(MENAFN- DailyFX) Advertisement US Dollar Forecast Overview:

- The US Dollar has proved buoyant thus far in 2021. Will it continue now that administrations have changed? Depends on fiscal stimulus.

- A quieter economic calendar leaves the US Dollar susceptible to news-driven event risk over the rest of the week.

- Retail trader positioning sees more gains for the US Dollar vis-à-vis EUR/USD , GBP/USD , and USD/JPY rates.

US Dollar Hanging in There

The US Dollar (via the DXY Index) is trading higher as President Joe Biden officially begins his first term in office, yet still remains below the weekly open. Stronger risk appetite, as evidenced by ever-higher US equity prices, has diminished some of the recent demand for the US Dollar. But the US Dollar may not be done with its attempt to climb higher, in what appears to be a short covering-driven move: US fiscal stimulus speculation will be back in the headlines soon.

While Democrats now control both chambers of Congress and the Presidency, the slim margin in the Senate (50-50, with Vice President Kamala Harris serving as the tiebreaking vote) means that every aspect of the Biden stimulus plan will come under the microscope. Seemingly benign events like a Republican Senator holding up cabinet-level confirmation hearings may be interpreted as the canary in the coal mine for a difficult negotiating process when the next round of stimulus talks finally arise.

The impulse of US fiscal stimulus is likely to remain the key driver for the US Dollar in the coming days amid an otherwise quieter US economic calendar through the end of the week.

[

...]

DXY PRICE INDEX TECHNICAL ANALYSIS: DAILY CHART (January 2020 to January 2021) (CHART 1)

In our first DXY Index forecast update of 2021 , it was noted that 'if the DXY Index moves above 90 at all this week, then there could be a ‘reset' in the market that sees the DXY Index return to the latter of these descending trendlines as January unfolds, potentially trading into the mid 91s before turning lower anew.

The DXY Index continues to trade higher after finding a topside breakout from the bullish falling wedge relative to the November high. Thus far, the DXY Index's advance has been stunted by the December 21 inverted hammer candle high at 91.02. However, the DXY Index remains well-below the descending trendline from the March and November 2020 highs.

The DXY Index's momentum is slowly turning more bullish, will price above the daily 5-, 8-, 13-, and 21-EMA envelope, which remains inbullish sequential order. Daily MACD is still rising and nearing its signal line from below, while daily Slow Stochastics are still in overbought condition.

[

...]

DXY PRICE INDEX TECHNICAL ANALYSIS: WEEKLY CHART (January 2011 to January 2021) (CHART 2)

The longer-term view established in the latter half of December 2020 remains valid: 'we thus view the latest development with hesitation, particularly when viewed in context of the longer-term technical damage wrought in recent months; the DXY Index remains below its multi-year uptrend, and could be working on a multi-year double top. So long as the rebound remains below 91.75, the DXY Index outlook remains bearish on a longer-term basis.

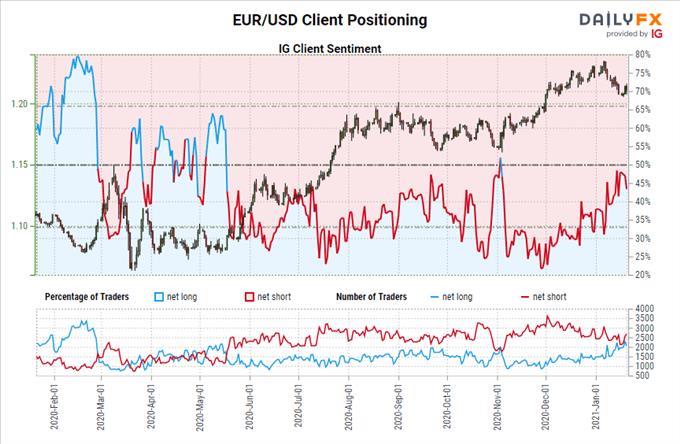

IG Client Sentiment Index: EUR/USD RATE Forecast (January 20, 2021) (Chart 3)

EUR /USD : Retail trader data shows 46.02% of traders are net-long with the ratio of traders short to long at 1.17 to 1. The number of traders net-long is 4.01% higher than yesterday and 5.64% higher from last week, while the number of traders net-short is 6.68% lower than yesterday and 3.40% lower from last week.

We typically take a contrarian view to crowd sentiment, and the fact traders are net-short suggests EUR/USD prices may continue to rise.

Yet traders are less net-short than yesterday and compared with last week. Recent changes in sentiment warn that the current EUR/USD price trend may soon reverse lower despite the fact traders remain net-short.

--- Written by Christopher Vecchio, CFA, Senior Currency Strategist

MENAFN21012021000076011015ID1101466689

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.