(MENAFN- DailyFX)

US Dollar Price, News and Analysis:

- US Jobs report – massive miss against expectations and last month.

- Economic calendar key to the US dollars fortune

The latest US Jobs report rocked the financial market Friday, missing expectations by a huge margin, sending the greenback spinning lower against a range of currencies. The market, expecting one million new jobs to be added to the economy – with some commentators calling for a much higher number – fell sharply as new jobs totaled just 266k in April, while March’s figure was lowered to 770k from a prior 916k.

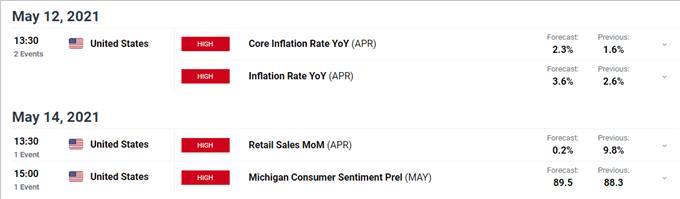

With the Jobs Report now out of the way, next week’s economic calendar will be key with three important data releases which will help shape the short-term trend in the greenback. The latest US inflation numbers, the topic du jour, will be closely watched, especially after US Treasury Secretary, and former Fed chair, Janet Yellen suggested earlier this week that ‘very modest’ rate increases could be needed if inflation starts to become a problem. Ms. Yellen backtracked later, say ‘it’s not something I’m predicting or recommending’, but the soft signal was already in, and spooking, the market. Looking at Friday’s report, rate hikes have been pushed much further back unless inflation runs hot.

US retail sales are expected to pull back sharply from the 9.8% m/m print in March as government stimulus checks and a further re-opening of the economy sent spending sharply higher. Another beat this month – expectations are for a very modest 0.2% m/m increase - would continue to boost the and fuel sentiment in the US economy. Last, but not least, Michigan Consumer Sentiment, an index comparing current and future economic conditions, is released late Friday and is expected to continue its recovery from the April 24, 2020 low print of 71.8.

Michigan Consumer Sentiment

For all market-moving economic data and events, see the

Traders should also be aware of a fresh supply of US Treasury notes and bonds being auctioned off next week which may well cause current UST yields to fluctuate ahead of the sales. On Tuesday, USD58 billion 3-years are on offer, on Wednesday there are USD41 billion 10-years for sale while on Thursday, USD27 billion 30-years hit the street.

The - post-NFP report – is now touching lows seen in lateFebruary and will need a strong batch of data prints to stem further selling.

US Dollar Basket (DXY) Daily Price Chart (September 2020 – May 7, 2021)

What is your view on the US Dollar– bullish or bearish?? You can let us know via the form at the end of this piece or you can contact the author via Twitter .

MENAFN08052021000076011015ID1102049606

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.