(MENAFN- ING) BI keeps policy rate at 3.5% but looks to nudge RR up to 5%

Bank Indonesia (BI) kept policy rates untouched, a move widely expected by market participants. BI kept its policy rate at 3.5% but also announced a March increase in reserve requirement (RR) from 3.5% to 5%. Monetary authorities have been wary to adjust policy rates with BI Governor Perry Warjiyo hoping to retain his“pro-growth” stance for as long as possible.

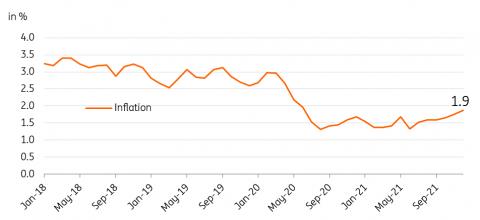

Economic activity in Indonesia has picked up of late, aided by solid export growth and supported by household spending, but authorities are hoping to maintain support just a little longer to help solidify momentum. BI maintained its growth projection for 2022 at 4.7-5.5% but a recent pickup in daily Covid-19 infections, and the potential resurgence of inflation, could complicate the recovery process.

Inflation was below target last year but 2022 could be different

Badan Pusat Statistik

BI retains its stance for now, but Fed rate hike and inflation resurgence could change dynamic

BI has opted to retain its“pro-growth” stance for now, suggesting that the country is well placed to weather the impending Fed rate hike cycle. Governor Warjiyo had signalled late last year that although he would eventually switch to“pro-stability” in 2022, he would likely start the process via tweaks to liquidity rather than to adjustments to policy rates. Today's decision shows this bias as BI appears aware of the need to gradually normalise policy while still preferring to provide support to the economy in the near term.

With Fed rate hikes looming and with inflation likely to pick up this year, we could see BI resorting to actual rate hikes by 2Q22 should the Indonesian rupiah (IDR) come under pressure. IDR has remained relatively stable and will not likely react much to the announcement on RR in the near term, but the currency may come under pressure as we approach the projected Fed rate hike.

MENAFN20012022000222011065ID1103570815

Author:

Nicholas Mapa

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.