(MENAFN- Asia Times)

Well, China's dream of 5.5% growth this year sure sounded grand while it lasted.

Covid-19 has a different trajectory in mind for Asia's biggest economy, with a big assist from President Xi Jinping's government. The damage from Xi's“zero-Covid” policy went from theoretical to official Monday with news the industrial output fell 2.9% in April from a year ago, far surpassing predictions from a gentler 0.5% contraction.

Retail sales shrank 11.1% in the same period, while unemployment climbed to 6.1%. The downshift is accelerating despite a 6.8% jump in fixed-asset investment in the first four months of the year to power Xi's push to expand infrastructure spending.

Property sales by value fell in April at their fastest pace in at least 12 years as lockdowns slammed demand. The 46.6% from a year earlier is the steepest plunge since 2010.

The economic shock unleashed by Xi's zero-tolerance policy is dismal news for a global economy facing the specter of recession in the US. Europe and Japan, meantime, are competing to see which economies flatline faster.

Asia is in an even worse position, considering governments from Seoul to Jakarta hitched 2022 growth hopes to China.

“China's Covid policy is adding to the mounting confluence of credit headwinds, which includes the inflation-suppressing Fed and Ukraine-Russia conflict,” says Eunice Tan at S&P Global Ratings.“All this could heighten downside risks for institutions and corporates, in China and globally.”

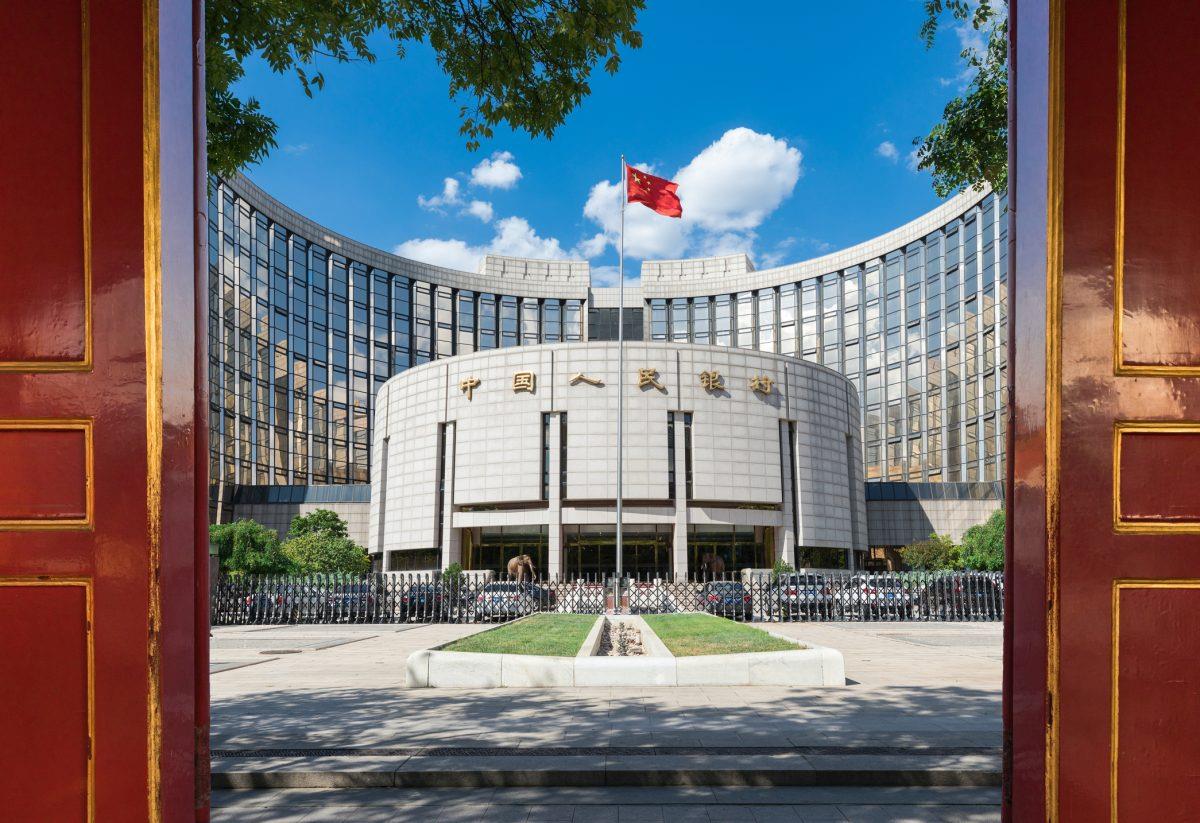

The only good news, potentially, is the apparent lack of panic at the People's Bank of China headquarters.

On Sunday, the PBOC eased mortgage rates for first-time homebuyers to alleviate a housing crunch. On Monday, though, Governor Yi Gang's team refrained from a more consequential cut in one-year policy loans unchanged. This, economists suggest, could be important signaling from the PBOC.

The People's Bank of China headquarters. Photo: iStock

'Big impact' from Covid

“Lending was much weaker than expected last month as lockdowns weighed on credit demand,” noted Julian Evans-Pritchard at Capital Economics.“This should nudge the PBOC to announce further easing measures soon. But the central bank continues to signal a relatively restrained approach.”

While releasing Monday's data, China's National Bureau of Statistics stressed Covid outbreaks had a“big impact” in April, but will ultimately be short-lived.“With progress in Covid controls and policies to stabilize the economy taking effect, the economy is likely to recover gradually,” it said.

The NBS stresses that gross domestic product will not contract in the April-June quarter.

Yet Evans-Pritchard's team now forecasts full-year Chinese growth of only 2%, markedly less than half Xi's target.“Even once the current virus wave is quashed, Covid controls will continue to hold back activity to some degree over the coming quarters,” Capital Economics analysts argue in a note.

Huang Yiping, a former central bank adviser and Peking University professor, speaks for many when he says“it's time to do whatever we can to save the economy.”

That means increased regulatory tweaks and stimulus pledges to keep liquidity flowing to vulnerable sectors, says economist Iris Pang at ING Bank.

“During lockdowns, banks tend to be more risk-averse,” Pang says.“They have been told to keep past-due loans on their books. Under these circumstances, banks have become unwilling to create new loans, as that would mean taking on more risk by getting new loans and then waiting for them to become past due if lockdowns continue.”

Economist Larry Hu at Macquarie Bank adds that Sunday's action“to save property” is“far from enough to turn the property sector around, but more property easing would come.” A major remaining headwind, warn economists at Nomura Holdings, is Xi's lockdowns in Shanghai, Guangzhou and increasingly Beijing.

“Although we expect [Sunday's] cut to provide a benefit, the positive impact could be quite limited, as stringent anti-Covid measures appear set to continue for an unspecified time,” Nomura argued in a note.

Premier Li Keqiang. Photo: World Economic Forum / Benedikt von Loebell / Flickr

A risky business

Economists at ANZ Research, in their own note, point to recent stimulus pledges from top Xi lieutenants, including Premier Li Keqiang. China's Politburo, ANZ notes, is sending a“strong signal that policymakers are committed to this year's GDP target despite downside risks from Covid-19 disruptions and geopolitical tensions.”

The worry is that those risks are spiraling out of control. One of the more troubling data points is that passenger car production in China dropped by 41.1% year-on-year in April. The nation's auto sector generates at least one-sixth of jobs.

Its slowdown could portend higher unemployment, lower wages and less robust retail sales, until now a bright spot for the No 2 economy.

There are concerns, too, that China's export boom is drawing to a close, despite a weaker yuan. In April, growth in overseas shipments slowed to single digits. The 3.9% increase in exports in US dollar terms from a year ago was the slowest in two years and marked a significant drop off from a 14.7% increase in March.

Analyst Chang Ran at Zhixin Investment Research Institute calls it irrefutable evidence that“the virus outbreaks in China led to huge difficulties in the production chains and the supply chains.”

Yet the data also show that the external sector is turning less and less favorable to Beijing's hopes of exporting its way to strong 2022 growth.

As Evans-Pritchard notes,“the sharpest falls were in shipments to the EU and US, where high inflation is weighing on real household incomes. The declines were also especially pronounced in electronics exports which suggest a further unwinding of pandemic-linked demand for Chinese goods.”

Headwinds from abroad may put additional pressure on the PBOC to add more stimulus. Yet it's hardly a straightforward call with the yuan down 7% versus the dollar this year and inflation heating up.

In recent weeks, Beijing officials voiced concern about rising commodity prices and capital outflows as the Federal Reserve in Washington hikes interest rates. In March, capital outflows from China hit a record high, making Xi's currency the worst performing in Asia.

That may limit the PBOC's options, lest easier policy in Beijing sends the yuan down even more sharply. A weak yuan might do more than have China importing more inflation. It would make it harder for property developers to make dollar-bond payments, increasing default risks.

Steering the yuan in the right direction will require a delicate balancing act. Photo: AFP

A weakened yuan spells trouble

It also might set back Xi's multi-year plan to internationalize the yuan. The International Monetary Fund just lifted the yuan's weighting in its top-five currency basket. The yuan's weighting is now 12.28% of the“special drawing rights” system, up from 10.92%. It was the first increase in the yuan's global role since 2016.

The increase prompted the Chinese central bank to pledge Beijing“will continue to resolutely push for the opening up of China's financial markets and further simplify the process of overseas investors coming into the Chinese market.” Letting the yuan weaken too sharply might jeopardize China's hard-won gains in currency circles.

This caution helps explain Yi's gradualist approach toward monetary loosening. In January, for example, Yi's team engineered an unusually modest cut in the medium-term lending facility rate.

In April, the same with the amount of cash banks must keep in reserve. Instead, the PBOC has prioritized moves that wouldn't affect exchange rates – like lending programs for small enterprises.

China's slowdown comes as investors increase bets on a US recession. On Sunday, Lloyd Blankfein, senior chairman at Goldman Sachs, called a US downturn a“very, very high risk.”

He told CBS News that a recession is“not baked in the cake” and there's a“narrow path” to avoid one. But, he added,“if I were running a big company, I would be very prepared for it. If I was a consumer, I'd be prepared for it.”

The two biggest economies sputtering in unison is a scenario developing Asia hadn't seen coming this year. Inflation at 40-year highs is slamming household and business confidence. That has investors bracing for bigger Fed tightening moves that crater national demand and confidence.

The US is experiencing its own fresh Covid-19 infection wave, which is boosting hospitalization rates again. Yet China's lockdowns could prove more demanding to global demand.

S&P economist Louis Kuijs notes that“China's continuing shutdowns of cities and towns, notably Shanghai, have hit demand and business operations. This has led us to reduce our base-case 2022 GDP growth forecast for China to 4.2% from 4.9%.”

But, he adds,“in the event that restrictions on people's mobility are extended to another economically important city, the growth rate could fall as low as 3.5%.”

Movement and travel in many parts of China have been severely restricted. Photo: WikiCommons

Vulnerable sectors

Kuijs says that the sectors most vulnerable to big Covid-lockdown hits are transport, retail and leisure.“In addition,” he says,“suppressed sales and delays to housing construction and delivery have put the beleaguered property sector under more strain. Housing sales have dropped sharply in the first half of 2022, exacerbating the liquidity stress of developers.”

Chinese banks, meantime, may face uneven effects from asset quality pressures.“Credit divergence between the large and small banks will deepen further, while the deteriorating financial health of small businesses will call for higher loan-loss provisioning,” Kuijs says.

“Meanwhile, banks could be asked to marginally increase loan growth to support the economy despite lower lending rates and fees.”

China could increase the odds of getting to 5.5% by immediately reversing the zero-Covid policy and formally halting the regulatory crackdown that began in late 2020 and erased trillions of dollars of stock-market value.

Until then, the globe is adjusting to the reality of China rapidly losing momentum.

MENAFN16052022000159011032ID1104220430