(MENAFN- Baystreet.ca) Natural gas could be the single most important energy source of the next decade.

For investors who want both profitability and longevity, the natural gas sector is the very first place to look.

The math is simple:

Big banks are fleeing oil.

The coal industry is in terminal decline.

And renewable energy is years or even decades away from meeting global demand.

So while the multi-trillion-dollar ESG trend is cutting off financing for oil and coal, the global energy transition to renewables is helpless without a bridge fuel.

A fuel that is abundant, cleaner than oil or coal, and cheap to produce.

That fuel is natural gas.

Big money is banking on this bridge.

And the trend has already begun, with some players racing to one of the most profitable natural gas frontiers in the world… Colombia.

A combination of skyrocketing demand and falling supply have left the Latin American nation desperate for the world's most sought after transition fuel, making it a great case study for the coming global natural gas resurgence.

In fact, while prices for natural gas in the U.S. have spent most of the year below $2 per thousand cubic feet, prices in Colombia have climbed as high as $7/mcf.

That's a 250% premium on a resource that costs roughly $0.60 to produce and transport to the market. [seems low as the proposed pipeline tariff is $.70]

Colombia truly is a producer's paradise...

And right now, a top exploration and production team in this most profitable venue is NGX Energy International ( TSX.V:GASX ; OTCMKTS:PENYF ).

With one of the most successful management teams in the Colombian E & P space, working in one of the best natural gas frontiers on the planet, NGX is likely to be the first of many natural gas success stories in the coming years.

Natural gas is the near-term future of energy, and Colombia's government is fully behind it.

Colombia: The Big Margin Bonanza

Colombia's natural gas prices are some of the highest in the world. Imagine gas contracts at $5/mcf and above, or spot prices that reach to $7/mcf.

And then imagine near-zero volatility.

Three charts tell the whole story:

Colombia's natural gas supply is about to be cut in half at a time when demand is set to rise over 50% ...

Existing producers can't keep up ...

And prices are strong: Take a look at the prices (after transportation) that Canacol (CNE-TSX), one of the biggest producers in Colombia, has been getting for its gas, consistently:

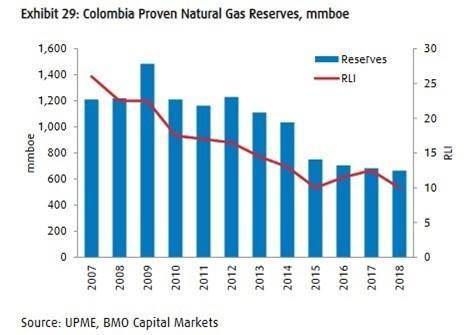

Now, consider that amid the skyrocketing demand, declining supply and high natural gas prices, Colombia's proven reserves are dwindling … Proved gas reserves are almost half what they were in 2009.

That means it desperately needs another major discovery.

It's the perfect setup for NGX Energy ( TSX.V:GASX ; OTCMKTS:PENYF ) ... which is parked right next to one of Colombia's biggest producing natural gas plays … giant Ecopetrol's Chuchupa:

And that play is in major decline.

Nothing more poignantly illustrates Colombia's natural gas conundrum than this. Chuchupa has produced nearly half of the country's gas--for 35 years.

3 Blocks--All of Them Potential Kingmakers for Colombia

NGX Energy owns 3 key natural gas assets that could end up generating many times in cumulative cash flows compared to its current market valuation…

#1 Maria Conchita

Maria Conchita is a 32,518-acre block located in the Guajira Basin in Colombia's Caribbean coast.

This is the block right next to giant Chuchupa to the north.

NGX has completed 3-D seismic testing on Maria Conchita and successfully re-entered its first well hitting substantial gas projected to yield 14 - 20 MMcf/d with 2 additional re-entry wells and 3 new wells planned in the near-future.

#2 SN-9

The SN-9 block is NGX's flagship exploratory 311,353-acre block, in which NGX has a 72% interest.

And again, it's the closelogy. This block is adjacent and upstructure to Canacol Energy, Colombia's largest independent gas producer, which has booked natural gas reserves of 624 Bcf and production of 200 MMcf/d.

The news flow on this one should also be fast-paced, with NGX about to start drilling and seismic already indicating gas.

It will be drilling up to four conventional exploration wells here in the initial phase to depths of 4,500 - 6,000 feet and at a budgeted cost of $4.5-6 million per well for completion.

But the full drill will be 36 wells and NGX is hoping to hit up to 1 trillion cubic feet based on management's best-case estimates.

NGX ( TSX.V:GASX ; OTCMKTS:PENYF ) is anticipating potential production from this block at 180 MMscfd based on management estimates. That means it's another potential Canacol--but with a tiny market cap company, so the upside potential is huge if it reaches its target.

#3 Tiburón

Tiburon is NGX's blue sky exploratory project with huge potential capacity of up to 2Tcf of natural gas (based on management estimates) thanks to its location sitting in the same basin as Chuchupa and surrounded by massive offshore discoveries Orca and Perla.

NGX is estimating Tiburón's peak production potential at 400 MMscfd--for 10 years. That's twice the production of Canacol, Colombia's largest independent gas producer.

It's a huge undertaking, which means NGX will be looking for a multinational partner to help develop this one after shooting 2D seismic.

Getting It Across the Finish Line

When you're sitting on a huge natural gas play in a country that desperately needs new reserves, with soaring demand, declining supply and solid prices, one thing that can trip you up as a junior E & P company is management.

In this case, we're looking at a management team that's made shareholders a ton of money before.

Even better: They've done it before in Colombia.

NGX's board has some serious pedigree. They come as former executives of the region's largest oil and gas company, PDVSA (Petróleos de Venezuela).

They know oil and gas on a supermajor level, and they know politics, and Latin America, too.

They not only know Colombia, but they built up a major Colombian oil and gas play--Pacific Rubiales--14,000 bpd to 330,000 bpd in only four years.

In 2006, Rubiales--led by the same people--acquired a massive land package in Colombia, in La Creciente. It was the second largest natural gas field in the entire country.

NGX executive chairman Ronald Pantin held various senior executive positions at PDVSA and was CEO and Executive Director of Pacific Rubiales from 2007 until 2016.

Federico Restrepo-Solano is the Director & President of NGX, and partner and corporate director at Qvartz Capital Partners private equity fund. He's got more than 25 years of experience mining, oil and infrastructure, including as Senior VP of Corporate Affairs at Frontera Energy, President of Colombia's national federation of coal producers, Fenalcarbón. Importantly, he's also served as a representative for Colombia before the Inter-American Committee on Ports, in Washington DC.

Serafino Iacono, NGX CEO, has over three decades of experience in capital markets and public companies and has raised more than $4 billion for numerous natural resource projects internationally. He serves as an Executive Chairman at Gran Colombia Gold Corp and former Co-Chairman and Executive Director of Pacific Rubiales, among a long line of other high-profile executive roles.

These guys are the Who's Who of major energy plays in Latin America. They've done this in Colombia before. They're likely to do it again--only this time the play could be even bigger. It's less remote. It's surrounded by huge producers. It's got a lot more infrastructure in place. And the macro picture for Colombian natural gas is a producer's dream.

If it all comes together, they are positioned to become the kingmakers of Colombia's natural gas industry.

The Clock Is Ticking in Natural Gas Ground Zero

This is an exploration story.

That means it's higher risk and higher reward.

But it's hard to find a story with higher potential reward than this, and management with a track record that strikes confidence.

And any good exploration story has to have news flow. This one does. The NGX ( TSX.V:GASX ; OTCMKTS:PENYF ) announcement calendar is expected to be packed ...

NGX stock has already climbed over 300%… but could go much higher if there is good news once the drill bit starts hitting the ground.

Colombia is desperate for new natural gas, and it's great to work with a government faced with soaring demand and declining supply.

This is Colombia's official transition fuel, which means that so much is at stake.

Colombia only has proven natural gas reserves of 3.1 Tcf (as of 2019). But Colombia's National Hydrocarbons Agency (ANH) president Armando Zamora estimates the real potential in the ground to be "eight times higher ".

NGX ( TSX.V:GASX ; OTCMKTS:PENYF ) is on the ground floor of this potential, sitting on three highly prospective blocks, where even a single discovery will likely provide this tiny market-cap company with major cash flow. And where a single discovery has the potential to establish NGX as one of the most important companies on the Colombian oil and gas scene.

Other companies to watch during the energy transition:

TC Energy Corporation (TSX:TRP) is a major oil and energy company based in Calgary, Canada. The company owns and operates energy infrastructure throughout North America. TC Energy is one of the continent's largest providers of gas storage and owns and has interests in approximately 11,800 megawatts of power generations. It's also one of the continent's most important pipeline operators.

With TC Energy's massive influence throughout North America, it is no wonder that the company is among one of Canada's highest valued energy companies. Investors can feel comfortable with the company due to its huge and diverse portfolio, and continuing eye for success.

Though Canadian oil has had a particularly rough go at it this year, Canadian Natural Resources (TSX:CNQ) , kept its dividend intact after swinging to a loss for the first half of the year, while Canada's producers are scaling back production by around 1 million bpd amid low oil prices and demand. Though Canadian Natural Resources kept its dividend, it withdrew its production guidance for 2020, however. It also said it would curtail some production at high-cost conventional projects in North America and oil sands operations and carry out planned turnaround activities at oil sands projects in the second half of 2020.

While the Canadian energy giant has seen its stock price slump this year, it could provide a potentially opportunity for investors as oil prices rebound. It is already up over 170% from its March lows, and it could still have some more room to run.

Suncor Energy (TSX:SU) has adopted a number of high-tech solutions for finding, pumping, storing, and delivering its resources. Not only is it big in the oil sector, however, it is a leader in renewable energy. Recently, the company invested $300 million in a wind farm located in Alberta.

When the rebound in crude prices finally materializes, giants like Suncor are sure to do well out of it. While many of the oil majors have given up on oil sands production - those who focus on technological advancements in the area have a great long-term outlook. And that upside is further amplified by the fact that it is currently looking particularly under-valued compared to its peers.

Enbridge, Inc (TSX:ENB), based in Canada's oil sands capital Alberta, is an energy delivery company focusing on transportation, distribution, and generation of energy. Operating in the United States and Canada, Enbridge owns and operates the largest natural gas distribution network in Canada and the longest crude oil transportation system in the world. Founded in 1949, investors can feel confident in Enbridge's experience and market know-how.

Though not strictly dealing in commodities, Enbridge's diversified assets and connections to a variety of industries position the company as solidified player in many Canadian investors' portfolio.

Cenovus Energy (TSX:CVE) is most known for its oil business, but it is also actively investing in renewable energy. More importantly, however, is that it has set truly ambitious sustainability goals for itself, aiming to cut emissions by a massive 30% in just 10 years.

This is one of the most actively traded stocks on the TSX. The potential is certainly here for this oil company, so for investors who are bullish on the return of the oil markets, this is a perfect pick in the Canadian market.

By. Nikki Taylor

**IMPORTANT! BY READING OUR CONTENT YOU EXPLICITLY AGREE TO THE FOLLOWING. PLEASE READ CAREFULLY**

Forward-Looking Statements. Statements contained in this document that are not historical facts are forward-looking statements that involve various risks and uncertainty affecting the business of NGX. All estimates and statements with respect to NGX's operations, its plans and projections, size of potential gas reserves, comparisons to other gas producing fields, oil prices, recoverable gas, production targets, production and other operating costs and likelihood of gas recoverability are forward-looking statements under applicable securities laws and necessarily involve risks and uncertainties including, without limitation: risks associated with oil and gas exploration, timing of reports, development, exploitation and production, geological risks, marketing and transportation, availability of adequate funding, volatility of commodity prices, imprecision of reserve and resource estimates, environmental risks, competition from other producers, government regulation, dates of commencement of production and changes in the regulatory and taxation environment. Actual results may vary materially from the information provided in this document, and there is no representation that the actual results realized in the future will be the same in whole or in part as those presented herein. Other factors that could cause actual results to differ from those contained in the forward-looking statements are also set forth in filings that NGX and its technical analysts have made, We undertake no obligation, except as otherwise required by law, to update these forward-looking statements except as required by law.

Exploration for hydrocarbons is a speculative venture necessarily involving substantial risk. NGX's future success will depend on its ability to develop its current properties and on its ability to discover resources that are capable of commercial production. However, there is no assurance that NGX's future exploration and development efforts will result in the discovery or development of commercial accumulations of natural gas. In addition, even if hydrocarbons are discovered, the costs of extracting and delivering the hydrocarbons to market and variations in the market price may render uneconomic any discovered deposit. Geological conditions are variable and unpredictable. Even if production is commenced from a well, the quantity of hydrocarbons produced inevitably will decline over time, and production may be adversely affected or may have to be terminated altogether if NGX encounters unforeseen geological conditions. Adverse climatic conditions at such properties may also hinder NGX's ability to carry on exploration or production activities continuously throughout any given year.

DISCLAIMERS

ADVERTISEMENT. This communication is an advertisement and is not a recommendation to buy or sell securities. Oilprice.com, Advanced Media Solutions Ltd, and their owners, managers, employees, and assigns (collectively "the Company") has been paid by the profiled company to disseminate articles and certain banner ads, but is not being paid for this specific article. This compensation is a major conflict with our ability to be unbiased, more specifically:

This communication is for entertainment purposes only. Never invest purely based on our communication. We have been compensated by NGX to conduct investor awareness advertising and marketing for TSXV:GASX. Therefore, this communication should be viewed as a commercial advertisement only. We have not investigated the background of the company. Frequently companies profiled in our alerts experience a large increase in volume and share price during the course of investor awareness marketing, which often end as soon as the investor awareness marketing ceases.

The information in our communications and on our website has not been independently verified and is not guaranteed to be correct.

SHARE OWNERSHIP. The owner of Oilprice.com owns shares of this featured company and therefore has an additional incentive to see the featured company's stock perform well. The owner of Oilprice.com will not notify the market when it decides to buy more or sell shares of this issuer in the market. The owner of Oilprice.com will be buying and selling shares of this issuer for its own profit. This is why we stress that you conduct extensive due diligence as well as seek the advice of your financial advisor or a registered broker-dealer before investing in any securities.

NOT AN INVESTMENT ADVISOR. The Company is not registered or licensed by any governing body in any jurisdiction to give investing advice or provide investment recommendation. ALWAYS DO YOUR OWN RESEARCH and consult with a licensed investment professional before making an investment. This communication should not be used as a basis for making any investment.

PAST PERFORMANCE IS NOT INDICATIVE OF FUTURE RESULTS. Investing is inherently risky. Don't trade with money you can't afford to lose. This is neither a solicitation nor an offer to Buy/Sell securities. No representation is being made that any account will or is likely to achieve profits similar to those discussed.

MENAFN2210202002120000ID1101000676