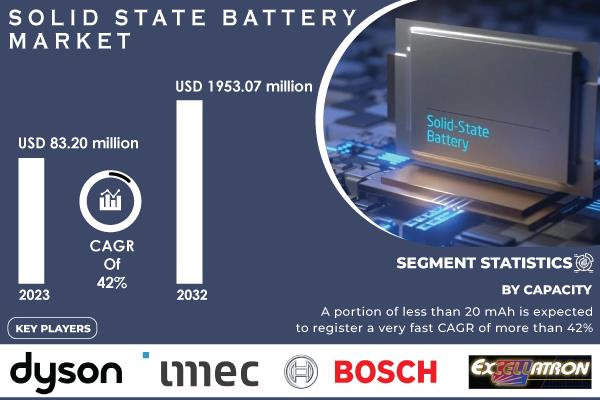

(MENAFN- GlobeNewsWire - Nasdaq) Technological innovations and increasing demand in electric vehicles (EVs), consumer electronics, and renewable energy systems.Pune, Sept. 19, 2024 (GLOBE NEWSWIRE) -- The SNS Insider report indicates that, “ The Solid State Battery market size was valued at USD 83.20 Million in 2023 and is expected to grow at USD 1953.07 Million and grow at a CAGR of 42% over the forecast period of 2024-2032. ”

Transforming Energy Storage the Emergence of Solid-State Batteries

The Solid-State Battery Market is advancing rapidly, driven by the technology's ability to overcome the limitations of traditional lithium-ion batteries. Unlike their predecessors, solid-state batteries use a solid electrolyte, offering benefits such as higher energy density, faster charging, longer lifespan, and enhanced safety with minimized fire risk. This makes them highly attractive for electric vehicles (EVs), where extending range, reducing charging times, and ensuring safety are vital. Leading automotive brands like Toyota, BMW, and Volkswagen are investing heavily in solid-state technology for EVs. Additionally, the consumer electronics sector and renewable energy storage systems are increasingly adopting solid-state batteries for their reliability and resilience.

Download PDF Sample of Solid State Battery Market @

Key Companies:

Altairnano (Lithium Titanate Batteries) Beijing Weilan New Energy Technology Co., Ltd. (Sodium-Ion Solid-State Batteries) BrightVolt Solid State Batteries (Thin-Film Solid-State Batteries) Cymbet (Solid-State Energy Storage Systems) Hitachi Zosen Corporation (Sulfide-Based Solid-State Batteries) Ilika Ltd. (Stereax® Solid-State Batteries) Ion Storage Systems (Solid-State Lithium Batteries) ITEN (Rechargeable Solid-State Batteries) Johnson Energy Storage, Inc. (Lithium Metal Solid-State Batteries) Prieto Battery Inc (3D Solid-State Batteries) QuantumScape Corporation (Solid-State Lithium Metal Batteries) Samsung SDI Co., Ltd. (Solid-State Lithium-Ion Batteries) Solid Power (High-Energy Solid-State Batteries) STMicroelectronics (Solid-State Lithium Batteries for Electronics) Toyota (Solid-State Lithium-Ion Batteries for EVs) Others

Solid State Battery Market Report Scope:

| Report Attributes | Details |

| Market Size in 2023 | USD 83.20 Million |

| Market Size by 2032 | USD 1953.07 Million |

| CAGR | CAGR of 42% From 2024 to 2032 |

| Base Year | 2023 |

| Forecast Period | 2024-2032 |

| Historical Data | 2020-2022 |

| Report Scope & Coverage | Market Size, Segments Analysis, Competitive Landscape, Regional Analysis, DROC & SWOT Analysis, Forecast Outlook |

| Key Segments | . By Type (Thin Film, Portable, Single-cell Battery, Multi-cell Battery)

. By Application(Consumer & Portable Electronics ,Electric Vehicles , Energy Harvesting ,Wearable & Medical Devices ,Others)

. By Rechargeability (Primary Battery ,Secondary Battery)

.By Capacity(< 20 mAh ,Between 20 mAh and 500 mAh,> 500 mAh) |

| Key Drivers | . The Importance of Solid-State Batteries in Addressing Increasing EV Needs

. Overcoming Limits in Range through Next-Gen Battery Tech |

If You Need Any Customization on Solid State Battery Market Report, Enquire Now @

The Rise of New Solid-State Battery Technology in Energy Storage

The Solid-State Battery Market is set for remarkable growth due to its superior attributes compared to traditional lithium-ion batteries. By utilizing solid electrolytes, solid-state batteries offer improved energy density, faster charging, longer lifespan, and enhanced safety-key advantages for electric vehicles (EVs), consumer electronics, and renewable energy storage. Major automakers like Toyota, BMW, and Volkswagen are heavily investing in this technology to enhance EV range and safety. Challenges such as high production costs and technical complexities persist, but government and industry efforts are addressing these issues. In Europe, the European Battery Alliance (EBA) is pivotal, with EUR 100 billion invested to boost battery innovation and reduce reliance on external suppliers. Similarly, the U.S. Li-Bridge initiative aims to strengthen the domestic battery supply chain, potentially generating significant economic benefits and job growth by 2030.

Solid-state batteries in the high-capacity and consumer electronics sectors.

By Capacity: The segment with capacities exceeding 500 mAh captured the largest share of the Solid State Battery Market, holding 46% of the revenue in 2023. This dominance reflects the rising demand for high-capacity batteries that support longer range and improved performance in applications such as electric vehicles (EVs), portable electronics, and advanced wearables. Companies like QuantumScape and Solid Power are leading innovations in this space, creating high-capacity battery cells with enhanced safety and energy density. Toyota's recent prototype solid-state battery with a capacity over 500 mAh highlights the ongoing efforts to improve driving range and efficiency for EVs.

By Application: The Consumer & Portable Electronics segment led the market with a 38% revenue share in 2023. Solid-state batteries are well-suited for this sector due to their higher energy density, improved safety, and compact size compared to traditional lithium-ion batteries. Companies such as Samsung SDI and BASF are at the forefront, developing advanced solid-state battery prototypes to enhance the efficiency of smartphones and wearable devices. Toyota's latest prototype also demonstrates significant advancements in energy storage and safety for portable electronics.

Leadership in the solid-state battery market in Asia-Pacific and Europe on a regional level.

In 2023, the Asia-Pacific region dominated the Solid-State Battery Market, commanding 52% of the revenue. The region's advanced electronic manufacturing, rapid technological progress, and substantial investments in energy storage drive this leadership. Japan, South Korea, and China are at the forefront, with Toyota and Sony in Japan developing prototypes, while Samsung SDI and LG Energy Solution in South Korea integrate these batteries into smartphones and EVs. China's CATL is also investing heavily in solid-state technology, underscoring the region's pivotal role.

Europe, as the second fastest-growing market, benefits from strong innovation, stringent environmental policies, and rising demand for EVs and sustainable storage. Germany's Volkswagen and BMW are heavily investing in solid-state batteries, with Volkswagen collaborating with QuantumScape and BMW incorporating these batteries into their EVs. The UK's Ilika is also advancing innovations to boost energy density and safety.

Buy Full Research Report on Solid State Battery Market 2024-2032 @

Recent Development

On September 10, 2024, Mercedes-Benz and U.S. battery startup Factorial announced a collaboration to develop the Solstice solid-state battery. This new battery aims to boost EV range by approximately 80% over current averages, with an energy density of 450 Watt-hours per kilogram, and is expected to be ready for production by the end of the decade. In July 2023, ProLogium Technology Co, Ltd. and MAHLE GmbH agreed to collaborate on creating the initial thermal management system for ProLogium's upcoming solid-state batteries. This deal will facilitate the marketability of solid-state battery solutions with higher energy density, enhanced safety, and longer lifespan. In May 2023, Sakuu Corporation unveiled the Li-Metal Cypress Battery Cell Chemistry for licensing in manufacturing. Moreover, this Li-Metal chemistry can provide a high-power density and high energy density, while prioritizing safety.

Key Takeaways

The Solid State Battery Market is set for exponential growth, driven by technological advancements and increased demand for efficient energy storage solutions. Asia-Pacific leads the market, reflecting its role as a major hub for innovation and production. Europe's growth is fueled by strong investments and regulatory support for sustainable energy technologies. Recent product launches and technological developments underscore the dynamic progress and competitive landscape of the solid-state battery industry.

Table of Contents – Major Key Points

1. Introduction

1.1 Market Definition

1.2 Scope (Inclusion and Exclusions)

1.3 Research Assumptions

2. Executive Summary

2.1 Market Overview

2.2 Regional Synopsis

2.3 Competitive Summary

3. Research Methodology

3.1 Top-Down Approach

3.2 Bottom-up Approach

3.3. Data Validation

3.4 Primary Interviews

4. Market Dynamics Impact Analysis

4.1 Market Driving Factors Analysis

4.1.1 Drivers

4.1.2 Restraints

4.1.3 Opportunities

4.1.4 Challenges

4.2 PESTLE Analysis

4.3 Porter's Five Forces Model

5. Statistical Insights and Trends Reporting

5.1 Production Volumes by Region (2023)

5.2 Technology Development Trends (Historic and Future)

5.3 Capacity Utilization (2023)

5.4 Supply Chain Metrics

6. Competitive Landscape

6.1 List of Major Companies, By Region

6.2 Market Share Analysis, By Region

6.3 Product Benchmarking

6.3.1 Product specifications and features

6.3.2 Pricing

6.4 Strategic Initiatives

6.4.1 Marketing and promotional activities

6.4.2 Distribution and supply chain strategies

6.4.3 Expansion plans and new product launches

6.4.4 Strategic partnerships and collaborations

6.5 Technological Advancements

6.6 Market Positioning and Branding

7. Solid State Battery Market Segmentation, by Type

7.1 Chapter Overview

7.2 Thin Film

7.3 Portable

7.4 Single-cell Battery

7.5 Multi-cell Battery

8. Solid State Battery Market Segmentation, by Application

8.1 Chapter Overview

8.2 Consumer & Portable Electronics

8.3 Electric Vehicles

8.4 Energy Harvesting

8.5 Wearable & Medical Devices

8.6 Others

9. Solid State Battery Market Segmentation, by Rechargeability

9.1 Chapter Overview

9.2 Primary Battery

9.3 Secondary Battery

10. Solid State Battery Market Segmentation, by Capacity

10.1 Chapter Overview

10.2 < 20 mAh

10.3 Between 20 mAh and 500 mAh

10.4 > 500 mAh

11. Regional Analysis

12. Company Profiles

13. Use Cases and Best Practices

14. Conclusion

Access Complete Report Description of Solid State Battery Market Report 2024-2032 @

[For more information or need any customization research mail us at ... ]

About Us:

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company's aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

CONTACT: Contact Us:

Akash Anand – Head of Business Development & Strategy

...

Phone: +1-415-230-0044 (US)

MENAFN19092024004107003653ID1108692385