(MENAFN- ING) The rationale behind our call

The twists and turns within financial markets are tied to feelings and intuition nowadays, rather than to facts and data. In this context, next week's rate-setting meeting will be a difficult one for the National Bank of Hungary. We see the direction as crystal clear (more tightening), but the magnitude of the hikes in the base rate and the one-week deposit rate will highly depend on prevailing market sentiment.

We see the base case as a copy-paste from last month, with a 50bp rise in the base rate followed by a 30bp move in the one-week deposit rate on Thursday. The central bank might not want to retreat so quickly from its well-telegraphed “predictable and continuous” rate hike approach, at least not in the case of the base rate.

In the recent environment, where monetary policy by its nature is essentially helpless against inflationary forces (supply-side and real disposable income shocks, labour shortages, etc.), the only logical step would be to keep the exchange rate as stable as possible. In this regard, the size of the effective rate hike (the change in the one-week deposit rate) depends mainly on the behaviour of the forint, in our view.

Should we see EUR/HUF stabilising around 395, we might see that 30bp move in the one-week rate, while a break above 400 might push decision-makers to take a more aggressive, frontloaded approach in the one-week deposit rate (e.g., a hike by 50bp, matching the size of the one-off hike on 16 June).

The next rate-setting meeting (unrelated to the size of the hikes) will bring us further reassurance that the central bank remains committed to tackling inflation. With the new staff projections coming (the June Inflation Report), we see the NBH revising the inflation path upwards in 2022 and 2023. This will result in forward guidance that pencils in further rate hikes over the remainder of the year, committing to a higher interest rate environment.

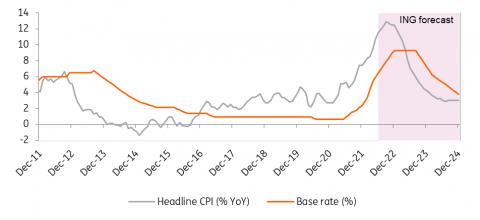

In our view, this ongoing tightening will lead us to a 9.25% terminal rate by the end of this year, when and where the base rate and the one-week deposit rate will be merged again. Over the remainder of the year, we see the base rate being raised by 50bp each month, with the finishing touch of a 35bp move in December. As pro-inflationary risks dominate, the changes in the one-week deposit rate might be less gradual, being a bit more frontloaded.

Thus, should we see HUF weakening further despite the NBH's hawkish forward guidance and commitment to tackle inflation, we might see more one-off hikes in the one-week deposit rate, reacting to idiosyncratic market shocks.

ING's inflation and base rate forecasts in Hungary

NBH, ING

What to expect in FX and rates markets

As above, a hike in the one-week deposit rate is the NBH's first line of defence as EUR/HUF continues to press 400. Even though investors seem reasonably short the forint already, it seems hard to see a sustainable rally in the currency until either the external environment improves (unlikely this summer) or some local news improves. Concessions on the Rule of Law dispute, perhaps in September, may be the best hope.

CEE currencies vs EUR (1 Feb = 100%)

NBH, ING

We continue to see that rates are getting close to their peak, but again low liquidity in the summer months and a very volatile external environment call for extreme agility here. As we discussed in our last preview, the one- to three-year segment of the swaps curve may be the best area to be looking to receive rates – perhaps something like in the two-year area, which has recently turned lower from just under 10%.

On the bond side, the focus will eventually shift to the improved fiscal balance and thus the lowered risk of excessive financing needs although with all sorts of bad headlines about windfall taxes, the dust might need more time to settle. This, along with our view on progress in the looming rule-of-law debate, suggests investors may have increasing confidence in adding to long HGB positions. With close to a 700bp concession already being built into 10-year HGB yields versus German Bunds and Bund yields looking toppish near 1.80%, we could expect to see investor interest into HGB dips this summer.

MENAFN23062022000222011065ID1104424311

Author:

Peter Virovacz, Chris Turner

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.