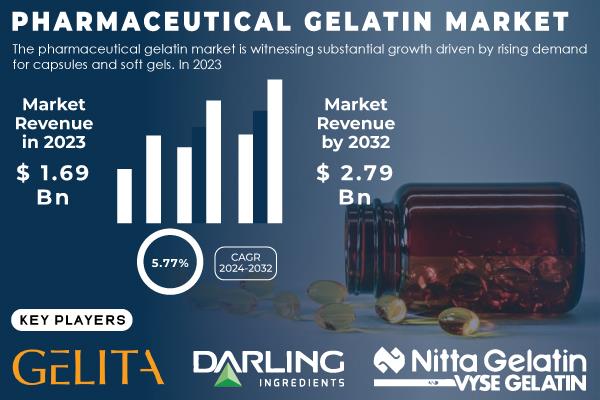

(MENAFN- GlobeNewsWire - Nasdaq) The Pharmaceutical gelatin market is driven by increasing demand for capsules, new drug delivery methods, and plant-based options. Heightened research and development in pharmaceuticals along with the expansion of vegan markets bolster this trend.Austin, Nov. 11, 2024 (GLOBE NEWSWIRE) -- The S&S Insider report indicates that, “ The Pharmaceutical Gelatin Market was valued at USD 1.69 Billion in 2023 and is projected to reach USD 2.79 Billion by 2032, growing at a compound annual growth rate (CAGR) of 5.77% from 2024 to 2032. ”

Growing Demand for Pharmaceutical Gelatin Market Driven by Advancements in Drug Delivery and Plant-Based Alternatives

Sturdy growth in the pharmaceutical gelatin market is determined by increasing demand for capsules and soft gels. In 2023, total global pharmaceutical R&D expenditure was $300 billion. This reflects considerable investment in drug formulation and delivery technologies. As prescription medicine expenditure is increasing by 6.0% to 8.0% in 2023, the pharmaceutical gelatin market will continue to grow in terms of drug delivery systems. 2023 Market volume: 464,410 tonnes Production is constantly growing, based on the development of a solid foundation.

As plant-based diets gain increased traction, more attention is being paid to vegan-friendly gelatin products. A global market valued nearly at USD 25 billion shows shifting trends toward plant-based protein options. According to consumer sentiment at around 70%, plant-based options are associated with a healthier element compared to animal-based alternatives. Pharmaceutical companies will focus on creating plant-based alternatives, and the demand for pharmaceutical gelatin especially vegan-related pharmaceutical gelatin will grow further in the future years, and this product will capture the market share.

Download PDF Sample of Pharmaceutical Gelatin Market @

Major Players:

Sterling Biotech Limited (Sterling Gelatin Capsules, Sterling Pharmaceutical Gelatin) Gelita AG (Gelita Gelatin, Gelita Pharma Gelatin) Darling Ingredients Inc. (Pharmaceutical Gelatin, Gelatin Capsules) Nitta Gelatin Inc. (Nitta Gelatin Capsules, Nitta Pharmaceutical Gelatin) India Gelatine & Chemicals (India Gelatin Capsules, Pharmaceutical Gelatin) Tessenderlo Group (Tessenderlo Gelatin, Gelatin for Capsules) PB Gelatins GmbH (PB Gelatin for Capsules, PB Pharmaceutical Gelatin) Junca Gelatines S.L. (Junca Gelatin, Pharmaceutical Gelatin) Trobas Gelatine BV (Trobas Gelatin Capsules, Pharmaceutical Gelatin) Weishardt Holding SA (Weishardt Gelatin, Weishardt Pharma Gelatin) Lapi Gelatine S.p.a. (Lapi Pharmaceutical Gelatin, Lapi Gelatin Capsules) Italgel S.r.l (Italgel Pharmaceutical Gelatin, Italgel Gelatin Capsules) Gelnex (Gelnex Gelatin, Gelnex Pharmaceutical Gelatin) Rousselot (Rousselot Pharma Gelatin, Rousselot Gelatin Capsules) Norland Products (Norland Gelatin, Norland Pharma Gelatin) Collagen Solutions (Collagen Gelatin, Collagen Pharma Gelatin) Qingdao Yuantong (Yuantong Pharmaceutical Gelatin, Yuantong Gelatin Capsules) Shandong Tianli Pharmaceutical (Tianli Gelatin Capsules, Tianli Pharma Gelatin) Haide Biochem (Haide Gelatin, Haide Pharmaceutical Gelatin) KIMICA Corporation (KIMICA Pharmaceutical Gelatin, KimiGel Gelatin Capsules)

Pharmaceutical Gelatin Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 1.69 Billion |

| Market Size by 2032 | USD 2.79 Billion |

| CAGR | CAGR of 5.77% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | . By Type (Type A, Type B)

. By Product (Hard Capsules, Soft Capsules, Tablets, Absorbable Hemostats)

. By Source (Porcine, Bovine, Marine, Poultry)

. By Function (Stabilizing Agents, Thickening Agents, Gelling Agents & Other Functions) |

| Key Drivers | . Growth in Food and Cosmetics Industries Fuels Gelatin Consumption Worldwide, Driving Market Expansion

. Rising Demand for Gelatin from Pharmaceutical and Nutraceutical Industries Drives Market Growth Growth |

If You Need Any Customization on Pharmaceutical Gelatin Market Report, I nquire Now @

Surge in Food and Cosmetics Sectors Drives Gelatin Consumption and Market Growth

The rapid growth of the food and cosmetic industries has fueled the increased demand for gelatin, especially in the confectionery, dairy products, and beauty formulation sectors. With the global beauty market account to USD 446 billion in 2023, and the rising dairy trade, gelatin plays an important part in fulfilling consumers' needs across multi-segments for steady market growth.

Pharmaceutical and Nutraceutical Industries Spark Rising Demand for Gelatin-based Solutions

The pharmaceutical and nutraceutical industries are among the leaders in gelatin consumption mainly for capsule, tablet, and drug delivery applications. Its digestibility and facilitation of improved bioavailability make it an essential part of dietary supplements and functional foods, and that will increase the market since increasing demand is reported to continue worldwide, especially within aging populations.

Type B Remains the Leading Application in the Pharmaceutical Gelatin Market

Type B gelatin accounted for the biggest market share of about 63% in 2023 because of its very wide application in soft and hard capsules, stability, and consistency in pharmaceutical applications. It also happens to be relatively inexpensive as it comes from bovines. Type A porcine gelatin is expected to maintain the highest CAGR of 6.39% from 2024-2032, due to the greater gelling strength and more extensive usage in developing countries where pharmaceutical formulations can be used with it.

Dominance of Stabilizing Agents and Projected Growth of Gelling Agents and Functional Additives in the Pharmaceutical Gelatin Market through 2032

In 2023, Stabilizing agents held the majority share of 47% in the Pharmaceutical Gelatin Market as they are considered to be the backbone in maintaining the stability and shelf life of gelatin-based pharmaceutical products. These agents are needed to ensure the structural integrity of gelatin capsules and tablets. Gelling agents and functional additives are projected to grow at a CAGR of 6.83% from 2024-2032 with innovations in gelling strength and the demand for multifunctional products in pharmaceutical formulations.

North America Leads Microfluidics Market in 2023, While Asia Pacific Poised for Significant Growth Through 2032

In terms of revenue, North America captured the maximum market share of 42% in 2023. This is on account of the concentrated pharmaceutical industry, tremendous growth in demand for the latest and innovative drug delivery systems, and steady investment in research and development. Additionally, interest in quality standards and regulatory compliance by the region strengthens the demand for pharmaceutical-grade gelatin, mainly in capsule stabilization.

The Asia Pacific is expected to expand considerably from 2024 to 2032 with a CAGR of 7.31%. Growth factors for the region include the rise in spending on healthcare, an increasing demand for nutraceuticals, and expanding pharmaceutical manufacturing, especially in developing countries like China and India. Affordable healthcare initiatives within the region have formed the basis of substantial opportunities in gelatin-based applications; thus, further propelling the market forward.

Buy Full Research Report on Pharmaceutical Gelatin Market 2024-2032 @

Key Developments in Pharmaceutical Gelatin Market

In 2024, Darling Ingredients introduced NextidaTM GC collagen peptide as a bioactive health component for pharmaceutical use, offering controlled support for post-prandial glucose elevation. Alsiano teamed up with Trobas Gelatine BV in 2024 to enhance gelatin supply for pharmaceuticals, nutraceuticals, and personal care throughout the Nordic markets.

Table of Contents – Major Key Points

1. Introduction

Scope (Inclusion and Exclusions)

2. Executive Summary

3. Research Methodology

4. Market Dynamics Impact Analysis

Market Driving Factors Analysis

Porter's Five Forces Model

5. Statistical Insights and Trends Reporting

Incidence and Prevalence (2023)

Prescription Trends, (2023), by Region

Drug Volume: Production and usage volumes of pharmaceuticals.

Healthcare Spending: Expenditure data by government, insurers, and out-of-pocket by patients.

6. Competitive Landscape

List of Major Companies, By Region

Market Share Analysis, By Region

Strategic partnerships and collaborations

Technological Advancements

Market Positioning and Branding

7. Pharmaceutical Gelatin Market Segmentation, by Type

8. Pharmaceutical Gelatin Market Segmentation, by Application

9. Pharmaceutical Gelatin Market Segmentation, by Source

10. Pharmaceutical Gelatin Market Segmentation, by Function

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Speak with O ur E xpert A nalyst T oday to G ain D eeper I nsights @

[For more information or need any customization research mail us at ... ]

About Us:

S&S Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us:

Akash Anand – Head of Business Development & Strategy

...

Phone: +1-415-230-0044 (US)

MENAFN11112024004107003653ID1108872693

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.