(MENAFN- Newsfile Corp) Palladium One Continues to Deliver Strong drilling Results at Kaukua South, Finland

HIGHLIGHTS

3.1 g/t Palladium Equivalent over 21.3 meters, within 2.4 g/t Palladium Equivalent over 48.5 meters at Kaukua South, LK Project, Finland

Drilling extends mineralization 200 meters on eastern side of Kaukua South, returning 1.0 g/t Palladium Equivalent over 51.0 meters

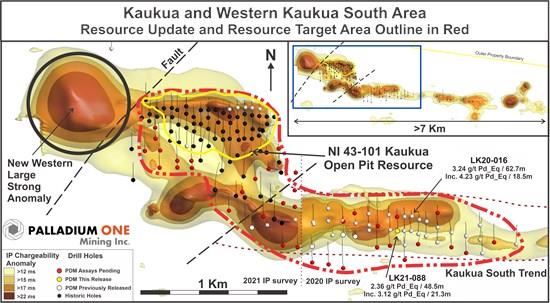

Toronto, Ontario--(Newsfile Corp. - October 5, 2021) - Palladium One mining Inc. (TSXV: PDM) (FSE: 7N11) (OTCQB: NKORF) ("Palladium One" or the "Company") is pleased to announce Kaukua South drillhole LK21-088 intersected 3.1 g/t Palladium Equivalent ("Pd_Eq") over 21.3 meters, within 2.4 g/t Pd_Eq over 48.5 meters , starting at 120 meters depth (Figure 1, and 2).

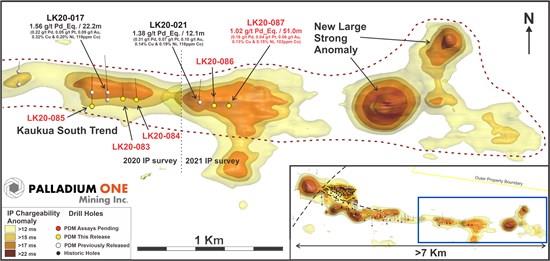

Additionally, with hole LK-21-087 returning 1.0 g/t Pd_Eq over 51.0 meters the mineralized zone of Kaukua South has been extended 200 meters east from previous drilling, (Figure 3). In aggregate, the Kaukua Trend which includes both the Kaukua deposit and the Kaukua South Zone, now boasts a drill defined mineralized strike length of 4.4 kilometers within a 7-kilometer-long Induced Polarization ("IP") chargeability anomaly (Figure 1 and 3). Hole LK21-087 confirms that the eastern portion of the Kaukua Trend remains open for further expansion, particularly given a robust IP anomaly has been identified 1 kilometer east of hole LK21-087, see news release July 7, 2021 .

Derrick Weyrauch, President and CEO of Palladium One highlighted: "Our Kaukua South discovery continues to deliver excellent results. Today's drill results from the eastern portion of the Kaukua Trend is further evidence of a prolific mineralized system on our property which we plan to follow up with additional drilling."

The eastern portion of Kaukua South has received significantly less drilling as we are focused on brining the western two kilometers of Kaukua South to a maiden Resource Estimate and expanding the initial 2019 Kaukua Mineral Resource Estimate. The eastern portion of Kaukua South has returned significant results in the past, such as hole LK20-017 which returned 1.56 g/t Pd_Eq over 22.2 meters (0.22 g/t Pd, 0.05 g/t Pt, 0.09 g/t Au, 0.32% Cu, 0.20% Ni, 119 ppm Co), see October 22, 2020 . Today's announcement of hole LK21-087 , is the furthest step-out hole drilled to the east at Kaukua South which when combined with the strong IP anomalies indicate a strong potential to add additional resources along the eastern extension of the Kaukua Trend.

Figure 1. Historic and current drilling in the Kaukua and Western portion of the Kaukau South area having a drill data cut off date of September 4, 2021 (hole LK21-128), assays have been received for holes up to LK21-088, the rest are pending. Background is Induced Polarization ("IP") Chargeability.

To view an enhanced version of Figure 1, please visit:

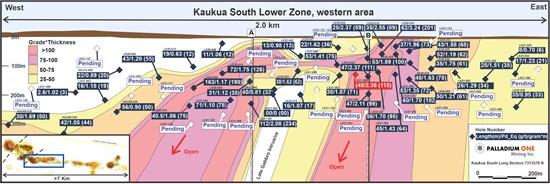

Figure 2. Kaukua South Long Section. Having a drill data cut off date of September 4, 2021 (hole LK21-128), assays have been received for holes up to LK21-088, the rest are pending. The long section covers only the western portion of Kaukua South which the Company is focused on bringing to an initial NI43-101 resource estimate. The long section is a vertical slice representing only the ~55° south dipping Lower Zone of Kaukua South. Intercepts are represented in both width (meters) and grade (Pd_Eq*) as well as gram*meters (grade*width).

To view an enhanced version of Figure 2, please visit:

Figure 3. Eastern portion of Kaukua South, showing results for holes LK21-083 through 087.

To view an enhanced version of Figure 3, please visit:

Table 1. LK Project Kaukua South Drill Hole Results

| Hole | From

(m) | To

(m) | Width

(m) | Pd_Eq

g/t* | Spot

Cu_Eq

g/t** | Spot

Au_Eq

g/t** | Pd

g/t | Pt

g/t | Au

g/t | Cu

% | Ni

% | Co

ppm |

| LK21-083 | | | | | | | | | | | | |

| Upper Zone | 92.0 | 106.5 | 14.5 | 1.11 | 0.68 | 1.12 | 0.19 | 0.05 | 0.07 | 0.12 | 0.17 | 108 |

| Lower Zone | 191.0 | 206.5 | 15.5 | 0.92 | 0.56 | 0.93 | 0.34 | 0.12 | 0.04 | 0.08 | 0.09 | 68 |

| Inc. | 191.0 | 197.0 | 6.0 | 1.69 | 1.04 | 1.71 | 0.79 | 0.26 | 0.09 | 0.13 | 0.11 | 72 |

| Inc. | 191.8 | 192.7 | 0.9 | 3.89 | 2.39 | 3.93 | 1.81 | 0.65 | 0.16 | 0.31 | 0.28 | 135 |

| LK21-084 | | | | | | | | | | | | |

| Upper Zone | 78.5 | 98.0 | 19.5 | 0.71 | 0.44 | 0.72 | 0.10 | 0.03 | 0.04 | 0.07 | 0.11 | 86 |

| Inc. | 78.5 | 87.5 | 9.0 | 0.98 | 0.60 | 0.98 | 0.15 | 0.04 | 0.06 | 0.09 | 0.16 | 111 |

| Lower | 142.5 | 148.5 | 6.0 | 0.80 | 0.49 | 0.81 | 0.18 | 0.09 | 0.04 | 0.09 | 0.10 | 75 |

| LK21-085 | | | | | | | | | | | | |

| Upper Zone | 114.7 | 116.1 | 1.4 | 2.37 | 1.49 | 2.44 | 0.00 | 0.00 | 0.01 | 0.71 | 0.29 | 424 |

| LK21-086 | | | | | | | | | | | | |

| Upper Zone | 79.5 | 99.0 | 19.5 | 1.06 | 0.65 | 1.07 | 0.19 | 0.04 | 0.07 | 0.14 | 0.15 | 98 |

| Inc | 81.0 | 88.7 | 7.7 | 1.43 | 0.88 | 1.44 | 0.29 | 0.07 | 0.09 | 0.16 | 0.20 | 128 |

| lower Zone | 172.0 | 176.0 | 4.0 | 0.76 | 0.46 | 0.76 | 0.33 | 0.15 | 0.02 | 0.04 | 0.06 | 59 |

| LK21-087 | | | | | | | | | | | | |

| Upper Zone | 70.0 | 121.0 | 51.0 | 1.02 | 0.63 | 1.04 | 0.16 | 0.04 | 0.06 | 0.13 | 0.15 | 103 |

| Inc | 78.0 | 82.5 | 4.5 | 1.56 | 0.97 | 1.59 | 0.32 | 0.05 | 0.09 | 0.20 | 0.22 | 135 |

| Lower Zone | 230.0 | 248.0 | 18.0 | 0.53 | 0.33 | 0.54 | 0.13 | 0.05 | 0.02 | 0.06 | 0.07 | 50 |

| Inc. | 230.0 | 232.0 | 2.0 | 1.30 | 0.79 | 1.30 | 0.40 | 0.18 | 0.04 | 0.11 | 0.15 | 95 |

| LK21-088 | | | | | | | | | | | | |

| Upper Zone | 18.9 | 84.0 | 65.1 | 0.58 | 0.36 | 0.59 | 0.09 | 0.02 | 0.04 | 0.07 | 0.09 | 69 |

| Inc. | 18.9 | 42.0 | 23.1 | 0.73 | 0.45 | 0.74 | 0.11 | 0.04 | 0.05 | 0.07 | 0.11 | 86 |

| Lower Zone | 119.5 | 168.0 | 48.5 | 2.36 | 1.45 | 2.39 | 1.21 | 0.41 | 0.10 | 0.17 | 0.14 | 76 |

| Inc. | 122.2 | 143.5 | 21.3 | 3.12 | 1.92 | 3.15 | 1.57 | 0.51 | 0.15 | 0.23 | 0.19 | 99 |

| Inc. | 142.0 | 143.5 | 1.5 | 5.63 | 3.46 | 5.70 | 3.23 | 1.06 | 0.27 | 0.37 | 0.24 | 91 |

* Pd_Eq calculated using prices from the 2021 NI43-101 Haukiaho Mineral Resource Estimate; $1,600/oz Pd, $1,100/oz Pt, $1,650/oz Au, $3.50 Cu, and $7.50 Ni.

** Spot Au_Eq and Cu_Eq is calculated for comparison only, using recent prices, $1,850/oz Pd, $950/oz Pt, $1750/oz Au, $4.2/lb Cu, and $8.20/lb Ni, and $24/lb cobalt.

- Grey Italicised results are previously released (see press release October 22, 2020 ).

Palladium Equivalent

Revised price assumptions - The Company is now calculating Palladium equivalent using US$1,600 per ounce for palladium, US$1,100 per ounce for platinum, US$1,650 per ounce for gold, US$3.50 per pound for copper, and US$7.50 per pound for nickel consistent with the calculation used in the Company's September 2021 NI 43-101 Haukiaho Resource Estimate.

Spot Gold Equivalent

Spot palladium and gold equivalents are calculated using recent spot prices for comparison purposes using US$1,850 per ounce for palladium, US$950 per ounce for platinum, US$1,750 per ounce for gold, US$4.2 per pound for copper, and US$8.2 per pound for nickel.

Qualified Person

The technical information in this release has been reviewed and verified by Neil Pettigrew, M.Sc., P. Geo., Vice President of Exploration and a director of the Company and the Qualified Person as defined by National Instrument 43-101.

About Palladium One

Palladium One Mining Inc. is an exploration company targeting district scale, platinum-group-element (PGE)-copper nickel deposits in Finland and Canada. Its flagship project is the Lä ntinen Koillismaa or LK Project, a palladium dominant platinum group element-copper-nickel project in north-central Finland, ranked by the Fraser Institute as one of the world's top countries for mineral exploration and development. Exploration at LK is focused on targeting disseminated sulfides along 38 kilometers of favorable basal contact and building on an established NI 43-101 open pit Mineral Resource.

ON BEHALF OF THE BOARD

"Derrick Weyrauch"

President & CEO, Director

For further information contact: Derrick Weyrauch, President & CEO

Email:

Neither the TSX Venture Exchange nor its Market Regulator (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release includes "forward-looking information" that is subject to a few assumptions, risks and uncertainties, many of which are beyond the control of the Company. Statements regarding listing of the Company's common shares on the TSXV are subject to all of the risks and uncertainties normally incident to such events. Investors are cautioned that any such statements are not guarantees of future events and that actual events or developments may differ materially from those projected in the forward-looking statements. Such forward-looking statements represent management's best judgment based on information currently available. Factors that could cause the actual results to differ materially from those in forward-looking statements include regulatory actions and general business conditions. Such forward-looking information reflects the Company's views with respect to future events and is subject to risks, uncertainties and assumptions, including those set out in the Company's annual information form dated April 27, 2021 and filed under the Company's profile on SEDAR at . The Company does not undertake to update forward‐looking statements or forward‐looking information, except as required by law. Investors are cautioned that any such statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements.

To view the source version of this press release, please visit

MENAFN05102021004218003983ID1102918646

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.