(MENAFN- Asia Times) On Thursday the stock market partied like it was April 15 – not US tax day, but April 15, 1912, when the Titanic sank.

With a worse-than-expected report on producer prices on top of the previous day's blowout Consumer Price Index number, one might have expected inflation fears to drive stock prices down again. Not so: the S & P 500 recovered most of Wednesday's big loss, rising 1.6 percent.

If investors have learned one thing in the past ten years, it is: Don''t fight the Federal Reserve. As the Chart of the Day shows, the valuation of the S & P 500 (its forward price-earnings ratio based on forecasts by the analysts'' consensus) has followed the Federal Reserve's portfolio expansion.

In fact, about 85% of the change in stock market valuation is explained by the Fed's quantitative easing. Inflation-indexed interest rates on government bonds are sharply negative. On average, corporate bonds pay you just a percentage point of yield more than Treasuries, so the return after inflation is still negative.

The entire brass of the Federal Reserve System told the market with one voice that the spike in prices is ''transitory.'' Fed Governors Christopher Waller, Lael Brainard and Richard Clarida, along with several regional Federal Reserve Bank presidents, took to the media to assure the market that the Fed wouldn''t react to a temporary spike in inflation.

''Despite the unexpectedly high CPI inflation report yesterday, the factors putting upward pressure on inflation are temporary, and an accommodative monetary policy continues to have an important role to play in supporting the recovery,'' Governor Waller said.

The facts state otherwise. Shelter alone comprises a third of the Consumer Price Index, and the cost of homes has risen by 12% in the past year while the asking rent of the median apartment is up by 17%. House prices take 12 to 24 months to work their way into the Consumer Price Index, so there's a lot worse to come.

A 10% hike in used car prices was responsible for about a third of Tuesday's CPI increase. But wholesale used car prices are up 20% year-to-date, which means that there's worse to come from autos.

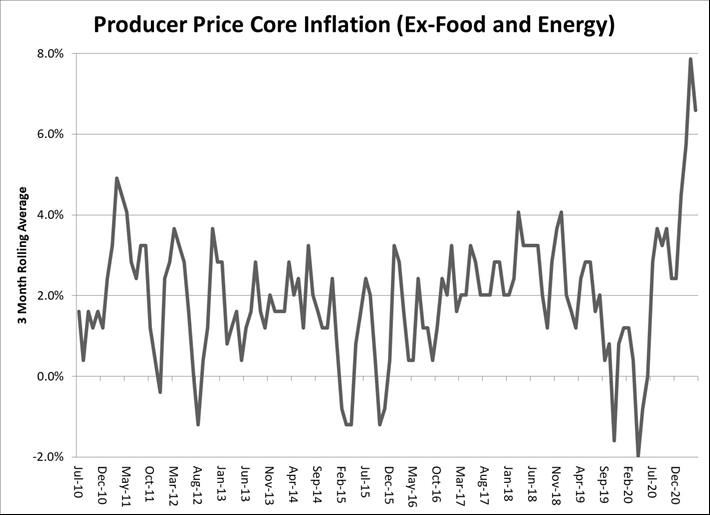

So-called ''core'' (ex-food and energy) producer prices meanwhile are rising at the fastest pace since the series began in 2010. Producer prices feed into consumer prices with a lag, so there's worse to come from a wide variety of rising costs, from industrial chemicals to freight transportation.

The problem is that the Biden Administration is pumping trillions of dollars of helicopter money into an economy crippled by two decades of chronic underinvestment. America's supply chains are creaking and breaking.

So equity investors have a tough choice to make. The Fed is supposed to remove the punch bowl just when the party gets good. Despite massive evidence of alcohol poisoning, the Fed insists that it will leave the punchbowl on the table indefinitely.

Everyone knows it has to stop sometime. But it will stop when the Fed is forced to make it stop – and that won''t happen until inflation persists for some time, perhaps through year-end.

We continue to favor inflation-friendly stocks like energy and financials in this environment. We also like interest-rate hedges, for example ETF's that move inversely with Treasury bond prices.

MENAFN13052021000159011032ID1102078159

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.