(MENAFN- Asia Times)

HONG KONG – China's government is signaling stronger support for property markets by cutting banks' reserve requirement ratios (RRR), a move that will allow for more lending to companies and homebuyers, and a possible relaxation on property market curbs next year.

The RRR cut, which will inject 1.2 trillion yuan (US$188.4 billion) into the economy from December 15, will help support small and medium-sized enterprises (SMEs) while allowing state-owned banks to allocate more funds to the property sector, analysts said.

The politburo of the Communist Party of China (CPC)'s Central Committee said on Monday that the central government would support property markets and satisfy homebuyers' demands in 2022. It skipped its usual slogan“houses are for living in, not for speculation,” signaling that some property curbs may be relaxed, analysts surmised.

Hong Kong-listed Chinese property developers' shares mostly rebounded on Tuesday, although many of them have lost more than 70% of their value over the past year. Big beleaguered developers like Evergrande and Kaisa continue to weigh on the market amid concerns they will fail to pay their US dollar debts on time.

On December 3, Evergrande said in a filing to the Hong Kong stock exchange that it had received a demand to perform its obligations under a guarantee in the amount of about US$260 million. It said there was no guarantee that it would have sufficient funds to continue to perform its financial obligations.

The company also said if it was unable to meet its guarantee obligations or certain other financial commitments, it could cause creditors to demand accelerated repayment.

In the evening of the same day, the People's Bank of China (PBoC) said it had sent a task group to Evergrande to help it improve internal management and maintain“normal” operations. The central bank said this was done at the request of Evergrande as well aw the Guangdong provincial government.

China Banking and Insurance Regulatory Commission and the China Securities Regulatory Commission spokesmen have criticized Evergrande for its over-expansion, which they have said caused its financial vulnerability. They added, in an apparent bid to calm markets and investors, that Evergrande's problems are isolated and not systemic in the property sector.

The Ministry of Housing and Urban-Rural Development also said it had sent a task group to Evergrande to ensure that the company would continue to deliver its apartments to homebuyers.

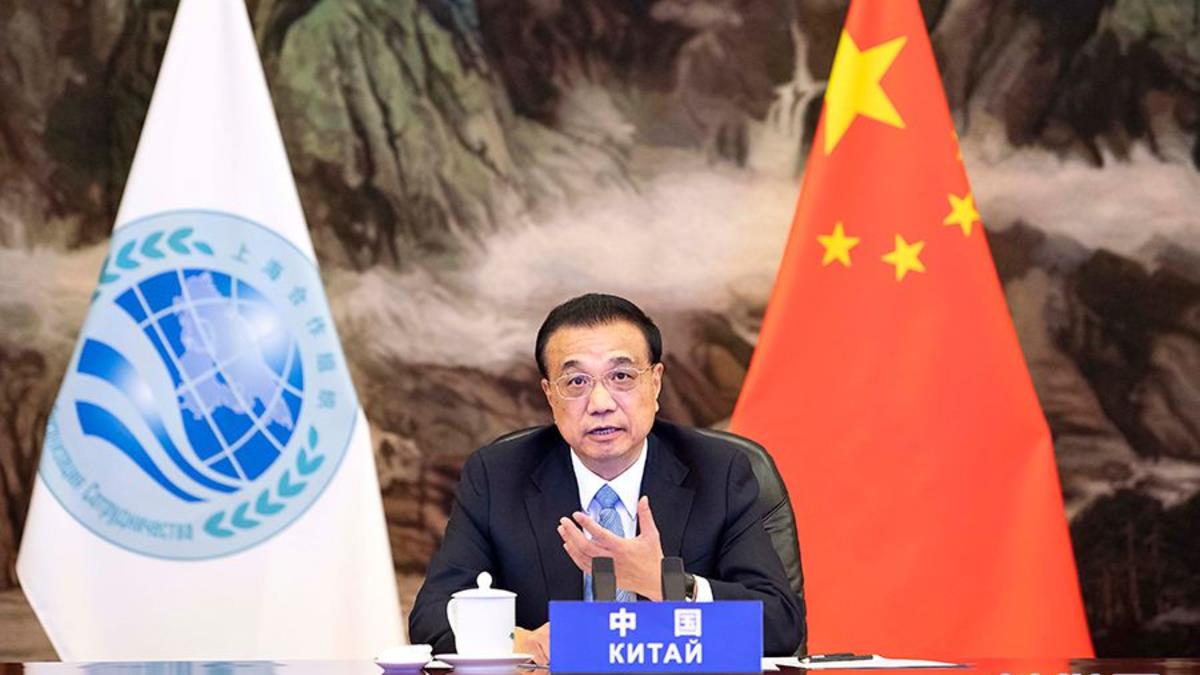

Chinese Premier Li Keqiang says China will maintain reasonable liquidity in the markets. Photo: Xinhua

On the same day, Chinese Premier Li Keqiang said in a meeting with Kristalina Georgieva, managing director of the International Monetary Fund, that China would maintain“reasonable” liquidity in the markets and reduce the RRR at the right time to support the country's SMEs.

On Monday, the PBoC announced that it would cut the RRR by 50 basis points on December 15. After this, the weighted average RRR will decrease to 8.9%, meaning that financial institutions can keep fewer reserves on hand and offer more loans to customers. The RRR reduction will release long-term funds of 1.2 trillion yuan to boost the economy.

A meeting of the CPC's Central Committee's politburo, chaired by General Secretary Xi Jinping, also said on Monday that it would push forward the healthy development of Chinese property markets and form a“virtuous circle” in the sector.

Yan Yue, a director at the Shanghai E-House Real Estate Research Institute, said it was necessary for China to cut its RRR as economic growth starts to slow.

Yan said in the past RRR cuts were aimed at increasing market liquidity and lowering borrowing costs but this time the PBoC had added one new goal, namely to“increase the fund allocation ability of financial institutions.”

It marked the first time that the politburo mentioned“virtuous circle” as there was a“vicious circle” of homebuyer hesitancy due to property developers' financial difficulties which in turn has hit the cash flows developers need to maintain their operations, Yan said.

“Under the backdrop of the RRR cut banks can offer more mortgage loans, helping activate the property markets,” Yan said.

The latest politburo meeting signaled that Beijing did not want a big fluctuation in the property markets while a stable supply of funds to the sector would help stabilize the markets, said Li Yujia, chief researcher at Guangdong Property Policy Research Institute.

A“virtuous circle” would be formed if there were sufficient funds for property developers to purchase sites and develop and sell their apartments, Li said.

In August last year, Chinese financial regulators announced“three red lines” that forbade heavily indebted property developers from borrowing money from banks until they lowered their gearing ratios. Since then, many developers, including Evergrande and Kaisa Group, have faced cash shortages.

Their financial situations have continued to deteriorate due to their worse-than-expected contracted sales this year.

Many developers such as Evergrande have faced a shortage of cash.. Photo: Handout

On Monday, Evergrande's bondholders were unable to receive overdue coupon payments from the property developer after a month-long grace period expired.

Evergrande said it had set up a risk management committee chaired by its chairman and founder Hui Ka-yan. The committee includes representatives from Guangdong Holdings, China Cinda Asset Management Co, Guangzhou Yuexiu Holdings, Guosen Securities Co and Beijing Zhonglun Law Firm.

Meanwhile, Kaisa faced a deadline to repay $400 million worth of bonds that fell due on Tuesday. A group of its bondholders has reportedly sent Kaisa a formal forbearance proposal, which should help it to avoid an immediate default.

Lifted by the RRR announcement, KWG Property rose 10.32% to close at HK$6.2 (79.5 US cents) while Sunac China jumped 16.84% to HK$15.54 on Tuesday. China Aoyuan Group rose 12.8% to HK$1.85.

Evergrande increased 1.11% to HK$1.83 while Kaisa gained 1.1% to 92 HK cents. Shares of Country Garden were up 1.67% to end at HK$7.31.

Those gains come against heavy earlier losses. Over the past year, Aoyuan and Kaisa have declined 75% while Evergrande has dropped 87%. KWG, Sunac and Country Garden have seen a 25-43% decrease in their share prices.

Leung Kit-man, an investment manager at Wocom Securities Ltd, said it was not time for investors to fish the bottom of the market as many property developers were still facing financial difficulties.

Leung said some property developers had recently reported a significant drop in their contract sales, underscoring still sluggish property market sentiment.

Read: Evergrande's bankruptcy still just a matter of time

MENAFN07122021000159011032ID1103319419

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.