(MENAFN- ING) 2Q GDP at 5.4%

Indonesia's economy grew 5.4%YoY in the second quarter, outpacing market expectations for a 5.1% gain. Year-to-date GDP growth is now 5.2%. ING had expected growth to hit 5.4% on the back of solid household consumption supported by a resurgent export sector. Household spending has been robust, in part, because of relatively manageable inflation.

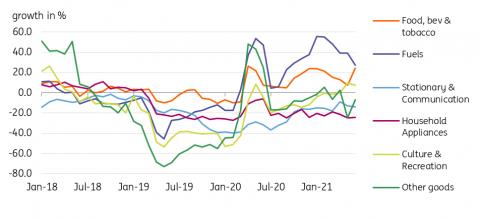

Retail sales continue to expand although spending is concentrated on food items and fuel and consumers are postponing purchases of durable equipment, communications and other items. Meanwhile, exports have benefited from the ongoing conflict in Ukraine as coal prices have surged, resulting in substantial trade surpluses for the first half of the year.

Retail sales have remained solid but gains are limited mostly to food and fuel items

CEIC

Solid recovery but headwinds loom

Bank Indonesia (BI) Governor Warjiyo, flagged the threat of slowing global growth at the 21 July policy meeting. BI retained its growth projection for the year but admitted that full-year GDP will likely settle at the lower end of the 4.5-5.3% range. Slower global growth could weigh on export growth prospects, especially if a slower growth outlook translates to sliding coal prices. On the domestic front, the sustained acceleration in headline inflation could eventually sap some momentum from household spending and drag on overall GDP.

BI remains cool to rate hikes, at least for now, citing well-behaved core inflation, which should cushion the fallout from a potential slowdown in global growth. However, the eventual BI rate hike (in late 3Q or early 4Q) coupled with accelerating inflation could eventually slow Indonesia's economy with full-year GDP likely at 4.6% for the year .

MENAFN04082022000222011065ID1104649496

Author:

Nicholas Mapa

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.