(MENAFN- ING) Surging employment and wages show the economy remains strong

The US economy added 263,000 jobs in November, well ahead of the 200,000 consensus estimate, even when accounting for a 23,000

downward revision

to the past couple of months of data. Private payrolls rose 221,000, led by 88,000 jobs in leisure and hospitality and 82,000 in education and health. Construction was up 20,000 and manufacturing gained 14,000. However, there was weakness in trade & transport (-49,000) and retail trade (-30,000).

There was more positive news for workers in the form of big wage gains of 0.6% month-on-month, double what was expected, which leaves the annual rate of wage growth at 5.1%.

The unemployment rate remained at 3.7% despite the household survey showing an apparent drop of 138,000 people saying they were in work – the second consecutive decline. The unemployment rate held steady because the participation rate fell yet again as workers remain reluctant to return to the workforce.

Given the Fed's repeated warnings that rates are likely to stay higher for longer to ensure inflation is defeated, officials will be hoping that today's numbers will be the jolt needed to get market participants to finally believe the Fed's intent.

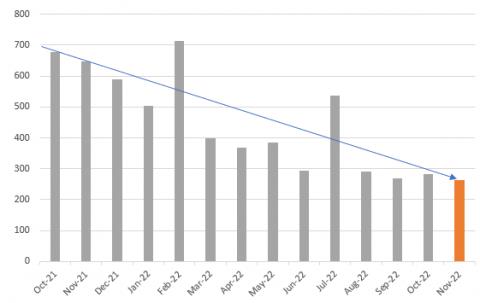

Payrolls growth is slowing, but not fast enough for the Fed (Jobs added per month '000s)

Macrobond, ING

Jobs market remains far too hot for the Fed

In his speech earlier this week, Fed Chair Jerome Powell discussed the prospect of declines in inflation relating to core goods and housing. His focus though was on another area, core services other than housing, where the situation is more troubling. This grouping accounts for more than half of the core PCE index, the Fed's favoured measure of inflation. The tightness of the jobs market and the implication for wage pressures, which make up the largest cost in delivering these services, is therefore key to the outlook for interest rates.

In the speech, he argued that“job growth remains far in excess of the pace needed to accommodate population growth over time—about 100,000 per month by many estimates.” Consequently, wage growth“shows only tentative signs of returning to balance”. Today's 263,000 jobs number confirms we remain a long way off from demand balancing with supply, which would ease those labour market related inflation pressures.

Adding to the Fed's problems, monetary conditions have loosened in recent weeks as the dollar and longer-dated Treasury yields have fallen and credit spreads have narrowed. This is undoing the tightening effects of the Fed's recent rate rises. Furthermore, the latest consumer spending numbers together with the anecdotal evidence of the Black Friday weekend sales show

that the economy has not yet met the Fed's requirements of slowing to a rate“well below its longer-run trend”.

As such, the Fed has more work to do and we look for further 50bp rate hikes in December and in February, with the potential for tightening needing to go on for longer.