(MENAFN- NewsBytes) While pursuing MBA at IIM Ahmedabad, Bhanu Harish Gurram realized that an average Indian's financial literacy is sub-par. Moreover, financial news is loaded with technical jargon and aimed squarely at someone from the industry.

In conversation with NewsBytes, he explains his journey addressing this problem with one article each day delivered through his 2019 start-up Finshots.

In this article Finshots delivers three-minute reads about everything finance Bhanu is an IIT Roorkee graduate from Andhra Pradesh He realized that the corporate nine-to-five grind wasn't for him Bhanu realized that financial news should be simplified for millennials Bhanu co-founded Finception with fellow IIM alumni in 2018 Finshots just asks for three minutes of your day Finshots received funding from Rainmatter in September 2019 Well-researched content earned Finshots 300,000 subscribers despite zero advertising Ditto by Finshots helps simplify insurance policy selection for readers 'Understand your policy' feature highlights pitfalls in users' existing policies #ditto-would-sell-a- better-policy-rather-than-chase-commissions,

Ditto would sell a better policy rather than chase commissions Youngsters should be taught personal finance at undergrad level: Bhanu Bhanu advises entrepreneurs to prepare to toil during initial years Finshots will continue to simplify financial products for commoners

Quick overview Finshots delivers three-minute reads about everything finance

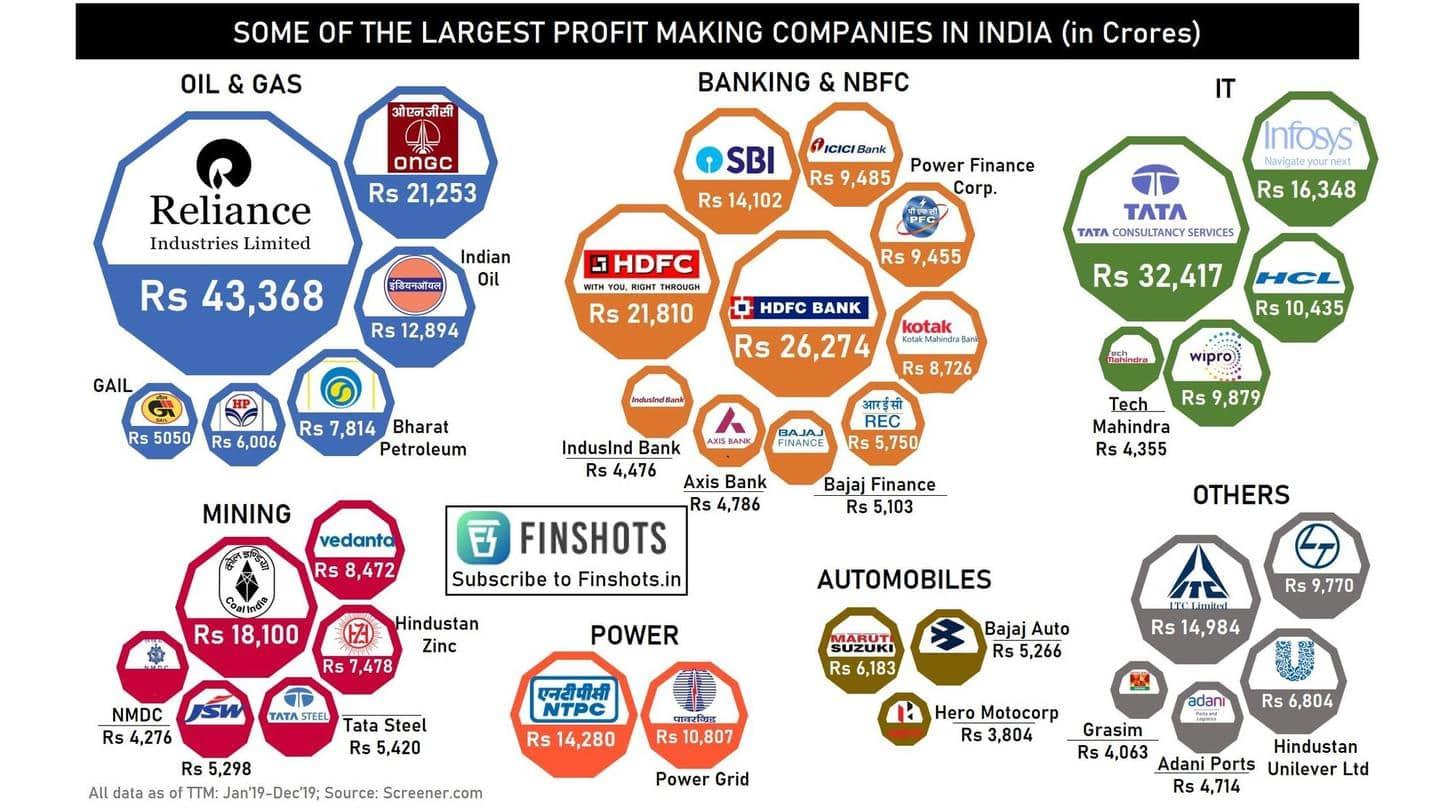

Finshots is an online financial news platform that delivers just one news piece a day, sans the typical terminology-heavy language. The crisp infographic-rich articles take around three minutes to read, and cover wide topics including weekly round-ups. Finshots has over 300,000 subscribers.

More recently, Bhanu launched Ditto, a platform that simplifies insurance policy selection for the average consumer.

Early years Bhanu is an IIT Roorkee graduate from Andhra Pradesh

Bhanu hails from a middle-class family in Andhra Pradesh. After acing the tenth grade exams, he was advised to train and apply for admission to IITs. He graduated from IIT Roorkee in 2013 with a degree in electrical engineering and was hired by Nestle India Ltd. during campus recruitment. Bhanu worked at Nestle for close to three years.

A small cog He realized that the corporate nine-to-five grind wasn't for him

Over time, Bhanu realized that he wasn't adding significant value at work. His role at Nestle was comparable to a small cog in a larger system, he says. He put in his papers in 2016 to pursue an MBA degree at IIM Ahmedabad. During his studies, he interned at Amazon, which further reaffirmed his aversion to the structured corporate life he had just escaped.

Jargon minefield Bhanu realized that financial news should be simplified for millennials

At IIM, Bhanu met Shrehith Karkera and Pawan Kumar Rai. At the time, Rai was working on a way to simplify stock markets for millennials. Diving deeper into the idea, Bhanu understood that financial news from major media houses was loaded with industry-specific terminology, as though it wasn't intended for the masses.

It was clear that millennials must be helped traversing these jargon minefields.

New beginnings Bhanu co-founded Finception with fellow IIM alumni in 2018

After completing his MBA course, Bhanu and his batchmates Shrehith Karkera and Pawan Kumar Rai founded Finception in 2018. Lokesh Gurram, an IIT Delhi graduate, worked for Samsung in South Korea for two years before joining the venture. Finception delivered explanatory long-form stories for a year. The objective was clear: to simplify financial news for the masses.

Food for thought Finshots just asks for three minutes of your day

In 2019, a separate brand called Finshots came about when the team realized that audiences suffered from information overload. Finshots delivers only one news a day. Bhanu explains that readers spend just three minutes each day but in a month, they would have read about 28 topics.

Additionally, a little information at a time acts as food for thought.

Investment Finshots received funding from Rainmatter in September 2019

In September 2019, the start-up received an investment of Rs. 4 crore from Zerodha Broking Ltd.'s fintech fund and incubator called Rainmatter. The founders were also a part of IIM Ahmedabad's IIMAvericks program which gave them a monthly stipend. Nevertheless, Bhanu says Karkera taught part-time classes at coaching institutes like T.I.M.E. and Career Launcher, so Finshots could hire more interns and grow.

The complete picture Well-researched content earned Finshots 300,000 subscribers despite zero advertising

Explaining how Finshots shapes content, Bhanu says the idea is to keep readers abreast with financial news, without the technical mumbo jumbo. He emphasizes that Finshots's content is well-researched and the platform attempts to paint a complete picture for the readers.

The company doesn't spend a dime on advertising, says Bhanu. Finshots's subscriber base has grown to 300,000 just by word of mouth.

Making better choices Ditto by Finshots helps simplify insurance policy selection for readers

Bhanu says that while Finshots educates people about the financial markets, readers are still left asking which financial product is best-suited to their needs. Enter Ditto, the latest product under the Finshots brand aimed at simplifying insurance policies for people.

Bhanu says this is one of the many ways Finshots intends to simplify financial products and financial planning for the masses.

Peace of mind 'Understand your policy' feature highlights pitfalls in users' existing policies

Ditto simplifies legally-worded policy documents and helps people compare insurance policies. The platform uses customers' age and budget to narrow down the search. Bhanu explains that Ditto reads the fine print for customers and lays out what particular policies cover and what they don't. This gives customers peace of mind and helps them structure personal finances better, he says.

No surprises Ditto would sell a better policy rather than chase commissions

Bhanu rightly says that insurance is usually used long after it is purchased. This makes it important that customers know of potential surprises buried in the documentation. He says that Ditto would sell the customer a better policy rather than a sub-par product in exchange for higher commission. He says that this will help the platform grow just like Finshots, through word of mouth.

Starting early Youngsters should be taught personal finance at undergrad level: Bhanu

Talking about financial literacy in the country, Bhanu says youngsters should be taught personal finance at the undergrad level because around that time people start earning from freelancing or part-time jobs. He says that at the very least, people should be taught to buy insurance early on in life when policies are cheaper and they have options to pick from.

Making an impact Bhanu advises entrepreneurs to prepare to toil during initial years

While Bhanu admits that Finshots shoulders responsibility regarding the advice it gives to readers, he says that he is happy to have made an impact. Talking about his journey so far, he observes that things turned out quite differently than he initially anticipated.

People should be ready to put in at least two years of hard work if they start up, he added.

In the pipeline Finshots will continue to simplify financial products for commoners

While Finshots is gradually building a reputation for simplicity and credibility, Bhanu says that it is the least he could do to help commoners steer clear of scams, misinformation, and the pitfalls of poor financial planning. Outlining future goals, he says that either through content on Finshots or via products such as Ditto, the team will continue to simplify financial products for customers.

MENAFN17042021000165011035ID1101933483

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.