(MENAFN- ING)

The 8.2% December 2021 inflation is the highest in over 10 years. Without the administrative measures that are being discussed to deal with electricity and gas prices, inflation could move into the double digits this spring. We put on hold our 7.2% average inflation estimate for 2022 until we get more clarity on the set of measures adopted

Shutterstock

Share

Author

Valentin Tataru

Newsletter

Stay up to date with all of ING's latest economic and financial analysis.

Subscribe to THINK

December inflation came in higher than our 7.7% estimate, exclusively due to the increase that the Statistical Institute estimated for electricity (+6.3% versus the previous month) and natural gas (+1.44%). In all fairness, gauging the price dynamics in the energy sector during this period has become a bit of a gamble and the asymmetric information is meaningful, hence volatility in both actual inflation and estimates is to be expected for the foreseeable future.

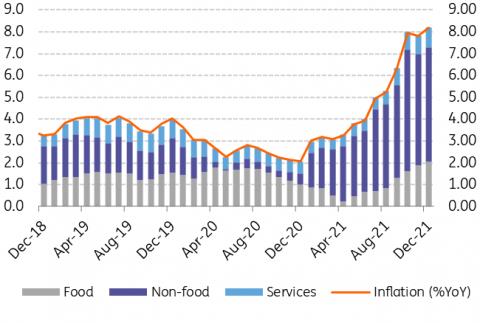

Headline inflation and components

NIS, ING

Perhaps more worrying than headline inflation itself is the fact that core inflation is departing more and more meaningfully from the National Bank of Romania's 1.5%-3.5% target range, coming at 4.7% in December from 4.3% the previous month. While the upward trend might not continue at the same pace, we believe that the downside is also very limited in 2022 as supply side shocks start to overlap demand side pressures.

For those who love numbers, today's inflation shows a rather generalised price increase. Food items advanced by 0.8% in December versus the previous month, non-food by 0.7% and services by 0.4%. However, besides the already mentioned energy items, there are few eye-catching details in today's reading. It is already obvious that the energy price transmission to the rest of the economy is in full swing and without the administrative measures to alleviate the energy price impact, a 10% headline inflation rate in the second quarter is not a distant possibility.

So far, we only know about the government's intention to cut VAT for electricity from 19% to 5% starting in April, and various schemes to help the agriculture & food industry, as well as SMEs. The media has reported, however, that the measures could be much more substantial, targeting VAT cuts for natural gas and basic food products as well. An earlier application date is also being discussed.

All of this makes our inflation forecast highly uncertain at the moment. While the caps and subsidy measures already in place would mostly delay the unavoidable inflation spike when they expire, a permanent VAT cut could have a more significant and sustainable impact, possibly reducing headline inflation by over 1-2ppt this year. Hence, until we have more clarity on the new measures, our 7.2% average inflation forecast for 2022 is on hold.

As for the central bank reaction, today's number certainly doesn't look good, but as usual the NBR is likely to look through the inflation cycle. The administrative measures under discussion could also be a reason not to push on with larger rate hikes. Still, given regional developments and higher core inflation, we believe that a 3.00% key rate is the minimum the central bank will reach this year.

MENAFN14012022000222011065ID1103542127

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.