(MENAFN- Asia Times) Covid-19 cases worldwide reached a new record level this week, almost entirely due to a geometric rate of increase in India. The pandemic has made shambles of the notion of 'emerging markets.'

Remember the acronym 'BRICs,' coined by a Goldman Sachs economist to characterize Brazil, Russia, India and China? You don't know who's swimming naked until the tide goes out, Warren Buffett likes to say.

The difference between countries that have modernized down to the grass roots and countries where a thin patina of modernity sits atop a largely unchanged traditional society is evident in infection rates – and financial performance.

As the chart shows, the explosion in Covid-19 infection rates came first in Turkey, now suffering 60,000 new cases per day, compared with the previous peak of 30,000 a day in December 2020.

The Philippines reports 10,000 new cases a day, double the previous peak of August 2020.

And India's new cases now stand at nearly 300,000 per day, triple the September 2020 peak.

Of course, lack of testing capacity makes it hard to evaluate these numbers. But they are alarming by any interpretation – even before taking into account the presence of viral variants that appear more contagious, and that may have the potential to defeat existing vaccines.

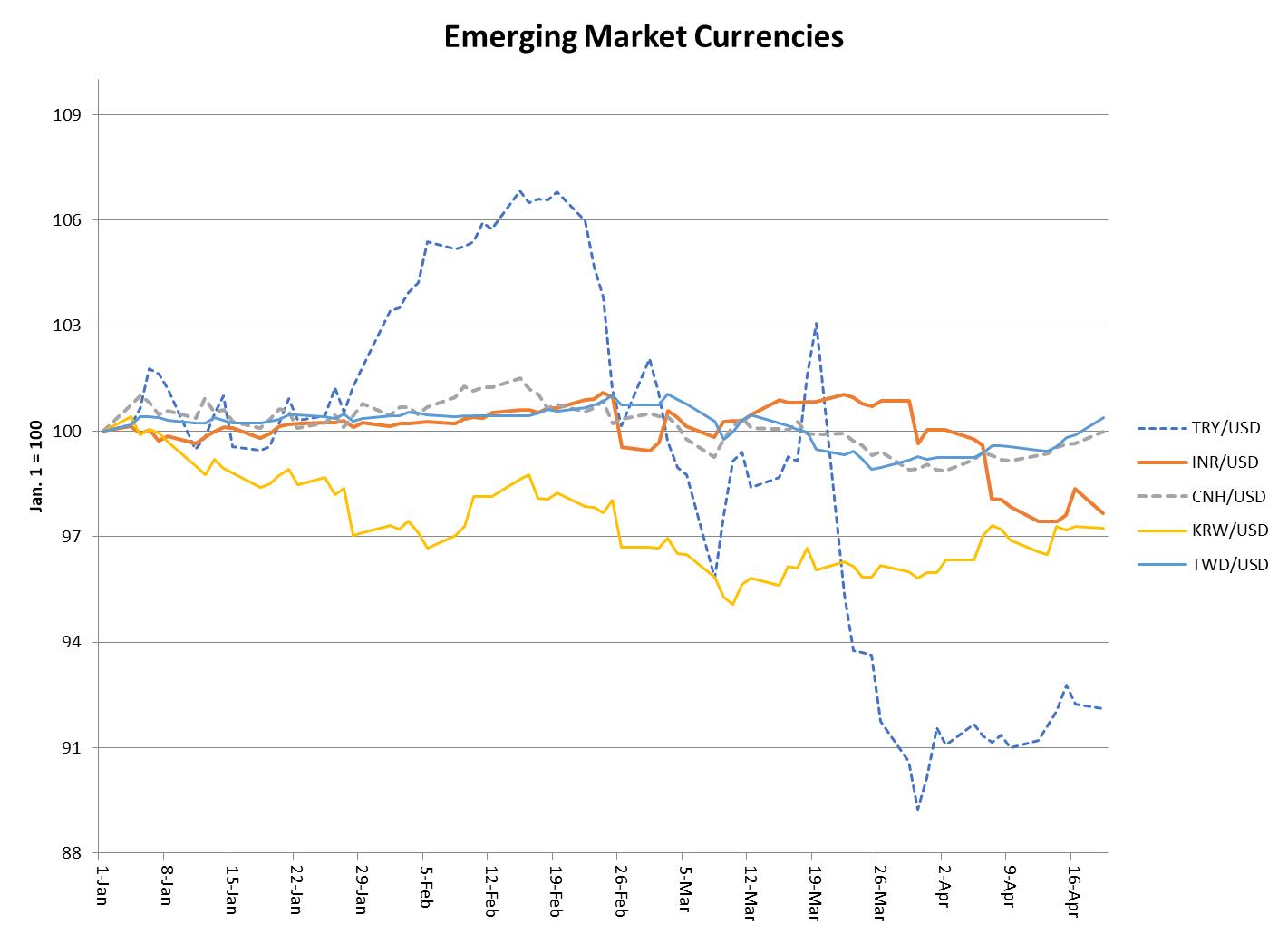

And now financial performance is starting to track the rate of Covid-19 infections.

Turkey, to be sure, has structural economic problems that have resisted a generation of attempted solutions, but the fact that the Turkish lira is the worst-performing major emerging-market currency this year is in large part due to the Covid-19 pandemic.

India's rupee, which seemed poised for gains earlier in the year, fell sharply during the past few weeks as the pandemic ran out of control.

China's infection rate remains minimal – thanks not only to strict controls and occasional lockdowns but also to public-health infrastructure that allowed the Chinese authorities to bring the pandemic under quick control.

Turkey and China have roughly the same per capita GDP (about $10,000 per year), and Turkey has a higher rate of urbanization (76%) than China (61%), but the aggregate numbers conceal vast differences.

Turks who migrate to cities remain peasants in income and habit, with low rates of participation in the formal economy. Turkey's economy is geared toward medium-tech assembly industries, including autos and household appliances. It has a few pockets of high tech supported by a handful of elite universities. Its public infrastructure remains primitive, despite a few showcase projects sponsored by the regime.

China remains eminently investible although, as we have observed recently, de-leveraging has produced some pain in its equity markets.

Until the Covid-19 situation clarifies, there is no reason to dabble in the markets of India, Turkey, Mexico, Brazil, or the Philippines.

MENAFN20042021000159011032ID1101946214

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.