(MENAFN- Asia Times) SEOUL – The sum of US$461 billion is hardly small change, but when you consider it is the market capitalization of the biggest company in one of the hottest sectors in the global economy, something looks amiss.

Is Samsung Electronics undervalued? Its nearest rival in chip-making, Taiwan-based TSMC, is worth $602.33 billion. Its nearest rival in smartphones, US super brand Apple, has a whopping $2.4 trillion market cap.

Granted, Apple earned $274.5 billion in net income in 2020 – a tad more than Samsung's $212.43 billion , but hardly reflective of the colossal gap between the two company's valuations. Samsung's income in 2020 far outpaced TSMC's 2020 revenue of $47.78 billion .

The gap is explained by a complex range of factors. Some say the company is too diversified to excite investors who want focus, while others argue its governance issues generate a discount.

But the wider ecosystem is unfavorable to a higher Samsung valuation. South Koreans do not customarily invest in equities, and there are ceilings on how much many international investors can sink into South Korea's markets.

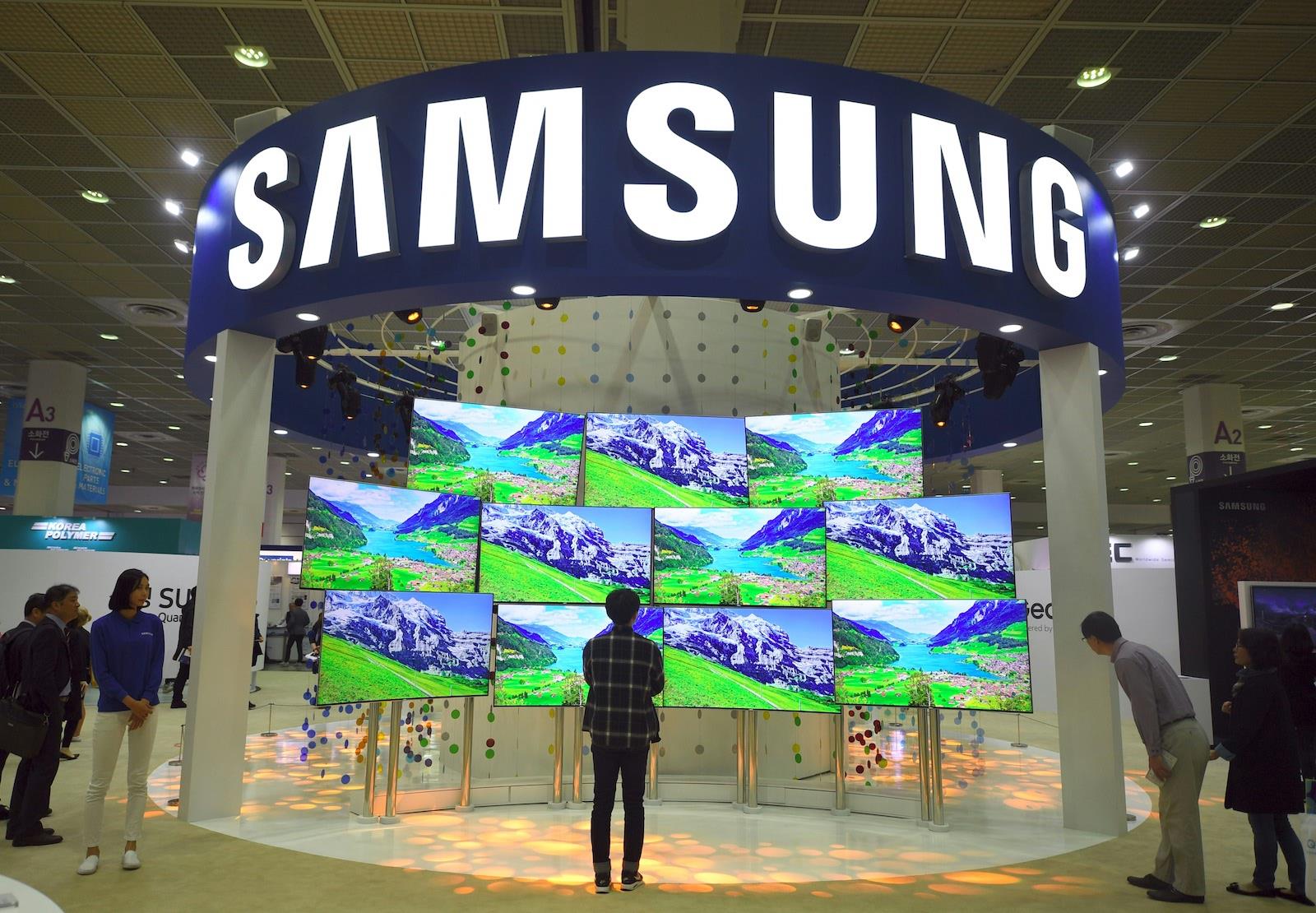

Samsung was the largest supplier of smartphones in 2020. Photo: AFP / Artur Widak / NurPhoto

Big and brawny or fat and flabby?

Samsung is widely described as“the world's largest electronics company,” and that is true in various metrics. For example, Samsung employed 267,937 staff in 2020 , compared with Apple's 147,000 , or TSMC's 56,831 in the same year.

Samsung also plays in all areas of electronics.

Is it the world's leading supplier of memory chips, and the second-largest supplier of non-memory chips. It was, in 2020, the largest supplier of smartphones , shipping 315 million units, compared with number two player Apple's 215 million. It also manufactures consumer electronic products and displays.

But it faces some valuation issues related to its two big competitors.

When it comes to smartphones, Apple has an edge over Samsung in terms of intangible value. According to Interbrand's 2020 survey , Apple is the world's number one brand, while Samsung is No 5.

Moreover, in the chip sector, Samsung falls below TSMC on the premium semiconductor value tree.

“The foundry market is higher value-added, and TSMC dominates foundry,” said a Seoul-based person familiar with the sector, but who spoke anonymously as he did not have permission to speak to the media.

“Samsung is doing well in memory, but memory is cyclical, so maybe that is why the market does not offer a high multiple for Samsung.”

Foundry companies manufacture non-memory chips, including highly advanced systems chips designed by other companies. Samsung largely makes memory chips based on its own designs, but is also a rising player in both in-house non-memory chips and foundry services.

That raises a moral hazard issue.

“Many fabless companies will be afraid of stealing, they don't want a rival manufacturing their own products,” said Park Sang-in, a Samsung watcher at the elite Seoul National University.

“Samsung has potential in logic chips as Apple and Qualcomm want second sources aside from TSMC – they are too powerful – but if Samsung develops their own processor, Qualcomm will be uncomfortable.”

Given the Taiwanese company's sole focus on foundry,“TSMC has never had that conflict of interest,” Park said.

And that is only one example of why Samsung's vaunted scale is not necessarily a plus.

South Korean companies were customarily famous as massive commodities players in multiple sectors – from chips to ships – but lacking a leading edge in any. They were forced to slim down and focus on core competencies by government fiat in the 1997-98 Asian financial crisis, and became global brands in the sectors they specialized in.

Samsung has not yet created a successful platform, nor been a force in software. But in hardware, Samsung is massively diversified across the sprawling electronics space.

Samsung champions like to tout cross-sector synergies and balance. If chips suffer a bad year, Samsung can maintain its earnings equilibrium with cellphones. But counter-intuitively, the scale of the company could be one reason why punters are not giving Samsung premium love – investors prefer focus.

“If you are really excited by handsets you would not buy Samsung, you would buy Xiaomi or Qualcomm, or if it was memory, even though Samsung is the biggest, you'd buy Micron or Hynix,” said Mark Newman, a former Samsung executive and an ex-analyst with Bernstein.

“Samsung tends to get a 'conglomerate discount.' They are a leader in share, cost and technology, but they don't trade at a premium.”

This issue reflects a long-term debate in South Korean business circles as to whether Samsung is better to remain the giant it is, or whether it might add value by splitting into three separate bodies.

The four key business areas of Samsung Electronics“are combined, so is it not that easy to calculate in detail,” said the source familiar with the semiconductor sector.“Investors complain that there is a lot of overlap in business, so the markets don't give high multiples.”

Still, even those who favor the splittist argument might concede that those who argue for the continued economy of scale also have a point. A more troubling issue for investors and potential investors is the opacity that dogs Samsung and other South Korean blue chips.

Lee Jae-young, the de facto head of Samsung and grandson of the corporation's founder, is in jail. Photo: Agencies

'The chaebol discount'

“Major institutional investors these days like to have transparency, and Samsung is essentially opaque,” said Hank Morris, a member of the Seoul Finance Forum, which advises authorities on financial regulatory policy.

Lee Jae-young, the de facto head of the company and the third-generation heir to Samsung, is hardly a charismatic corporate star. In fact, he barely has a public voice.

“JY does not give interviews with analysts or major institutional investors, nor with anyone else – not the local press, not the foreign press nor the financial press,” Morris said.“It all comes down to how many eggs you put in a non-transparent basket, and investors self- limit if transparency is not there.”

Lee is now in jail in a never-ending case connected to Samsung's bribery of National Pension Fund officials in 2015, in order for them to look with favor upon a merger of affiliates. While that merger may have looked sound for Lee's control of the group, prominent shareholders – notably US-based activist fund Elliot – roared that it destroyed value.

That issue extends beyond transparency to cover the corporate governance of the chaebol, or family-controlled conglomerates that are the top dogs in the South Korean economy. Multiple chaebol“royal families” have prioritized their own interests over those of their shareholders, which has led some to say South Korean stocks trade at a“Korean discount.”

It's a contentious claim. For example, Daniel Kim, a tech industry analyst and head of equities research at the Seoul branch of Australian investment bank Macquarie, considers the discount“BS.”

Those who do believe it exists tend to fall into two camps. Some say it refers to the perennial geopolitical risk of North Korea, while others say it refers to corporate misgovernance. SNU's Park is in the latter camp.

“Because of the existence of so-called emperor-style controlling families, which include a lot of illegal and irrational behaviors for the benefit of the controlling family, those are basically the reasons for the Korea discount,” he said.“Best to call it a chaebol discount.”

Now many lobbyists for Lee assert there is an element of political revenge in Lee's fate – he was implicated alongside conservative ex-President Park Geun-hye, who has been jailed for 33 years under the current Moon Jae-in administration.

Even the American Chamber of Commerce in South Korea has called for his release, and it is possible he will be pardoned by the president on August 15, the country's liberation day from Japanese colonialism.

But while there had been hopes in some circles that South Korea's falling tolerance for corruption would erode the“Korea Discount” – assuming it exists – current investment trends are shining a harsh new light.

“Lee is in prison and on trial at the same time, so on governance, Samsung is terrible on an ESG scale,” said Tony Michell, an economist who teaches at the Korean Development Institute.

Visitors look at TV monitors produced by South Korean electronics colossus, Samsung Electronics. Photo: AFP

Is South Korea undercapitalized?

A discount may not simply apply to individual stocks – it may apply to the entire market.

As of 2020, South Korea was the world's 10th largest economy, according to the OECD. However – and despite being home to global brands including Samsung, Hyundai, LG and SK – Korea Exchange's market capitalization in 2021 was 13th worldwide, according to Statista . That pits it behind bourse operators in Canada, India and Saudi.

Investing in stocks has customarily been seen by South Koreans as a risky business. Though this year has seen a noted uptick in the number of retail investors in South Korean equities, traditionally locals have preferred to invest in brick and mortar.

According to the Asia Society this month , more than 80% of South Korean household income is sunk in real estate.

There are also factors limiting how much money foreign investors can place in South Korea.

Few people looking at the nation today – with its democratic government, glittering infrastructure, high-tech gadgetry, prosperous consumers and far-famed popular culture – would consider it an emerging market.

But the highly influential Morgan Stanley Capital Index, or MSCI, does. That means money managers who subscribe to the index will have lower investment ceilings for South Korea than for other developed economies.

The reason is capital controls – the non-convertibility of the won.

“MSCI has a pretty hard rule that your currency has to be fully fungible to be a developed market,” said Morris.“This is one of the prime concerns of the Seoul Financial Forum, we have been urging the government to change its stance on convertibility for years but so far, no dice.”

The issue irks Korea Inc's lobby group, the Federation of Korean Industries (FKI). However, the FKI may be aiming its ire in the wrong direction.

In May this year, according to domestic press reports, the group sent a letter to the MSCI, calling it“inappropriate” to maintain South Korea as an emerging market, given the size of the economy and its globalized stock markets.

The FKI argued that other index providers, including Dow Jones, S & P and FTSE, consider South Korea“developed.”

But the MSCI has not budged, making South Korea the second-largest emerging market after China.

“When you compare Korea with China, where governance really smells, it is really not that bad,” said Michell.“The chaebol-owning families run things their way but this does not impact their business portfolio, and they are not putting their money into big yachts and fast women.”

Regardless of these arguments, currency non-convertibility remains the big barrier. Macquarie's Kim argues that if Seoul loosened its grip on the won, foreign investors would make a bigger splash.

“I think 99% of global investors think Korea deserves more,” Kim said.“The issue is whether Korea wants to be a big fish in a small pond or a small fish in a big pond.”

The“big-fish, small-pond” conundrum is also faced by Samsung.

“Samsung is a very big company, but the Korean market is not that big, it is small,” said the semiconductors expert.

With so few South Korean blue chips on the radar of international money managers, a raised investment ceiling for the country as a whole would almost certainly propel more money into Samsung stock.

But while these factors – and, of course, the much larger overall size of the US economy and capital markets – may explain why Samsung lags so far behind Apple in market cap, they don't explain why it is also behind TSMC, which is listed on the Taipei bourse.

The Korea Stock Exchange, on Wednesday, was valued at $2.3 trillion. The Taiwanese Stock Exchange was worth $1.95 trillion.

Perhaps the answer is simple – Samsung does not need to raise money in capital markets for two reasons.

One: As the national flagship, it has customarily enjoyed privileged access to loans from South Korea's banks. Two: It has a proven ability to pile up mountains of cash simply by engaging in its raison d'etre – doing business.

Samsung is sitting on loads of cash. Photo: AFP / Kim Hong-Ji

Limited capitalization, vast coffers

According to second-quarter consolidated financial statements, Samsung is sitting on a massive war chest bursting at the seams with 94 trillion won ($82 billion) in cash.

“The problem is overcapitalization, not the other way around,” said Macquarie's Kim.“They have the under-leverage problem.”

Yet this cash, which is spread across Samsung's far-reaching geographies, creates different managerial problems. Kim notes that large amounts are tied up in markets, such as China and India, from which it is difficult to repatriate, due to tax issues, for example.

Even so, the more basic problem is how to makes that cash productive. “They have got more money than they know what to do with,” said Morris.

Samsung has indicated it is seeking”non-organic” growth sources, suggesting possible overseas M & As – not an activity that chaebol, with their very strong, localized corporate cultures, have enjoyed great success with.

“It is good to have cash in a downturn, but markets prefer to see a company utilize cash for investments or dividends,” said the chip source.“Investors want more dividends, and Samsung have offered more, but the market is still hungry.”

The bottomless liquidity pool may explain why the company does not need to generate more cash from the local capital market. And the embarrassment created by table-banging activist investors like Eliot and the complications presented by an overseas issuance, may explain why the company does not want to.

Unlike TSMC, the company does not issue American Depository Receipts (ADRs) that represent shares in foreign stock, said the person familiar with the sector. Issued by US banks, ADRs are traded on American exchanges.

Nor, needless to say, has Samsung listed on a bourse outside South Korea.

“If Samsung dual-listed on the New York Stock Exchange, the company would have to follow the rules set by the NYSE,” said Park.“Many, including myself, believe that Samsung cannot comply with all the rules of the NYSE.”

MENAFN04082021000159011032ID1102566538