(MENAFN- ING) A marked slowdown in industrial production in July

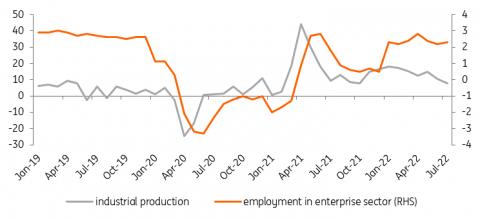

In July, industrial production grew by 7.6% year-on-year, slightly slower than expectations (consensus 8%) after a 10.4% YoY increase in June. This broke a string of eight consecutive months of double-digit growth, though it has been decelerating rapidly in recent months. In the context of weaker-than-expected GDP growth in the second quarter of this year and its decline in quarter-on-quarter terms, July's industrial production data increase the likelihood of a technical recession in the Polish economy starting in 2Q22.

Earlier locomotives of economic growth, such as some heavy industry divisions, are weakening, and the production of consumer durables are slowing down. The relatively strong growth in the production of primary goods – food, beverages, clothing, textiles, also paper or pharmaceuticals – has continued. This is associated with more than 2 million Ukrainians who escaped from their country after the Russian invasion and have remained in Poland. The weakening in demand for durable goods probably reflects very pessimistic consumer sentiment (as shown by yesterday's Central Statistical Office data) and weaker foreign orders from major trading partners, especially Germany, which probably entered recession in 3Q22.

Weakening external and domestic demand is suggested by a PMI index clearly below 50 points with a marked decline in new export orders. Disruptions over Nord Steam 1 gas supplies to Germany and the availability of gas to German industry intensified in the middle of the year could have negative consequences for Polish industry, which was a solid GDP growth driver in recent quarters. Today's data confirm a rapid deceleration in economic growth from 2Q22. They also support our cautious GDP forecast of 4.7 percent for 2022, which has been below consensus for quite some time. The impressive growth in a year as a whole results from so-called carry-over effects and overheated economy in 1Q22.

PPI still high, but price growth softens a bit

PPI inflation rose to 24.9% YoY in July (INGF: 24.8%, consensus: 25.1%) after 25.6% in June. The PPI index increased by 0.9% MoM, made up of a 1.8% price decline in mining, and increases of: 0.3% in manufacturing, a significant hike of 8.3% in electricity generation and supply and 0.1% increase in water supply/utilities prices. With the exception of 'electricity generation and supply', increases in the four main industrial categories were weaker than in June. This largely reflects the price correction in global commodity market.

Although the PPI in YoY terms passed the peak in June, the index's increase of almost 25% YoY will nevertheless be translated with a lag into consumer prices in the following months, though this may be partly mitigated by the marked weakening in demand.

The jump in prices in the 'generation and electricity' supply category shows that, while the commodity price shock is slowly receding, as seen in the fall in oil prices, the economy will have to adjust to a new energy shock. It is caused by a very large increase in wholesale electricity prices and soaring natural gas prices on European markets. This envisages a stagflationary scenario, with persistently elevated inflation and a slowdown in economic activity.

Solid labour market performance

The health of the domestic labour market remains good, despite the slowdown in economic activity. Both employment and wages rose above expectations in July. On a YoY basis, the number of employed in the corporate sector increased by 2.3% (consensus 2.1%), and nominal wages increased by 15.8% (consensus 12.8%).

At the same time, it should be kept in mind that the data largely (probably most of it) does not reflect the nearly 400,000 Ukrainians who entered Poland's labour market since the outbreak of the Russian aggression.

An additional factor that may have raised the pace of placements is the reduction of personal income tax rate from July. It is possible that some companies have delayed the payment of bonuses and other variable elements of salaries until July, when personal taxes were cut. The situation is likely to take a turn for the worse at the end of the year, when more symptoms of the slowdown will become apparent. Companies will also hold off on wage increases in 2H22, as they have to accommodate a significant hike in minimum wages starting in January 2023.

Still, the performance of the Polish economy should remain good enough for companies to further pass on high costs to final customers. The increase in labour costs (especially if accounting for Ukrainian refugees) significantly exceeds labour productivity and will be strongly pro-inflationary. This will be particularly evident in core inflation, which is heavily dependent on local demand and labour costs.

Industrial production and employment in enterprise sector, YoY change, in percent

ING based on CSO data.

MENAFN19082022000222011065ID1104725912

Author:

Leszek Kasek, Piotr Poplawski

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.