(MENAFN- NewsBytes) Accelerating the transition to a digital financial ecosystem in the country, Prime Minister Narendra Modi launched the e-RUPI digital payment system today. The new person-specific and purpose-specific payments system offers cashless and contactless payment options in the form of an SMS string or QR code that functions as a prepaid gift voucher. Here's how it works and how to use it.

In this article

- e-RUPI was conceptualized as leak-proof delivery system for state-run schemes

- Voucher-like system works without apps, internet banking, and bank cards

- Bank-generated e-RUPI codes are directly delivered to intended recipients

- Payments will be processed only after beneficiaries receive corresponding services

- e-RUPI works with 11 banks, some fully support the system

- e-RUPI distributes Indian rupee, but things could change soon

- Legal framework changes necessary before CBDCs are introduced

Tamper-proof e-RUPI was conceptualized as leak-proof delivery system for state-run schemes

The e-RUPI system is the brainchild of the National Payments Corporation of India (NPCI), the Department of Financial Services, the Ministry of Health and Family Welfare, and the National Health Authority. The system is built on the NPCI's UPI system. It is expected to ensure leak-proof delivery of government services to beneficiaries under Mother and Child welfare schemes, tuberculosis eradication programs, fertilizer subsidies, etc.

Like vouchers Voucher-like system works without apps, internet banking, and bank cards

The government added that e-RUPI can also be used by private sector entities for employee welfare and corporate social responsibility programs. The system works by sending an SMS string or QR code directly to the beneficiaries. The code can then be used as a prepaid gift voucher to redeem benefits at specific centers without the use of credit/debit cards, mobile apps, or internet banking.

Mechanism Bank-generated e-RUPI codes are directly delivered to intended recipients

Notably, NPCI has onboarded many partner banks that would issue the vouchers. This includes both public and private-sector institutions. To issue benefits using e-RUPI, corporate/government agencies will have to approach these banks with the details of the beneficiaries and the purpose of the payments. Cellular service providers would then be tasked with delivering the vouchers to the beneficiaries uniquely identifiable by their phone numbers.

Effectiveness Payments will be processed only after beneficiaries receive corresponding services

The vouchers will only be redeemable by the beneficiaries in whose name they have been issued. Additionally, the payment can only be processed after the service has been provided to the beneficiary. The biggest advantage of this system is that it can service the rural population since it doesn't need the beneficiary to have a smartphone or app. A trusty phone number should suffice.

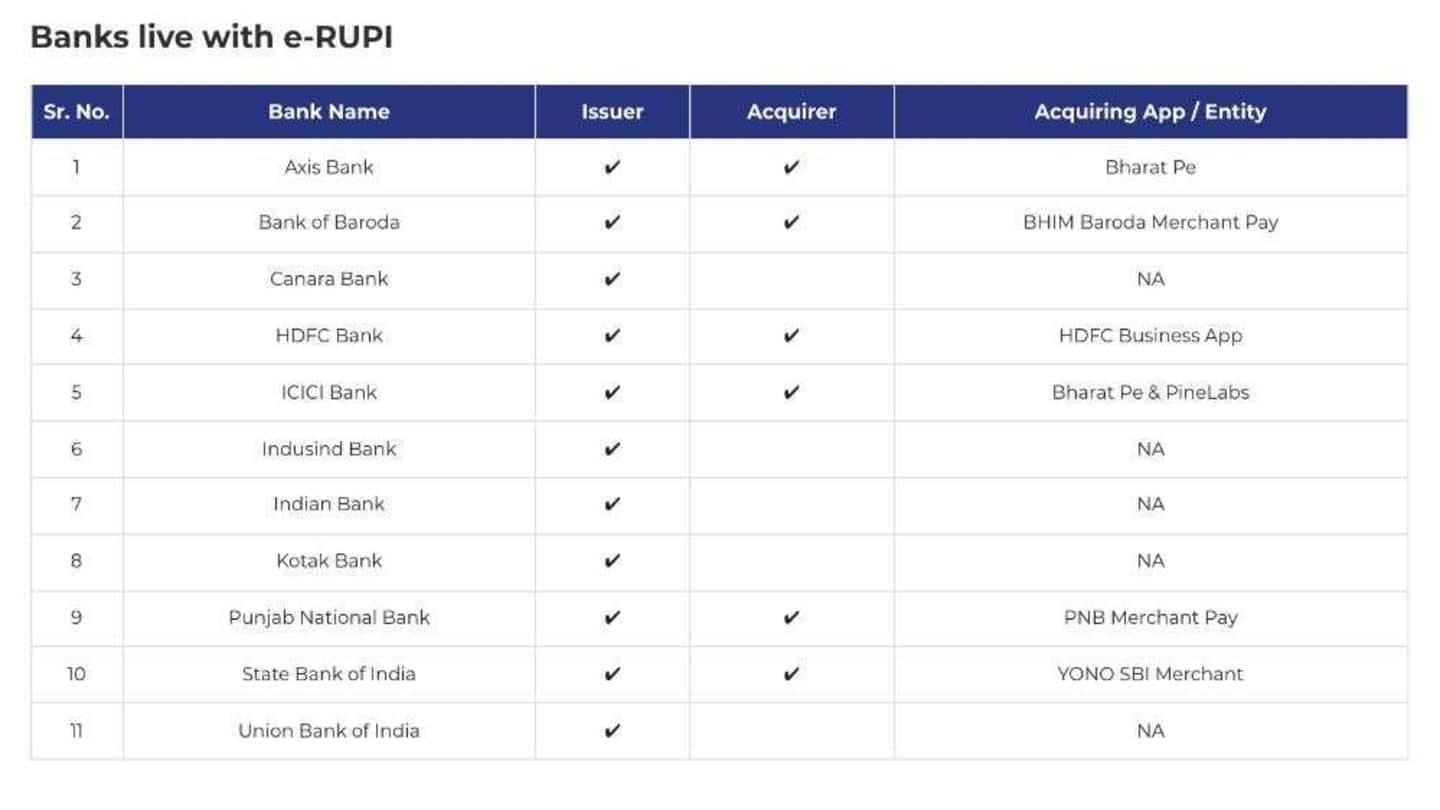

Partner banks e-RUPI works with 11 banks, some fully support the system

For starters, NPCI has partnered with 11 banks, of which Canara Bank, IndusInd Bank, Indian Bank, Kotak Bank, and Union Bank of India can only issue e-RUPI vouchers but cannot accept them. However, major banks like State Bank of India, ICICI Bank, HDFC Bank, and Punjab National Bank fully support both issuing and redemption of e-RUPI vouchers.

Digitization e-RUPI distributes Indian rupee, but things could change soon

At present, e-RUPI uses the Indian Rupee as the underlying asset being dispensed to beneficiaries. This is different from a central bank digital currency (CBDC) system that the government is reportedly developing. The e-RUPI system will be a cornerstone of the CBDC system since it can highlight potential loopholes and shortcomings in the digital infrastructure that is key to the CBDC's success.

Digital currency Legal framework changes necessary before CBDCs are introduced

The RBI said that it is working toward a phased implementation strategy for the CBDCs that would be equivalent to the Rupee. However, the introduction of CBDCs is preceded by sweeping changes to the enabling legal framework since the current provisions are designed for physical printed currency. That said, India hasn't pioneered the voucher system. America and many Asian countries already use similar systems.

MENAFN02082021000165011035ID1102556462

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.