(MENAFN- Brazil-Arab News Agency (ANBA))

Cairo – JP Morgan has announced that Egypt will officially join its bond index for emerging markets as of the end of January. Egypt's Finance minister Mohamed Maait said this is a new certificate of confidence from foreign investors in the solidity of the Egyptian economy, particularly since 90% of the foreign investors surveyed supported the inclusion.

Egyptian government bonds have been cleared to join JP Morgan's Government Bond Index-Emerging Markets (GBI-EM). The minister explained that the measure makes Egypt one of the few Middle East and Africa countries to be featured in the index. Some 14 Egyptian pound government bonds worth a total USD 26 billion are expected to be eligible for the benchmark.

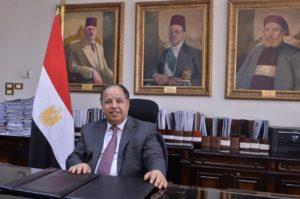

Minister Maait: Announcement is a certificate of confidence in Egypt

Egypt was removed from the index in June 2011 for failing to meet its requirements. About three years ago, the Ministry of Finance began seeking to re-join the Index by meeting the bank's requirements, including extending the life of government debt, adjusting the yield curve and raising the proportion of foreign investors' participation in government financial instruments with an increase in the volume of each issue.

Injection of USD 1 billion

The minister pointed out that this step reflects the continuous efforts to reduce the cost of public debt as part of the package of measures taken by the government for economic reforms. USD 1 billion of new additional investments are expected to be pumped into the Egyptian securities market, including treasury bills and bonds, thus allowing to achieve the debt management strategy in reducing the cost.

Deputy minister of Finance, Ahmed Kjok, said the inclusion of the country in the index reflects the Ministry's efforts to boost the efficiency of public debt management, while reducing the cost of its service. This was made possible by implementing a strategy to reduce the volume of the public debt in the medium term, which included programs to fast-track the reduction of the debt service in the budget by activating the bond market, thus allowing an increase in the levels of liquidity and a higher demand for public debt bonds, thus resulting in a reduction of the cost.

Neven Mansour, advisor to the Deputy Minister of Finance, explained that over the course of three years there was constant communication with the team of bank JP Morgan to provide them with the latest data and developments related to the government bond market and work towards meeting the requirements for joining the index

Improvements for foreigners

She added that the Ministry has also modified the procedures followed in non-double taxation matters and its application to foreign investors, thus contributing to the development of the Egyptian government debt instruments market, thus attracting a new segment of foreign investors to increase the demand for debt instruments and put them on the global indicator map and increase the confidence of international financial institutions and reduce the cost of debt.

Nevin explained that Egypt had been placed on the checklist for the“JP Morgan” index last April as a preliminary measure prior to its inclusion in the index, noting that after six months had elapsed, the institution announced that Egypt would actually be included in the index by the end of next January.

Translated by Guilherme Miranda

©Nicolas Economou/NurPhoto/AFP

Supplied

The post Egypt to join JP Morgan index in January appeared first on Agência de Notícias Brasil-Árabe .

MENAFN15102021000213011057ID1102977169

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.