(MENAFN- PR Newswire)

Representing media and entertainment behaviors in five different countries, Deloitte's 16th annual 'Digital Media Trends' survey shows global audiences are increasingly frustrated managing the costs and content of streaming video on-demand services

NEW YORK, March 29, 2022 /PRNewswire/ --

Key takeaways Continue Reading

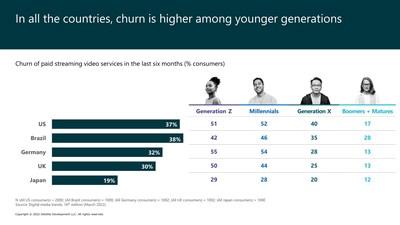

According to the 16th edition of Deloitte's Digital Media Trends survey, subscriber churn for paid streaming video services remains high, especially among younger generations.

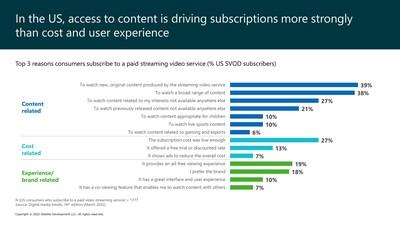

In the U.S., access to content is the main driver of paid streaming video on demand subscriptions, according to the 16th edition of Deloitte's Digital Media Trends survey.

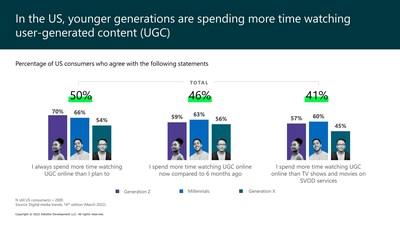

In the U.S., younger generations are spending more time watching user-generated content, according to the 16th edition of Deloitte's Digital Media Trends survey.

- The average churn rate in the United States remains at 37% across all paid streaming video on-demand (SVOD) services . In the United Kingdom (U.K.), Germany, Brazil, and Japan, the average overall churn rate is closer to 30%.

- In all five countries, Gen Z respondents prefer video games as their favorite form of digital entertainment. For older generations, watching TV and movies at home comes first.

- In the U.S., 81% of social media users say they use social media services at least daily; 59% use these services several times a day . Across the U.S., the U.K., Germany, Brazil and Japan, people in younger generations (including Gen Z, Millennial, and Gen X) are consistently more likely to say they use social media.

- Nearly half (46%) of U.S. respondents say they watch more user-generated content than they did six months ago, and half say they always end up spending more time watching user-generated content than they had planned (a number that jumps to 70% among Gen Z).

- In all five countries, Gen Z and Millennial gamers play an average of 11 hours a week. In the U.S., 61% of gamers say that personalizing their game character or avatar helps them express themselves .

Why this matters Deloitte's 16th annual ' Digital Media Trends ' survey revealed that streaming video providers face greater pressure to attract and retain subscribers who have become savvier about chasing the content they want and managing the costs they pay. This is especially true with younger generations who have grown up with smartphones, social media and video games, and prefer entertainment experiences that are more social and interactive. For the youngest generations, user-generated social media streams and social video games may be meeting their needs better than streaming video.

Deloitte's survey revealed that to prepare for the next generation of digital entertainment, media and entertainment companies should be thinking hard about how people socialize around entertainment and how entertainment itself is becoming more personalized, interactive and immersive. The online survey of 2,000 U.S. consumers was conducted in December 2021 and January 2022 and was also fielded for the first time in mature digital entertainment markets, including the U.K. (n=1,002), Germany (n=1,002), Brazil (n=1,000) and Japan (n=1,000).

Maturing streaming video services (SVOD) face savvier subscribers SVOD companies, while increasingly investing in premium content, have relied on lean-back-and-watch experiences to engage and retain subscribers. But as additional major media providers launch their own streaming video services, competition has heated up and the race to engage younger audiences is getting more intense. Audiences have many options and are empowered to move on and off services to get the most content at the least cost. SVOD companies are challenged to offer enough engaging content while incentivizing subscriber retention with ad-supported options, bundles and perks.

- The average churn rate, when people cancel, or both add and cancel a paid SVOD service, in the U.S. has remained consistent since 2020 at 37% across all paid SVOD services. Across the U.K., Germany, Brazil and Japan, the overall churn rate is closer to 30%.

- Churn is highest among the youngest generations as just over half of U.S. Millennials (52%) and Gen Z (51%) have either cancelled, or both added and canceled, an SVOD service within the last six months.

- Twenty-five percent of those in the U.S. have cancelled a streaming video service and then resubscribed to the same service within the past 12 months. Respondents say they churn and return either because a new season of their favorite show was released, they got a free or discounted rate, or content they wanted to watch moved to the service. It's global too. In the U.K., Germany, Brazil and Japan, around 22% have churned and returned. Overall, Gen Z and Millennials are significantly more likely to churn and return.

- Cost is also a factor in retaining consumers who are thinking of cancelling. For a reduced cost, some would be willing to sign up for an annual subscription, watch more ads, or wait 45 days to watch a new release. Globally, many people prefer ad-supported options for streaming video that reduce or eliminate their subscription costs.

- Perks and VIP treatment could also retain many people thinking of cancelling a streaming video subscription. Thirty-seven percent of U.S. consumers would be convinced to stay if the service gave them access to first-run movies, and 34% would stay if a loyalty program was included. Among Gen Zs and Millennials, 51% would stay if their subscription included a gaming or music service or another video streaming service option, signaling a potential upside to bundling services.

Key quote 'While streaming video on-demand business models look much the same as they did when they were created 15 years ago, social media and gaming companies have quickly evolved their offerings, leveraging technology, and capitalizing on behaviors. Social media is free and available anywhere, anytime, offering both passive and interactive experiences with endless streams of personalized content, without the cost of a subscription. And more people are interacting and socializing in game worlds that host millions of users, brands and franchises, and major non-gaming events. SVOD companies aren't just competing with each other for audiences, they are also competing with different, more social and immersive forms of entertainment.'

– Jana Arbanas , vice chair, Deloitte LLP and U.S. telecom, media and entertainment sector leader

Social media: a better way to watch and shop? On the most popular social media services, people engage with nearly infinite streams of trending social content, whether it's music, news, TV shows, sports and movies, shopping, or video games, all in one place without a subscription. Content feeds are personalized by algorithms that learn what users like and deliver relevant content, reinforced by social recommendations, influencers, targeted advertising, and trending topics. More social media is becoming shoppable, further leveraging user modeling and targeting. On social media, users don't need to chase content as they do with SVOD platforms. Content discovers them.

- In the U.S., 81% of social media users say they use social media services at least daily and 59% use these services several times a day. Across the U.S., U.K., Germany, Brazil and Japan, Gen Z, Millennials, and Gen Xers are consistently more likely to say they use these services.

- Forty-six percent of U.S. respondents say they watch more user-generated content than they did six months ago, and half (50%) say they always end up spending more time watching user-generated content than they had planned (a number that jumps to 70% among Gen Zs).

- About 4 in 10 (41%) of U.S. respondents say they spend more time watching user-generated video content than they do TV shows and movies on video streaming services — a sentiment that increases to around 60% for Gen Zs and Millennials.

- Seventy percent of U.S. respondents say they follow an influencer, and one-third (33%) say these online personalities influence their buying decisions; that figure jumps to more than half of U.S. Gen Zs (52%) and Millennials (53%). The appeal of influencers is also a global trend, with 88% of survey respondents in Brazil citing following an influencer, and 79% in Japan.

- Social media services are also becoming shoppable retail destinations; more than half of U.S. respondents (53%) and around 40% or more in the U.K., Germany and Japan say they see customized ads on social media for products or services they have been looking for — a number that increases to 72% in Brazil.

Key quote 'The web and all it offers is no longer a destination or a place we occasionally visit. It's become an integral part of our lives, and young generations are particularly adapted to the blurring of real and virtual experiences. For now, streaming video, social media and gaming are very successful but changing behaviors are pointing towards the next wave of digital entertainment. To evolve with younger generations on the way to the metaverse, global media companies should focus on younger generations and those generations that follow, by offering more social, interactive and immersive forms of entertainment.'

– Kevin Westcott , vice chair, Deloitte LLP and U.S. technology, media and telecom leader

Younger generations may already be in a metaverse Whether smartphone, console, or PC, gaming has become huge, and it's taking time away from other forms of entertainment. The youngest generations are especially attracted to gaming, ranking it as their favorite form of entertainment. Gaming also offers emotional value to many, helping them relax, stay connected to others, and express their self-identity through customizable avatars. Top gameworlds are hosting larger-than-life events: In the U.S., almost a quarter of gamers have attended a live in-game event in the past year. On the road to the metaverse, gaming may already be there.

- In the U.S., more than 80% of both men and women say they play video games, and half of smartphone owners say they play on a smartphone daily. Gen Z and Millennial gamers play the most, logging an average of 11 and 13 hours per week, respectively. Gen X gamers follow closely behind with around 10 hours of game play every week, reminding us that it's not just the kids.

- Most respondents in the U.K. (75%), Germany (78%), Brazil (89%) and Japan (63%) play video games regularly. In these countries, younger generations are more likely to be gamers, with Gen Z and Millennial gamers spending an average of 11 hours per week playing.

- About half of all U.S. gamers say that playing video games has taken time away from other entertainment activities; unsurprisingly, these percentages increase for younger gamers. This trend is also playing out in other markets, with just over half of gamers in the U.K. (55%), and just under half of gamers in both Brazil (45%) and Japan (44%) also trading other entertainment activities to play video games.

- Overall, more than three-quarters of U.S. gamers surveyed also say that gaming helps them relax, while nearly 60% report that gaming helped them through a difficult time. About half (53%) of U.S. gamers say that playing video games helps them stay connected to people. And these games are supporting identity: 61% of U.S. gamers say that personalizing their game character or avatar helps them express themselves.

- Gaming and music also appear to be closely linked; about half (51%) of U.S. gamers say they often discover new music while playing video games.

- About a quarter (23%) of U.S. gamers say they have attended an in-game event in the last year, with Millennials and men being the most likely attendees. Remarkably, 82% of those attending live in-game events also made a purchase because of the event: 65% purchased digital goods and 34% purchased physical merchandise, reinforcing the steady blurring of lines between real and virtual worlds.

For additional details on the findings, visit here . Connect with us on Twitter: @DeloitteTMT , @kwestcott911 , @Jeff_Loucks ; or on LinkedIn: @KevinWestcott , @JanaArbanas ; #digitalmedia, #tmttrends.

About Deloitte Deloitte provides industry-leading audit, consulting, tax and advisory services to many of the world's most admired brands, including nearly 90% of the Fortune 500® and more than 7,000 private companies. Our people come together for the greater good and work across the industry sectors that drive and shape today's marketplace — delivering measurable and lasting results that help reinforce public trust in our capital markets, inspire clients to see challenges as opportunities to transform and thrive, and help lead the way toward a stronger economy and a healthier society. Deloitte is proud to be part of the largest global professional services network serving our clients in the markets that are most important to them. Building on more than 175 years of service, our network of member firms spans more than 150 countries and territories. Learn how Deloitte's more than 345,000 people worldwide connect for impact at .

Deloitte refers to one or more of Deloitte Touche Tohmatsu Limited, a UK private company limited by guarantee ('DTTL'), its network of member firms, and their related entities. DTTL and each of its member firms are legally separate and independent entities. DTTL (also referred to as 'Deloitte Global') does not provide services to clients. In the United States, Deloitte refers to one or more of the US member firms of DTTL, their related entities that operate using the 'Deloitte' name in the United States and their respective affiliates. Certain services may not be available to attest clients under the rules and regulations of public accounting. Please see to learn more about our global network of member firms.

SOURCE Deloitte

MENAFN29032022003732001241ID1103931175

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.