 | 2.4 | 1,600 | 1.8 |

| Inferred | 28.4 | 1.7 | 480 | 0.4 | 340 | 3.3 | 3,000 | 2.0 |

Little Deer Mineral Resource Estimate

| | TONNES | COPPER | GOLD | SILVER | CuEq | |||

| | (Mt) | Grade (%) | Metal ('000 t) | Grade (g/t) | Metal ('000 oz) | Grade (g/t) | Metal ('000 oz) | Grade (%) |

| Measured | - | - | - | - | - | - | - | - |

| Indicated | 2.9 | 2.1 | 62 | 0.1 | 9 | 3.4 | 320 | 2.3 |

| TOTAL M&I | 2.9 | 2.1 | 62 | 0.1 | 9 | 3.4 | 320 | 2.3 |

| Inferred | 6.2 | 1.8 | 110 | 0.1 | 10 | 2.2 | 430 | 1.8 |

GREEN BAY TOTAL MINERAL RESOURCE ESTIMATE

| | TONNES | COPPER | GOLD | SILVER | CuEq | |||

| | (Mt) | Grade (%) | Metal ('000 t) | Grade (g/t) | Metal ('000 oz) | Grade (g/t) | Metal ('000 oz) | Grade (%) |

| Measured | 4.7 | 1.7 | 80 | 0.3 | 45 | 2.3 | 340 | 1.9 |

| Indicated | 19.7 | 1.7 | 330 | 0.2 | 154 | 2.6 | 1,600 | 1.9 |

| TOTAL M&I | 24.4 | 1.7 | 400 | 0.3 | 199 | 2.5 | 2,000 | 1.9 |

| Inferred | 34.6 | 1.7 | 600 | 0.3 | 348 | 3.1 | 3,400 | 2.0 |

Mineral Resource Estimates for the Green Bay Copper-Gold Project, incorporating the Ming Deposit and Little Deer Complex, are prepared and reported in accordance with the JORC Code 2012 and NI 43-101. Mineral Resources have been reported at a 1.0% copper cut-off grade. Metal equivalents for the Mineral Resource Estimate have been calculated at a copper price of US$8,750/t, gold price of US$2,500/oz and silver price of US$25/oz. Metallurgical recoveries have been set at 95% for copper and 85% for both gold and silver. Copper equivalent was calculated based on the formula: CuEq(%) = Cu(%) + (Au(g/t) x 0.82190) + (Ag(g/t) x 0.00822). Totals may vary due to rounding.

APPENDIX B - JORC CODE, 2012 EDITION

Table 1

Section 1 - Sampling Techniques and Data for Regional Geophysical Survey (Criteria in this section apply to all succeeding sections)

| Criteria | JORC Code explanation | Commentary |

| Sampling techniques |

Include reference to measures taken to ensure sample representivity and the appropriate calibration of any measurement tools or systems used. Aspects of the determination of mineralisation that are Material to the Public Report. In cases where 'industry standard' work has been done this would be relatively simple (eg 'reverse circulation drilling was used to obtain 1m samples from which 3 kg was pulverised to produce a 30 g charge for fire assay'). In other cases, more explanation may be required, such as where there is coarse gold that has inherent sampling problems. Unusual commodities or mineralisation types (eg submarine nodules) may warrant disclosure of detailed information. | HELICOPTER-BORNE VERSATILE TIME DOMAIN ELECTROMAGNETIC AND AEROMAGNETIC GEOPHYSICAL SURVEY The conductors reported are preliminary interpretations of preliminary data provided to the Company by the geophysical contractor. The data was acquired from an airborne electromagnetic and magnetic survey completed by Geotech Ltd., an independent geophysical contractor. The survey utilised the VTEM Plus (versatile time domain electromagnetic) system.

Transmitter loop diameter is 34.6m Peak dipole moment of 626956.35 NIA Transmitter pulse width of 6.9 ms VTEM plus receive with Z,X,Y coils Base frequency of 30 Hz |

| Drilling techniques |

|

|

| Drill sample recovery |

Measures taken to maximise sample recovery and ensure representative nature of the samples. Whether a relationship exists between sample recovery and grade and whether sample bias may have occurred due to preferential loss/gain of fine/coarse material. |

|

| Logging |

Whether logging is qualitative or quantitative in nature. Core (or costean, channel, etc) photography. The total length and percentage of the relevant intersections logged. |

|

| Sub-sampling techniques and sample preparation |

If non-core, whether riffled, tube sampled, rotary split, etc and whether sampled wet or dry. For all sample types, the nature, quality and appropriateness of the sample preparation technique. Quality control procedures adopted for all sub-sampling stages to maximise representivity of samples. Measures taken to ensure that the sampling is representative of the in-situ material collected, including for instance results for field duplicate/second-half sampling. Whether sample sizes are appropriate to the grain size of the material being sampled. |

|

| Quality of assay data and laboratory tests |

For geophysical tools, spectrometers, handheld XRF instruments, etc, the parameters used in determining the analysis including instrument make and model, reading times, calibrations factors applied and their derivation, etc. Nature of quality control procedures adopted (eg standards, blanks, duplicates, external laboratory checks) and whether acceptable levels of accuracy (i.e. lack of bias) and precision have been established. |

|

| Verification of sampling and assaying |

The use of twinned holes. Documentation of primary data, data entry procedures, data verification, data storage (physical and electronic) protocols. Discuss any adjustment to assay data. |

|

| Location of data points |

Specification of the grid system used. Quality and adequacy of topographic control. | HELICOPTER-BORNE VERSATILE TIME DOMAIN ELECTROMAGNETIC AND AEROMAGNETIC GEOPHYSICAL SURVEY

The navigation system used was a Geotech PC104 based navigation system utilizing a NovAtel's WAAS (Wide Area Augmentation System) enabled GPS receiver, Geotech navigate software, a full screen display with controls in front of the pilot to direct the flight and a NovAtel GPS antenna mounted on the helicopter tail. As many as 11 GPS and two WAAS satellites may be monitored at any one time. The positional accuracy or circular error probability ( CEP ) is 1.8m and, with WAAS active, it is 1.0m. |

| Data spacing and distribution |

Whether the data spacing, and distribution is sufficient to establish the degree of geological and grade continuity appropriate for the Mineral Resource and Ore Reserve estimation procedure(s) and classifications applied. Whether sample compositing has been applied. | HELICOPTER-BORNE VERSATILE TIME DOMAIN ELECTROMAGNETIC (VTEMTM Max) AND AEROMAGNETIC GEOPHYSICAL SURVEY

|

| Orientation of data in relation to geological structure |

If the relationship between the drilling orientation and the orientation of key mineralised structures is considered to have introduced a sampling bias, this should be assessed and reported if material. | HELICOPTER-BORNE VERSATILE TIME DOMAIN ELECTROMAGNETIC (VTEMTM Max) AND AEROMAGNETIC GEOPHYSICAL SURVEY

|

| Sample security |

|

|

| Audits or reviews |

| HELICOPTER-BORNE VERSATILE TIME DOMAIN ELECTROMAGNETIC (VTEMTM Max) AND AEROMAGNETIC GEOPHYSICAL SURVEY

|

Section 2 - Reporting of Exploration Results (Criteria in this section apply to all succeeding sections)

| Criteria | JORC Code explanation | Commentary |

| Mineral tenement and land tenure status |

The security of the tenure held at the time of reporting along with any known impediments to obtaining a license to operate in the area. |

FireFly also owns a mineral land assembly consisting of 23 map-staked mineral licenses (listed below) registered in the name of 1470199 B.C. Ltd., a wholly owned subsidiary of FireFly. FireFly holds all the permits required to operate the Ming Mine at its historic production rate. All lands are in good standing with the Provincial Government, and FireFly is up to date with respect to lease payments (for leases) and required exploration expenditure (for licenses). The following 23 Mineral Licences covered by the geophysical survey are registered in the name of 1470199 B.C. Ltd.:

|

| Exploration done by other parties |

|

The Main Mine sulphide zone was found in 1935 about 600ft north of the Enos England discovery. In 1940, the Newfoundland government drilled 18 diamond drill holes totalling 5,000ft. An airborne electromagnetic survey was flown from 1955 to 1956. The Ming Mine was discovered in 1970 by a helicopter borne AEM system. A large low grade stringer type copper deposit was later discovered in the footwall 300ft to 500ft below the Ming mineralisation during mining operations and delineated by 36 diamond drill holes. Mining ceased at the Ming Mine in 1982 because of low copper prices. In 1988, the property was awarded to the Rambler Joint Venture Group (a Consortium of Teck Exploration, Petromet Resources Ltd, and Newfoundland Exploration Company Ltd). Exploration consisted of ground geophysics and soil geochemistry, resulting in discovery of the Ming West deposit. 48 diamond drill holes (25,534ft) were completed. Altius Minerals Corporation: Under the terms of an option to purchase agreement with Ming Minerals, Altius conducted exploration on the Rambler property in 2001, 2003, and 2004. In 2001, a litho-geochemical program was initiated to chemically fingerprint rocks of the hanging wall and footwall to the sulphide deposits. Rambler Metals and Mining PLC: Rambler Metals and Mining (now dissolved) was a UK-based company listed on London's Alternate Investment Market ( AIM ). Rambler held a 100% interest in the Ming property between 2005 and 2023 and conducted a multi-phase diamond drilling program consisting of surface drilling, directional drilling, and underground delineation drilling. A total of 220,704m from 1,365 diamond drill holes were completed by Rambler. Between 2012 and 2022 the Ming Mine produced 3Mt at 1.86% Cu and 0.71% Au for total of 55Kt of copper and 68Koz of gold. The Ming Mine was placed on care and maintenance in February 2023. In October 2023, AuTECO Minerals Ltd (now FireFly Metals Ltd) acquired the project from the administrator. FireFly conducted drilling to test the down plunge extent of VMS lodes. An underground exploration drive is in progress to allow further drilling at more favourable drill angles. |

| Geology |

|

|

| Drill hole Information |

elevation or RL (Reduced Level - elevation above sea level in meters) of the drill hole collar dip and azimuth of the hole down hole length and interception depth hole length |

|

| Data aggregation methods |

Where aggregate intercepts incorporate short lengths of high-grade results and longer lengths of low-grade results, the procedure used for such aggregation should be stated and some typical examples of such aggregations should be shown in detail. The assumptions used for any reporting of metal equivalent values should be clearly stated. |

|

| Relationship between mineralisation widths and intercept lengths |

If the geometry of the mineralisation with respect to the drill hole angle is known, its nature should be reported. If it is not known and only the down hole lengths are reported, there should be a clear statement to this effect (eg 'down hole length, true width not known'). |

|

| Diagrams |

|

|

| Balanced reporting |

|

|

| Other substantive exploration data |

|

|

| Further work |

Diagrams clearly highlighting the areas of possible extensions, including the main geological interpretations and future drilling areas, provided this information is not commercially sensitive. |

|

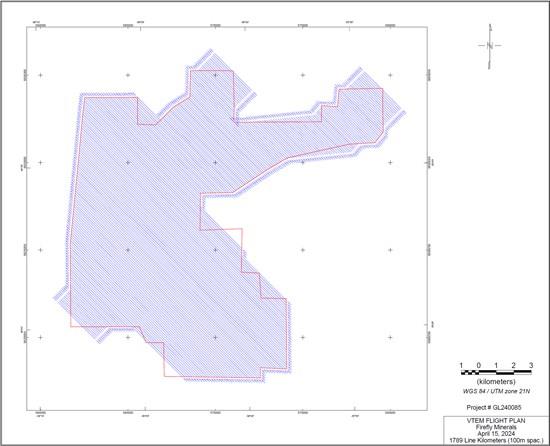

Plan view of VTEM Flight Plan in this announcement

To view an enhanced version of this graphic, please visit:

Section 1 - Sampling Techniques and Data for Tilt Cove Project (Criteria in this section apply to all succeeding sections)

| Criteria | JORC Code explanation | Commentary |

| Sampling techniques |

Include reference to measures taken to ensure sample representivity and the appropriate calibration of any measurement tools or systems used. Aspects of the determination of mineralisation that are Material to the Public Report. In cases where 'industry standard' work has been done this would be relatively simple (eg 'reverse circulation drilling was used to obtain 1m samples from which 3 kg was pulverised to produce a 30 g charge for fire assay'). In other cases, more explanation may be required, such as where there is coarse gold that has inherent sampling problems. Unusual commodities or mineralisation types (eg submarine nodules) may warrant disclosure of detailed information. | FLEM (TDEM) SURVEY

The survey was completed by Eastern Geophysics Ltd, an independent geophysical contractor. The equipment used was the Crone Pulse EM system. The Surface survey equipment consisted of a CDR4, 20 channel digital receiver, CHT3, 4.8 kw transmitter, a 6600w motor generator, and a surface induction coil (dB/dt). |

| Drilling techniques |

|

|

| Drill sample recovery |

Measures taken to maximise sample recovery and ensure representative nature of the samples. Whether a relationship exists between sample recovery and grade and whether sample bias may have occurred due to preferential loss/gain of fine/coarse material. |

|

| Logging |

Whether logging is qualitative or quantitative in nature. Core (or costean, channel, etc) photography. The total length and percentage of the relevant intersections logged. |

|

| Sub-sampling techniques and sample preparation |

If non-core, whether riffled, tube sampled, rotary split, etc and whether sampled wet or dry. For all sample types, the nature, quality and appropriateness of the sample preparation technique. Quality control procedures adopted for all sub-sampling stages to maximise representivity of samples. Measures taken to ensure that the sampling is representative of the in-situ material collected, including for instance results for field duplicate/second-half sampling. Whether sample sizes are appropriate to the grain size of the material being sampled. |

|

| Quality of assay data and laboratory tests |

For geophysical tools, spectrometers, handheld XRF instruments, etc, the parameters used in determining the analysis including instrument make and model, reading times, calibrations factors applied and their derivation, etc. Nature of quality control procedures adopted (eg standards, blanks, duplicates, external laboratory checks) and whether acceptable levels of accuracy (i.e. lack of bias) and precision have been established. |

|

| Verification of sampling and assaying |

The use of twinned holes. Documentation of primary data, data entry procedures, data verification, data storage (physical and electronic) protocols. Discuss any adjustment to assay data. |

|

| Location of data points |

Specification of the grid system used. Quality and adequacy of topographic control. | FLEM (TDEM) SURVEY

Data positioning was done with a handheld GPS |

| Data spacing and distribution |

Whether the data spacing, and distribution is sufficient to establish the degree of geological and grade continuity appropriate for the Mineral Resource and Ore Reserve estimation procedure(s) and classifications applied. Whether sample compositing has been applied. | FLEM (TDEM) SURVEY

|

| Orientation of data in relation to geological structure |

If the relationship between the drilling orientation and the orientation of key mineralised structures is considered to have introduced a sampling bias, this should be assessed and reported if material. | FLEM (TDEM) SURVEY

|

| Sample security |

|

|

| Audits or reviews |

|

|

Section 2 - Reporting of Exploration Results (Criteria in this section apply to all succeeding sections)

| Criteria | JORC Code explanation | Commentary |

| Mineral tenement and land tenure status |

The security of the tenure held at the time of reporting along with any known impediments to obtaining a license to operate in the area. |

|

| Licences 013054M 013055M 014109M 014111M 019122M 019158M 020510M 022576M 022791M 022796M 024119M 024535M 025051M 025291M 025437M 025558M 025832M 025838M 025853M 026202M 026379M 026404M 026540M 026680M 026729M 026730M 026950M 026992M 027285M 027398M 031602M 031816M 032148M 032906M 034851M 034854M 035078M 035079M 035080M 035081M 037157M | Registered Company Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. 1470199 B.C. Ltd. 1470199 B.C. Ltd. Tilt Cove Ltd. Firefly Metals Canada Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. 1470199 B.C. Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. 1470199 B.C. Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. Tilt Cove Ltd. | |

| | ||

| ||

| Exploration done by other parties |

|

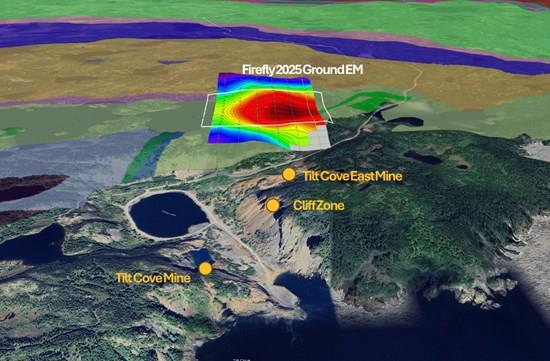

1864-1917 continuous mining in Tilt Cove Mine. 1875-1886 continuous mining in Betts Cove. 1931 Government Mapping. 1946 3657.6m of Diamond Drilling. 1948 Government Mapping. 1955 2056m of diamond drilling. 1951 Government Mapping. 1951 4877m of Diamond Drilling. 1954-1967 rehabilitation of old workings and mining at Tilt Cove Mine. 1958 Government Mapping. 1975 Airborne Electromagnetics survey. 1980-1983 geologic mapping, soil and rock sampling and ground, ground magnetic, VLF EM and pulse EM surveys and 850m of diamond drilling. 1983 Government compilation of Baie Verte Peninsula and Lake and stream sediment sampling. 1985-1989 basal till and geological mapping, trenching, rock, till, and soil sampling, ground magnetometer, VLF EM and IP surveys and multiple drill programs: 5 diamond drillholes, 6 diamond drillholes, 1500m of diamond drilling, 2306m of diamond drilling, 21769m of diamond drilling, 28m of diamond drilling and 172.8m of winkie holes. 1990-1994 Prospecting, rock and soil sampling, geophysical surveys, mag, VLF and IP, resampling of historic drillholes, 2109m of diamond drilling and auger drill testing 43.3m of the stockpile at Tilt Cove Mine. 1995-2001 Prospecting, geologic mapping, trenching, rock, channel and soil sampling, ground magnetic, IP and transient-EM geophysical surveying, BHEM surveys, and 13050m of diamond drilling. 1995-1996 high sensitivity EM and Magnetic Helicopter borne survey. 1996 start of Nugget Pond Mine. 1996-2001 continuous mining at Nugget Pond Mine 2003-2005 Prospecting, data compilation, re-logging of historic drill core and 2583m of diamond drilling. 2006 -2008 Prospecting, digital data compilation, re sampling of historic drill core, ground IP survey, airborne VTEM and magnetics and 4378m of diamond drilling. 2007 Government High-resolution airborne magnetics. 2011 A portion of the Tilt Cove Mine stockpile was processed. 2012 prospecting and rock sampling. 2017-2019 data compilation. 2018 soil sampling. 2019 Prospecting, rock and soil sampling, LiDAR imaging of the property. |

| Geology |

|

Nugget Pond Mine - The Nugget Pond Mine produced 168,748 ounces of gold with an average grade of approximately 9.85 g/t between 1997 and 2001. The deposit is hosted along the Nugget Pond Horizon, an iron formation with nearly 20 kilometres of strike and has similarities with other Canadian Banded-Iron-Formation hosted lode gold deposits. Tilt Cove Mine - The Tilt Cove Mine was discovered in 1857 and produced a total of 8,160,000 tonnes of ore grading between 1.25% to 12% copper and 42,425 ounces of gold between 1864 and 1917 and again between 1957 and 1967. Gold is typically associated with copper mineralisation and several of the historic copper deposits require follow-up testing for gold potential. Betts Cove Mine - The Betts Cove Mine was first discovered in the early 1860s. Between 1875 and 1886, approximately 130,000 tons of handpicked ore grading about 10% copper and 2,450 tons of pyrite were mined. Sampling of surface stockpiles from previous mining have retuned high gold values and base metals values up to 9.99 g/t gold, 18.3% copper and 1.7% zinc. No gold was recovered from the ore body. |

| Drill hole Information |

elevation or RL (Reduced Level - elevation above sea level in meters) of the drill hole collar dip and azimuth of the hole down hole length and interception depth hole length. |

|

| Data aggregation methods |

Where aggregate intercepts incorporate short lengths of high-grade results and longer lengths of low-grade results, the procedure used for such aggregation should be stated and some typical examples of such aggregations should be shown in detail. The assumptions used for any reporting of metal equivalent values should be clearly stated. |

|

| Relationship between mineralisation widths and intercept lengths |

If the geometry of the mineralisation with respect to the drill hole angle is known, its nature should be reported. If it is not known and only the down hole lengths are reported, there should be a clear statement to this effect (eg 'down hole length, true width not known'). |

|

| Diagrams |

|

|

| Balanced reporting |

|

|

| Other substantive exploration data |

|

|

| Further work |

Diagrams clearly highlighting the areas of possible extensions, including the main geological interpretations and future drilling areas, provided this information is not commercially sensitive. |

|

1 Cash, receivables and liquid investments position at 30 June 2025, plus A$10 million proceeds received from the Share Purchase Plan which completed on 14 July 2025, and anticipated net proceeds from the second tranche of the Institutional Placement ( T2 Placement ) of ~A$26.6 million, which is subject to shareholder approval at a general meeting planned to be held on 28 August 2025, noting that there is no guarantee that shareholders will vote in favour of the T2 Placement.

2 One final tranche of the capital raising (the T2 Placement) remains to be competed, as it is subject to receiving shareholder approval at a general meeting planned to be held on 28 August 2025.

3 Canadian "flow-through shares" provide tax incentives to the relevant investors relating to certain qualifying exploration expenditures under the Income Tax Act (Canada). (See ASX announcements dated 28 March 2024 and 5 June 2025).

4 Cash, receivables and liquid investments position at 30 June 2025, plus A$10 million proceeds received from the Share Purchase Plan which completed on 14 July 2025, and anticipated net proceeds from the second tranche of the Institutional Placement ( T2 Placement ) of ~A$26.6 million, which is subject to shareholder approval at a general meeting planned to be held on 28 August 2025, noting that there is no guarantee that shareholders will vote in favour of the T2 Placement.

To view the source version of this press release, please visit

SOURCE: FireFly Metals Ltd.

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment