(MENAFN- Asia Times)

Stock markets plunged about 1.5% half an hour after the US opening Tuesday after Fed Chairman Jerome Powell hinted at tighter monetary policy. That drop added to Friday's 2% decline in response to concerns over the Omicron variant of C0vid-19.

The market had been waiting for an excuse to sell off, and has both a medical and monetary one. It reacted to the virus on Friday and the Fed on Tuesday. We might term this one-two punch a Powellmicron.

Powell said,“At this point, the economy is very strong and inflationary pressures are higher, and it is therefore appropriate in my view to consider wrapping up the taper of our asset purchases – which we actually announced at the November meeting – perhaps a few months sooner. I expect that we will discuss that at our upcoming meeting.”

This blindsided equity investors, who had spent the previous 72 hours consulting virologists about the prospective severity of the Omicron strain.

The S&P 500 had gained 17% before the last few days' decline, as corporate profits rode the froth of fiscal and monetary stimulus. Corporations passed on higher input costs to their customers, while the after-inflation cost of financing turned negative as the Federal Reserve pushed down bond yield by purchasing $5 trillion worth of bonds.

The pricing power of US corporations and the collapse of financing costs supported the highest profit margins for US companies since 1952.

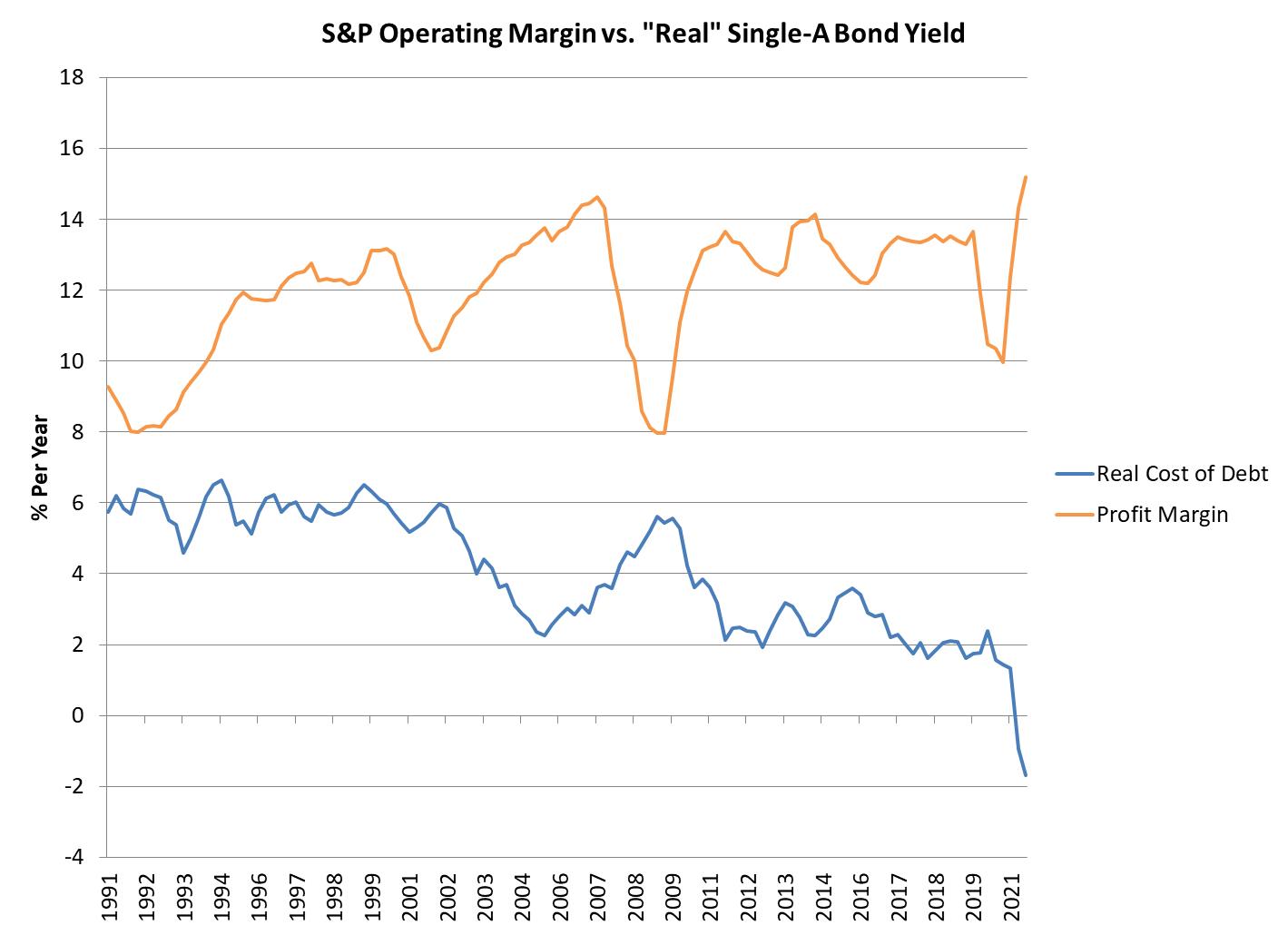

The“real” yield for the median member of the S&P 500 is now around negative 2 percent (that's the yield for corporate bonds rated single-A by Moody's minus the GDP deflator).

Thanks to the Fed, investors are willing to pay major US corporations to take their money and hold it for them. The chart below compares the after-inflation yield that corporations pay to issue single-A bonds with the S&P operating margin. The operating margin jumped as the cost of debt capital turned negative in 2021.

With $6 trillion in stimulus to spend, US consumers paid up for more expensive goods, including homes, up 19% year-on-year in October, and used cars, up 45% year-on-year.

The cornucopia that Covid-19 brought to corporate America thanks to the largesse of the federal government and the unprecedented balance-sheet expansion of the Federal Reserve can't last. Real wages are declining, with the Consumer Price Index up 6.1% in the year through October, stripping the 4.1% increase in wages as estimated by the Atlanta Federal Reserve's wage tracker.

The CPI number does not take into account increases in rents over the past year estimated at 9% and 15%, respectively, by Zillow and Apartmentlist.

Consumers are still spending their stimulus checks, but know that inflation is eroding real incomes – which explains strong retail numbers despite consumer confidence numbers usually registered during recessions.

The Federal Reserve has no choice but to lean against inflation sooner or later.

To the extent that the Fed signals later action, the stock market will continue to party.

But that wasn't the signal that Fed Chair Powell gave in Congressional testimony Tuesday morning. He said:

Consumers can't keep spending money indefinitely while their real incomes decline, and bond investors can't keep paying corporations to hold their money for them. At some point consumers and bond investors will balk, and the US will face the sort of stagflationary crisis that brought down the Carter presidency in the late 1970s.

At some point the party will come to an end. That's why equity investors are edging close to the exit.

MENAFN30112021000159011032ID1103282595

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.