(MENAFN- Asia Times) TOKYO – On September 17 Japan's JSR Corporation announced plans to make Inpria Corporation of the US a near wholly-owned subsidiary, a little-noticed deal that could have big implications for the global semiconductor industry.

Tokyo-based JSR is the world's top maker of photoresists, light-sensitive materials used to form circuit patterns on silicon and other types of semiconductor wafers during the photo-lithographic process of chip production.

The company commands a photoresists market share of about 35%. JSR and other Japanese companies including Tokyo Ohka Kogyo (TOK), Fujifilm, Shin-Etsu Chemical and Sumitomo Chemical have close to 90% of the global market for semiconductor photoresists.

DuPont of the US, Merck of Germany, SK Materials of South Korea and a joint venture between TOK and Samsung in South Korea also make photoresists.

Photoresists have evolved with lithography technology to enable the continuous miniaturization of semiconductors.

Lithography tools in mass production range from i-line (365-nanometer wavelength) mercury lamps to KrF (Krypton Fluoride) (248-nanometer) and ArF (Argon Fluoride) (193-nanometer) excimer lasers (also known as DUV, or Deep Ultraviolet), and now EUV (Extreme Ultraviolet) (13-nanometer).

Supplementary technologies including ArF liquid immersion lithography, multiple patterning and, going forward, high NA (numerical aperture) EUV lithography make it possible to produce circuit features smaller than the wavelength generated by the light source.

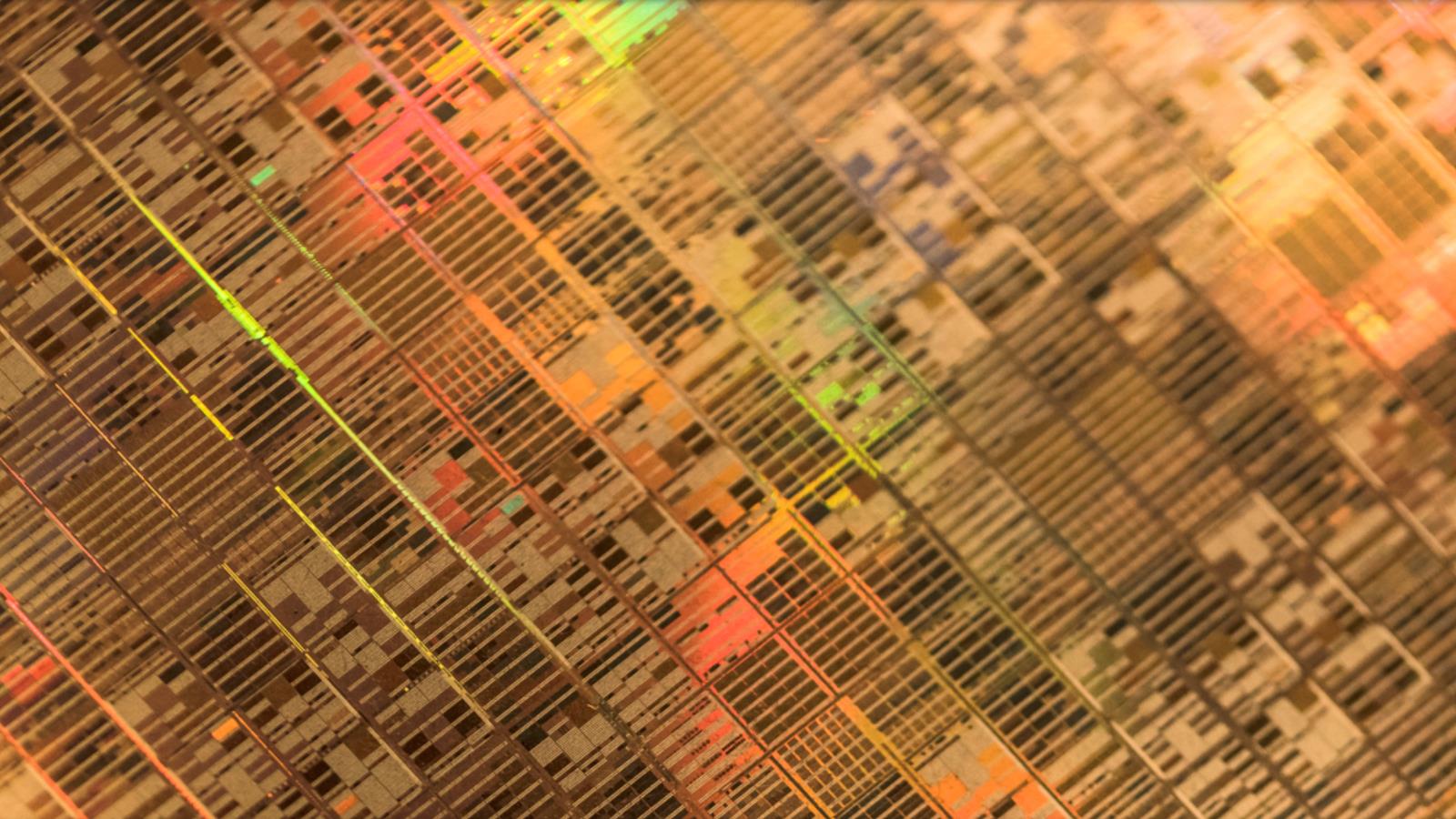

Photoresists are essential in the semiconductor production process. Image: Fujifilms

Until recently, semiconductor photoresists have been made from polymers. Inpria is the first and so far the only company in the world that uses inorganic materials.

Headquartered in Corvallis, Oregon, Inpria was spun out of the chemistry department at Oregon State University in 2007. Since then, its shareholders and technology development partners have included Samsung, SK Hynix, TSMC, Intel, Applied Materials, TOK and JSR.

Between 2017 and 2020, JSR acquired 21.3% of Inpria's shares. Now it has reached an agreement to acquire most of the rest for $514 million. Oregon State University plans to retain a small but undisclosed stake in the company. The transaction should be completed by the end of October.

Inpria, which lost $12.3 million on sales of $232 million in 2020, should turn profitable next year, according to management. With EUV-related production volumes ramping up quickly, this seems reasonable.

JSR also has facilities in Hillsboro and Beaverton, Oregon, located close to Intel. Last March, it completed a new $100 million factory in Hillsboro; Inpria will continue to operate in Corvallis.

Inpria specializes in metal-oxide photoresists developed specifically for EUV lithography, which enables the production of leading-edge semiconductor products with 5-nanometer and smaller design rules.

According to JSR's press release:

Over the next 10 years, JSR expects the semiconductor photoresist market to roughly double in size, with demand for previous generation ArF photoresists rising at a compound annual growth rate of 9% and demand for EUV photoresists at a rate of 40% through 2026. By then, the leading-edge design rule should reach 1-nanometer.

Inpria's metal-oxide resists are also expected to meet the technical challenges beyond 1-nm toward the end of the decade. In terms of final product, this is part of the roadmap to autonomous vehicles, neuro-morphic devices and quantum computing.

With this trajectory in mind, Inpria CEO told Oregon Live (The Oregonian) that“The time is perfect for this [acquisition] given where the technology is, where products are in the markets.”

In other words, Inpria does not have the resources to go it alone and JSR needs Inpria's technology to maintain its industry leadership.

The leading-edge design rule should reach 1-nanometer by 2026. Photo: Twitter

In July, the Korean press reported that Samsung Electronics plans to be using Inpria's metal-oxide photoresists in its EUV process by the end of this year. This story was spun as a diversification away from reliance on Japan but obviously that is not the case.

In 2019, when the Japanese government placed restrictions on the export of photoresists to South Korea, Samsung started sourcing them from JSR's subsidiary in Belgium. And both companies have worked with Inpria for several years.

Meanwhile, Jiangsu Nata Opto-electronic Material Co, Ltd and other Chinese companies are developing their own photoresist technology. Nata announced the first successful test of its ArF photoresist in 50-nanometer production in December 2020.

There is a lot of room for photoresist import substitution in China, but Chinese producers are only getting started while the industry leaders are poised for a great leap forward.

Scott Foster is an analyst with Lightstream Research, Tokyo.

MENAFN20092021000159011032ID1102825961

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.