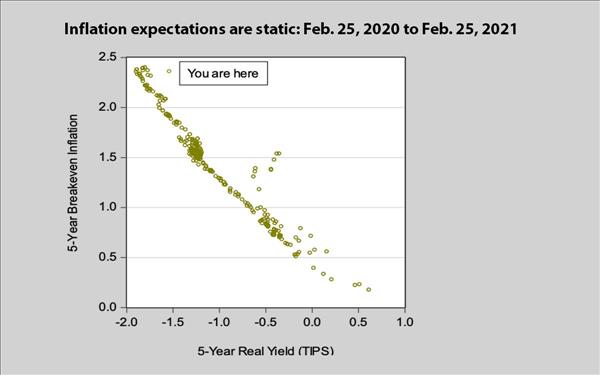

(MENAFN- Asia Times) The 'taper tantrum' of 2013 ubiquitously mentioned as a precedent for today's market was prompted by soaring inflation. As the first chart makes clear, inflation expectations embedded in Treasury bond yields went vertical as the Fed brought real interest rates down.

Nothing like that has happened this year: the real yield (as measured by the yield on the 5-year Treasury Inflation-Protected Security) moved in a straight line with inflation expectations (so-called 'breakeven inflation').

Central banks scrambled to talk the market down from the ledge on Feb. 26 after a pop in Treasury yields send world equity markets plunging. They aren't worried about inflation, as Fed Chair Jerome Powell has said repeatedly. But they are worried about financing a US budget deficit equal to 16% of GDP, something the US hasn't seen since the Second World War.

A run out of Treasury bonds in the face of $3.5 trillion of new Treasury bond issuance this year could get bloody. So the Fed will do whatever it takes to keep bond buyers coming in rather than bailing out.

MENAFN26022021000159011032ID1101669524

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.