(MENAFN- ValueWalk)

Totally not transitory inflation readings didn't sink S & P 500 – stocks recovered, and are likely to spend trading today near 4,400. Credit markets didn't disappoint after all, but the sectoral composition isn't a picture of screaming strength. Value erased steep intraday losses, so did the Russell 2000, but tech visibly lagged instead of being prodded by retreating yields. VIX also is approaching the more complacent end of its spectrum.

Get The Full Series in PDF

Get the entire 10-part series on Charlie Munger in PDF. Save it to your desktop, read it on your tablet, or email to your colleagues.

Q3 2021 hedge fund letters, conferences and more

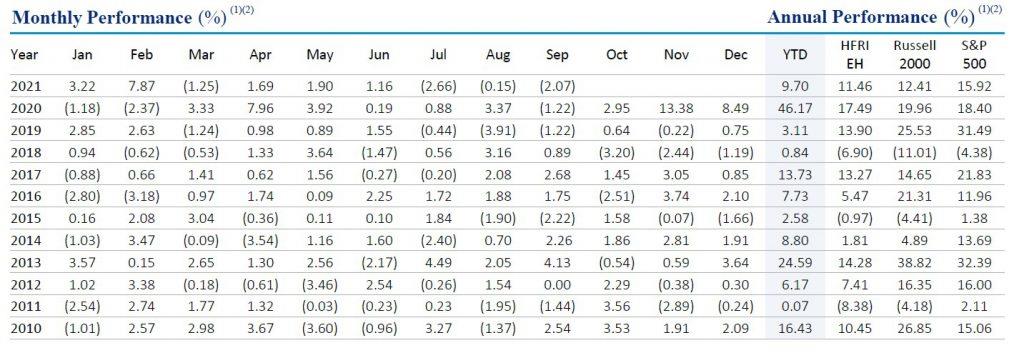

Roubaix September 2021 Performance Update; YTD Net Return +9.70%

Roubaix Fund Composite performance update for the month ended September 30, 2021. Q3 2021 hedge fund letters, conferences and more The Roubaix Fund Composite, a fundamental long/short equity strategy focused on small and mid cap U.S. stocks. On a year to date basis, Roubaix has generated a net return of +9.70% compared to the HFRI Read More

So, how far could the bulls make it? 4,420 is one resistance level, and then prior local highs at 4,470 await. The fate of this correction is being decided right there, and it's my view we have lower than 4,260 to go still. Therefore, I'm taking a big picture view, and that is one of continuous inflation surprises to the upside forcing the Fed to taper, which it may or may not do. The policy risks of letting inflation run wild are increasing, so the central bank would find it hard not to deliver fast – the market would consider that a policy mistake.

The tone of yesterday's FOMC minutes has calmed the Treasury market jitters, and the dollar succumbed. So did inflation expectations, but the shape of the TIP:TLT candle suggests that inflation isn't done and out. The Fed is in no position to break it, supply chain pressures, energy crunch and heating job market guarantee that it will be stubbornly with us for longer than the steadily increasing number of quarters Fed officials are admitting to.

That's what precious metals and commodities are sensing, by the way. Cryptos aren't having second thoughts either. Copper caught spectacular fire, and its sudden outperformance is very conducive to real assets appreciation. But where does that leave stocks?

Counting on the Fed being behind the curve, inflation has the power to derail the S & P 500 bull run – the more so it runs unchecked. The 1970s stagflation brought several wild swings, cutting the index in half as it spent the decade in a trading range. And given the breadth characteristics of the 500-strong index these days, the risks to the downside can't be underestimated. What's my target of 4,260 in this light?

Let's consider that from the portfolio point of view – purely stock market traders might prefer to short exhaustion at 4,420 or the approach to 4,470, or balance the short position's risk in the stock market with precious metals, cryptos and commodity bets they way I do it – and it's working just fine as the precious metals and crypto positions do great while I'm waiting for retracement in oil and copper (in price or in time).

Let's move right into the charts (all courtesy of ).

Table of Contents show

-

1.

S & P 500 and Nasdaq Outlook

-

2.

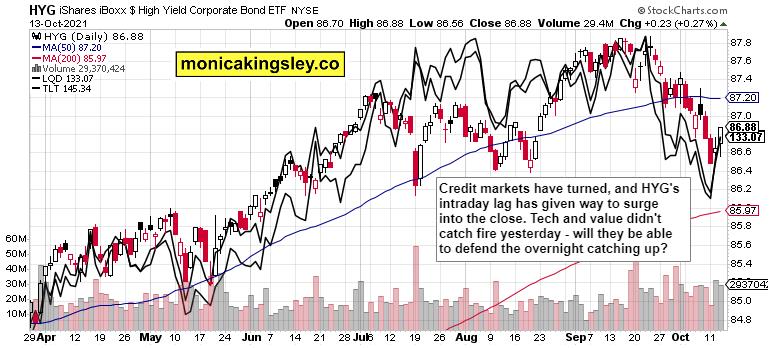

Credit Markets

-

3.

Gold, Silver and Miners

-

4.

Crude Oil

-

5.

Copper

-

6.

Bitcoin and Ethereum

-

7.

Summary

S & P 500 and Nasdaq Outlook

S & P 500 is in the early phase of its bullish upswing, which can fizzle out easily unless the 50-day moving average is conquered again. The bulls have benefit of the (short-term) doubt.

Credit Markets

Quality debt instruments and HYG turned around, lending credibility to yesterday's stock rebound.

Gold, Silver and Miners

Precious metals are finally on a tear, and the exhaustive move in the miners being reversed this fast, has legs. Get ready for a challenge to $1,840 next as the fireworks I was looking for, arrived.

Crude Oil

Crude oil consolidates in a very narrow range, and the low volume hints at better not expecting too much downside.

Copper

Last three days, copper didn't really look back, and clearly wants to outperform the CRB Index, which has very positive implications for precious metals in the very least. The predictive effect upon the real economy needs to be viewed in light of monetary and fiscal policies getting potentially less supportive, though.

Bitcoin and Ethereum

The expected crypto pause came, and is gone, how did you like it? The crypto bull run is on!

Summary

Stock market rebound has to deal with 4,420 now, and in today's extensive analysis, I talked how to approach the current macroeconomic setup (inflation, taper reflected in Treasuries and the dollar) accounting for real assets too. S & P 500 isn't likely out of the woods yet, and the next few days will be a crucial in showing whether we're past this correction, or not. Or, if more than a few percent dip awaits. The places to enjoy strong gains, are precious metals, cryptos and commodities.

Thank you for having read today's free analysis, which is available in full at my homesite. There, you can subscribe to the free Monica's Insider Club , which features real-time trade calls and intraday updates for all the five publications: Stock Trading Signals, Gold Trading Signals, Oil Trading Signals, Copper Trading Signals and Bitcoin Trading Signals.

Thank you,

Monica Kingsley

Stock Trading Signals

Gold Trading Signals

Oil Trading Signals

Copper Trading Signals

Bitcoin Trading Signals

[email protected]

All essays, research and information represent analyses and opinions of Monica Kingsley that are based on available and latest data. Despite careful research and best efforts, it may prove wrong and be subject to change with or without notice. Monica Kingsley does not guarantee the accuracy or thoroughness of the data or information reported. Her content serves educational purposes and should not be relied upon as advice or construed as providing recommendations of any kind. Futures, stocks and options are financial instruments not suitable for every investor. Please be advised that you invest at your own risk. Monica Kingsley is not a Registered Securities Advisor. By reading her writings, you agree that she will not be held responsible or liable for any decisions you make. Investing, trading and speculating in financial markets may involve high risk of loss. Monica Kingsley may have a short or long position in any securities, including those mentioned in her writings, and may make additional purchases and/or sales of those securities without notice.

Updated on Oct 14, 2021, 10:36 am

MENAFN14102021005205011743ID1102973030

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.