(MENAFN- Iraq Business News) By Ahmed Tabaqchali, CIO of Asia Frontier Capital (AFC) Iraq Fund .

Any opinions expressed are those of the author, and do not necessarily reflect the views of Iraq Business News .

Market Review: "The Dog Days of Summer"

The subdued "dog days of summer" were further subdued this year as the month of August was shortened by an Eid holiday that rolled into an extended lockdown at its start, and the beginning of the annual 40-day Arbaeen pilgrimage at its end.

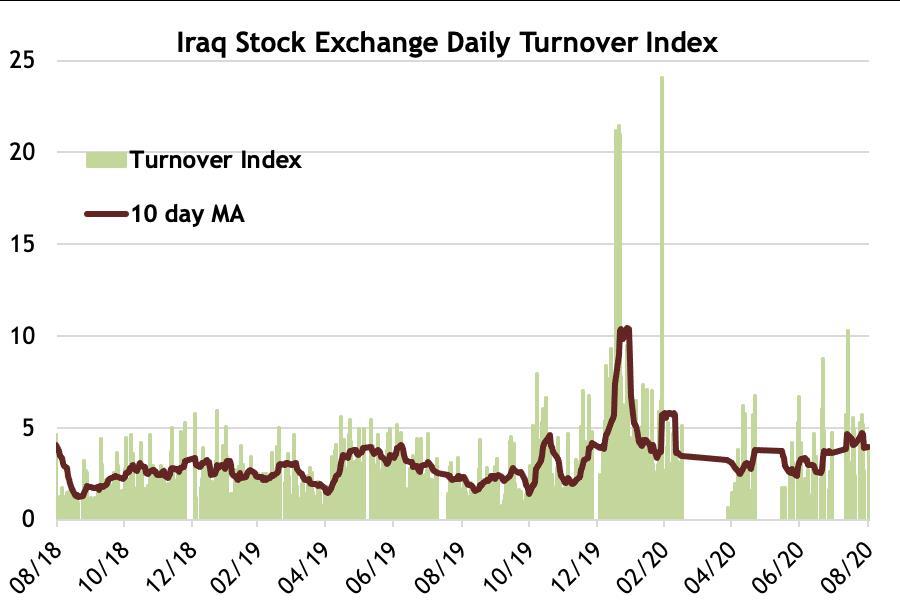

The market, as measured by the Rabee Securities RSISX USD Index (RSISUSD), rose 3.8% during August's 12 trading days, and is up 30.6% from the multi-year lows in April. The market's daily turnover continued to gradually increase after the declines following the lockdown starting in March - an increase encouraged by the market's better tone since then (chart below).

Banks, which led the market's recovery, were mostly flat, after their recent strong performances, and will likely experience some profit-taking during September given the expected slowdown in activity coinciding with the Arbaeen pilgrimage which finishes in the first week of October. While the pilgrimage will likely be more low-key than normal this year, given social distancing rules, early reports on the activities of pilgrims are mixed on the adherence to these rules.

(Source: Iraq Stock Exchange, Asia Frontier Capital, data as of August 31st. Turnover excludes block transactions)

The Iraq Stock Exchange (ISX) continued with its investors' Zoom conference calls initiative in which ISX-listed companies discuss their recent earnings results and outlook for the year. Among the leading companies recently presenting were Pepsi bottler Baghdad Soft Drinks ( IBSD ) in late July, mobile operator AsiaCell Communications ( TASC ) and Commercial Bank of Iraq ( BCOI ) both in August.

The initiative, a first for the ISX and its listed companies, has been promising in increasing investor understanding of the companies, their business plans, and outlooks - especially taking into account the effects of the disruptions to economic activities post-lockdown. This is a welcome development that is vastly different from the usual dearth of meaningful information beyond the annual reports and spartan quarterly reports which has traditionally led to rumours filling the information vacuum. The ISX intends to continue this initiative over the coming quarters and for the ISX-listed companies to proactively engage with investors.

Economic activity this summer seems to have mostly returned to pre-lockdown levels as can be seen from the Google mobility chart below. Encouragingly, this happened even after taking into account the effects of two Eid holidays in which each holiday was bundled into a 10-day lockdown, and the recent rolling Thursday-Saturday lockdowns which cut the working week to four days from five.

(Baseline is the median, for the corresponding day of the week, during January 3rd - February 6th,

Source: Google, data as of August 28th)

This recovery in activity built up gradually over the last few weeks as can be seen above, and it would have likely contributed to the healing of the economy from the shock brought about by the lockdown. However, it should be noted that the decline in activity as a result of the initial lockdown in March-May would have likely been more precipitous than shown in the above chart as activity in the retail, transport and hospitality sectors was subdued during the baseline period given the chilling effects of the dramatic events at the beginning of the year. More so, these events came on the back of a slowdown induced by the continued countrywide demonstrations since October 2019. Nevertheless, the recovery in economic activity is a positive development should it be sustained.

While there isn't any new economic data that might provide a fuller picture, the decline from 4.8% to 3.1% in the premium of the market price over the official price of the Iraqi Dinar (IQD) versus the USD is a positive added to the mobility data above - even though the current premium is much higher than the 1.2% that it averaged in 2019. Moreover, it is too early to conclude whether the decline in the premium is due to an easing of the flight to safety, i.e. the hoarding of the USD, or, if it's due to weak demand for imports - an important indication of economic activity and consumer confidence given the high dependence on imports to satisfy consumer demand.

(Source: Central Bank of Iraq, Iraqi Foreign Exchange Houses, Asia Frontier Capital, data from January 1st to August 28th)

The market's recovery over the last four months notwithstanding, arguably, the claim made here in May still stands that the 'worst-case' prognosis for Iraq in the wake of the carnage brought about by COVID-19 will not be as bad as originally feared, however the market continues to price it in.

Please click here to download Ahmed Tabaqchali's full report in pdf format .

Mr Tabaqchali ( @AMTabaqchali ) is the CIO of the AFC Iraq Fund, and is an experienced capital markets professional with over 25 years' experience in US and MENA markets. He is a non-resident Fellow at the Institute of Regional and International Studies (IRIS) at the American University of Iraq-Sulaimani (AUIS), and an Adjunct Assistant Professor at AUIS. He is a board member of the Credit Bank of Iraq.

His comments, opinions and analyses are personal views and are intended to be for informational purposes and general interest only and should not be construed as individual investment advice or a recommendation or solicitation to buy, sell or hold any fund or security or to adopt any investment strategy. It does not constitute legal or tax or investment advice. The information provided in this material is compiled from sources that are believed to be reliable, but no guarantee is made of its correctness, is rendered as at publication date and may change without notice and it is not intended as a complete analysis of every material fact regarding Iraq, the region, market or investment.

MENAFN0709202002170000ID1100760543

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.