(MENAFN- ValueWalk)

In his Daily Market Notes report to investors , while commenting on Evergrande being a“Lehman Moment”, Louis Navellier wrote:

Get The Full Ray Dalio Series in PDF

Get the entire 10-part series on Ray Dalio in PDF. Save it to your desktop, read it on your tablet, or email to your colleagues

Q2 2021 hedge fund letters, conferences and more

The Role Of Knowledge In Asset Management

Is there a link between intelligence, knowledge and successful investing? At first glance, it might appear as if there is. Wall Street is known for only hiring the best and brightest. However, some of the world's most successful investors didn't attend the world's best universities and don't claim to have a higher than average I.Q. Read More

Table of Contents show

-

1.

Fed Credibility

-

2.

Evergrand: A Lehman Moment

-

3.

IWM Set Up Favorable

-

4.

Heard & Notable:

Fed Credibility

Going into this week's FOMC meeting, the cooling of these inflation numbers gives the Fed credibility regarding its“transitory inflation” prediction. Overall, the August CPI was a very pleasant surprise!

The Labor Department also announced that import prices declined 0.3% in August, evidence that inflation may be“transitory,” as the Fed has implied . Export prices rose 0.4% in August, but that was the smallest monthly increase in 10 months, so there is some hope that inflationary forces are cooling.

The big surprise last week was that the Commerce Department announced on Thursday that retail sales rose 0.7% in August. Another example of inflation boosting retail sales is that gasoline sales rose by 2%.

Another trend reversal came Thursday when the Labor Department said weekly unemployment claims rose to 332,000.

Despite rising Covid cases last month, the consumer was clearly in the mood to spend money , since online sales rose 5.3%, furniture sales rose 3.7% and general merchandise sales rose 3.5%. In the past 12 months, retail sales have risen by an impressive 15.1%. You can't keep the American consumer down!

Evergrand: A Lehman Moment

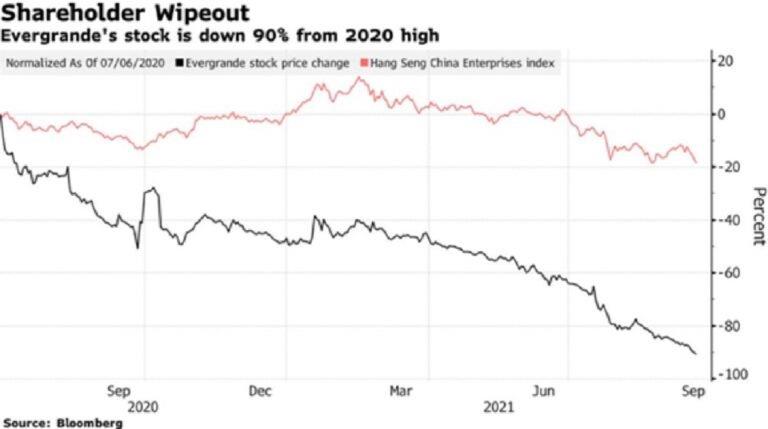

Will China's Evergrande Property Services Group Ltd (HKG:6666) be a“Lehman moment” if Beijing allows for what could be a default on over $300 billion in debt payments?

Evergrande's business accounts for about 2% of China's GDP, and the stock of the company has lost roughly 90% of its value. Hence, at this point, it seems that the worst-case scenario would be a controlled crash – a bankruptcy and break-up of the company by the state, with assets absorbed by western markets.

There is more evidence of a global economic slowdown brewing. On Wednesday, China 's National Bureau of Statistics announced that retail sales rose only 2.5% (annualized) in August, a major drop from an 8.5% annual pace in July. Real estate investment in China this year slowed to a 10.9% annual pace. When China's property market cools, consumer spending tends to also cool off.

Due to China's domestic woes and recent slowdown, the U.S. will continue to lead global GDP growth.

IWM Set Up Favorable

While the trend for equities is likely lower, markets are forward-looking and have likely priced in most of the pessimism brought about by these noted risks. Assuming there is progress on current headwinds, inflation, Fed policy, covid, it might behoove investors to take a hard look at going long the Russell 2000 , where the majority of stocks are smaller domestic companies. This might be the most under-owned sector with the most room to run.

What's good about this investment setup is that the downside risk is very well-defined by looking at the year-to-date chart of the Russell 2000 iShares ETF (IWM), which has been consolidating in a 20-point range for the past eight months.

The Russell 2000 has missed out on this year's rally. As of last Friday's close, the S & P 500 is up 18% and the Nasdaq is ahead by 16.7%, but the Russell 2000 is up only 13.3% Considering the fact that the small- to mid-cap stocks hold the greatest amount of investment risk, to see this tier of the market in the midst of so much hand wringing is not only counterintuitive, it is starting to look very compelling.

Heard & Notable:

The EU branch of Amazon was fined $885.9 million for "non-compliance with general data processing principles." The regulatory framework of the General Data Protection Regulation (GDPR) in the EU aims to give users more control over their own data – and lays the groundwork for fining companies offering their services in the EU for breaching its articles. Source: Statista

MENAFN22092021005205011743ID1102847712

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.