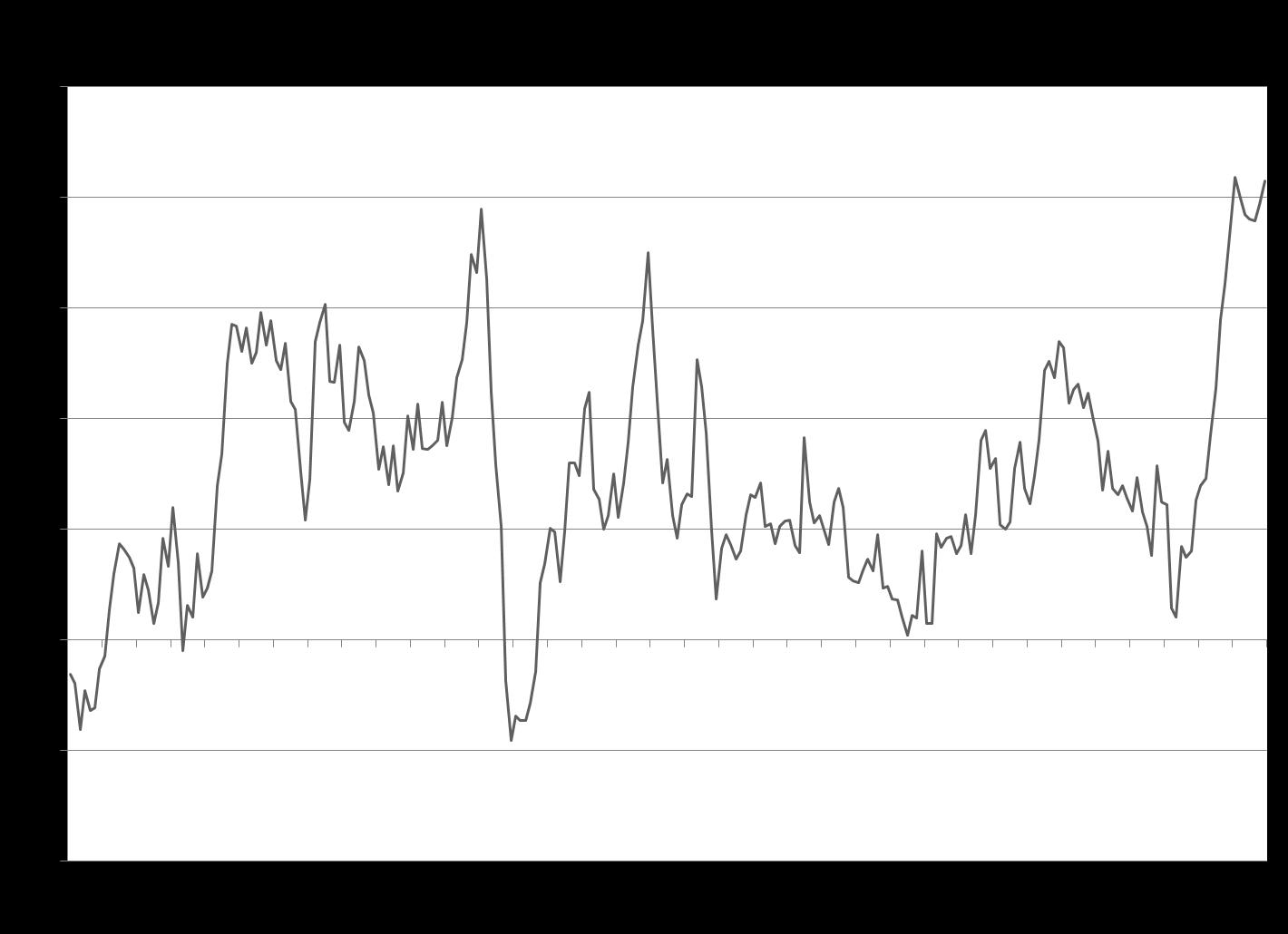

(MENAFN- Asia Times) A spike in inflation expectations embedded in US Treasury yields has pushed market fears of long-term inflation to the highest level since the series began twenty years ago. So-called“breakeven inflation” at the five-year horizon, the Treasury market's measure of average annual change in the Consumer Price Index over five years, rose another .08% to 3.2% on Monday. The rise followed publication of yet another Federal Reserve survey showing a jump in prices paid by manufacturers.

“Breakeven inflation” is the difference between the yield on ordinary Treasury notes and inflation-indexed notes (Treasury inflation-protected securities, or TIPS). TIPS pay a coupon plus the inflation rate as measured by the Consumer Price Index. The difference between the TIPS yield and the ordinary coupon yield is the expected average inflation over the life of the note.

Monday's breakout into a new historic high for breakeven inflation followed the 8:30 a.m. publication of the New York Federal Reserve Bank's Empire State survey, showing a record number of respondents reporting higher factory input costs.

Earlier this year, Asia Times warned that a wave of inflation was on the way – before it turned up in the official numbers (“US inflation isn't coming – it's already here ,” April 18, 2021).

MENAFN15112021000159011032ID1103178016

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.