(MENAFN- Send2Press Newswire) DES MOINES, Iowa, Sept. 25, 2024 (SEND2PRESS NEWSWIRE) - iEmergent , a forecasting and advisory services firm for the financial services, mortgage and Real estate industries, today announced downward revision of its 2024–2026 U.S. Mortgage Origination Forecast . Updated to reflect ongoing economic conditions, iEmergent now expects lower-than-anticipated growth for the next two years, particularly in the purchase mortgage market, while refinance volumes are projected to rise due to a gradual decline in mortgage interest rates.

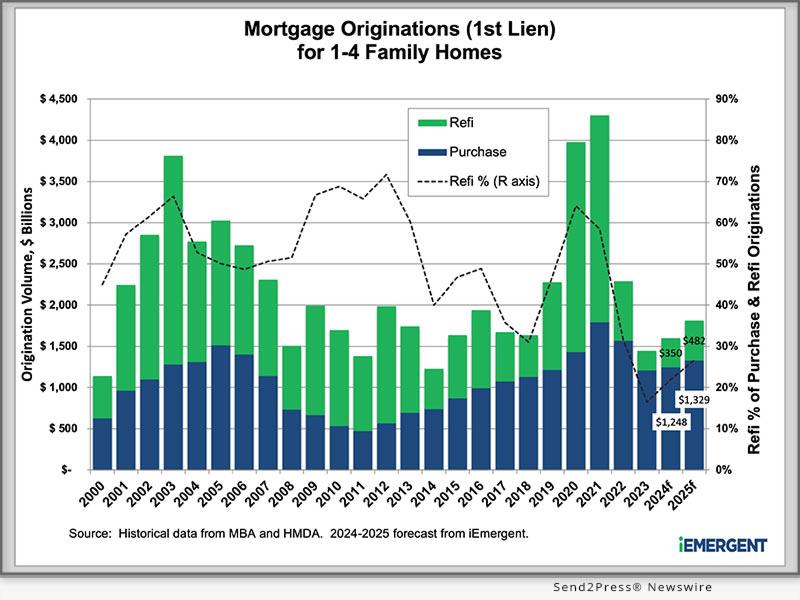

Image caption: Historical and forecasted first-lien mortgage originations for 1–4 family homes.

The revision comes as part of iEmergent's quarterly forecast update, which integrates the latest economic data and market trends into the company's detailed projections for mortgage originations across the United States. Using its proprietary forecasting methodology, iEmergent has adjusted its forecast for 2024 to reflect weaker-than-expected performance in purchase mortgage originations, which fell short of early-year estimates due to persistently high interest rates and continued housing affordability challenges.

According to iEmergent Chief Economist Mark Watson, 2024 purchase mortgage originations are now projected to decrease in loan count compared to 2023, though an increase in average loan sizes will lead to a modest 3.5% increase in purchase volume. Meanwhile, refinance originations are expected to rise 48% from their 2023 lows, driven by the recent softening of mortgage interest rates.

Looking ahead, iEmergent forecasts purchase volumes will grow by 7% in 2025, while refinance originations will increase by 37%, reflecting a more favorable interest rate environment. By 2026, overall mortgage origination volumes are expected to show modest recovery as housing affordability gradually improves.

“The economic boon of the COVID-era refinance boom has been underappreciated in its impact on keeping interest rates higher for longer than anticipated,” said Watson.“While this has helped maintain economic strength, it has also suppressed mortgage origination volumes. We expect rates to finally start declining in the months ahead, offering some relief for both potential buyers and those looking to refinance.”

The updated 2024–2026 U.S. Mortgage Origination Forecast is now available within iEmergent's Mortgage MarketSmart platform, which allows lenders to map future lending opportunities at the census tract level and overlay them with historical loan production data, demographic insights, property listings and more.

Read Mark Watson's latest blog for more detailed analysis and commentary on the forecast update.

Methodology

For more than two decades, iEmergent has been predicting mortgage market trends with a level of precision that surpasses even the industry's most trusted forecasts from the Mortgage Bankers Association, Freddie Mac and Fannie Mae. In fact, in almost 70% of the nation's 84,414 census tracts, iEmergent's U.S. Mortgage Origination Forecast has proven accurate to within 10 loans.

iEmergent's proprietary forecasting method is a hybrid of several traditional demand forecast models. Many variables go into these forecasts, but there are two fundamental elements: first, the Purchase Mortgage Generation Rate (PMGR), which is the rate at which an individual market produces purchase mortgages. Second, the homebuyer pool: the number of households that are ready, willing and able to buy a home. By evaluating the relationship between each census tract's homebuyer pool and PMGR, probability theory can be applied to estimate the number of purchase mortgage loans and dollars that will be originated in that market.

Read more about iEmergent's approach to forecasting here.

About iEmergent

Founded in 2000, iEmergent provides mortgage lending forecasts and analytics to the lending, housing and real estate industries. The company offers an extensive variety of forecast and market intelligence products, including Mortgage MarketSmart, a visualization tool that helps lenders quantify how mortgage markets will change. For more information, visit .

X/Twitter: @iemergent #housingfinance #housingequity #housingeconomy #mortgage #HMDA #fairlending

###

MEDIA ONLY CONTACT:

(not for print or online)

Leslie W. Colley

Depth for iEmergent

...

(678) 622-6229

News Source: iEmergent

MENAFN25092024004236004055ID1108715197

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.