(MENAFN- Caribbean News Global)

Mr Victor Poyotte is a retired public officer with twenty-six years public service experience, a decade of regional project management work with the CIDA funded OECS Eastern Caribbean Economic Management Programme (ECEMP) and the British funded Caribbean Overseas Territories Government Accounting Reform (COTGAR) Project, both of which were implemented by the firm CRC Sogema of Montreal Canada.

By Victor Poyotte

I have been a member of the Saint Lucia Civil Service Cooperative Credit Union (SLCSCCU) for over four decades now and served the society in the capacities of treasurer and president. I also served as a representative of the SLCSCCU on the board of the Cooperative League and as a National Delegate to the Caribbean Confederation of Credit Unions (CCCU). When a member of one of our credit unions wrote a note to me expressing concerns about the attempt by the government of Saint Lucia to entice the Credit Union society to buy government bonds, in the era of COVID-19 health and economic crisis, I decided to pen this article.

The full text of the note from the member reads as follows:

Concern of the Credit Union member

'I am a longstanding member of the largest rural credit union in Saint Lucia. As an educator, I also belong to the Teachers Credit Union. My husband is a member of the Civil Service Association (CSA) Credit Union. After the banks (especially RBTT) hiked their fees and charges on savers, we moved our loans and other transactions to the Credit Unions.

'I was very disturbed to learn that the prime minister and his ministry of finance have been holding meetings up to last week Thursday, May 21 to pressure the Credit Unions to rescue his failing "blended payments" scheme and to buy up more bonds and treasury bills. Especially, as the banks have rejected his offer and at a time when the representatives of the workers are battling the government to pay public servants their monthly salaries in cash, and on time; how can the Credit Unions which hold the savings of the same workers, the self-employed and the poor (pensioners, dependents, etc.) entertain any invitation to finance the ruling party's " bondage scheme "? Will this not be a stab in the back by these presidents?

'I know that our Credit Unions have been offering "skip a pay" and "waivers" on their mortgages, loan repayments, etc., to members who have lost their jobs or whose wages have been reduced. As this economic squeeze continues, I am sure more and more members will be withdrawing from the savings and fixed deposits they had set aside for "rainy days" and other projects like their children's university education and house repairs. The hurricane season starts next month. Do they understand that this means for members' savings and loans? Will they have enough cash flow to service our needs through a second COVID-19 wave (God forbid) with the planned arrival of stayover tourists in June and soon after the cruise ships?

'Sir, my family's investments with these credit unions were intended to allow us and other members to benefit from loans when needed. The managers and loan officers at the office have always assured us that our monies are safe, our information is confidential and that [we] customers are the owners. So, if this is true, why are they not calling the members to an Annual General Meeting (AGM) and putting this matter before us? We the members of Credit Unions need our dividends and patronage refunds urgently now, anyway, rather than see our monies diverted into scary government bonds.

'Lastly, Independent Senator Dr Adrien Augier reminded us a few weeks ago that citizens and corporations that invested in CLICO and BAICO have not yet received their monies [back]. We were assured that these insurance companies were properly supervised. Dr Augier also warned the government about the dangers of regularly dipping its hands into the workers' monies entrusted into the National Insurance Corporation (NIC) for the social security of the masses' welfare in sickness and old age.

'As members, we need to hear from the Credit Union Boards and the Supervisory Committees we elected; and from the Credit Union Registrar who is paid to protect our monies, whether credit unions will succumb like the NIC to the demands of the Allen Chastenet-led government. The Credit Unions' top priority is to serve and help their members who own permanent shares. Besides, the government of Saint Lucia is not a Credit Union member.'

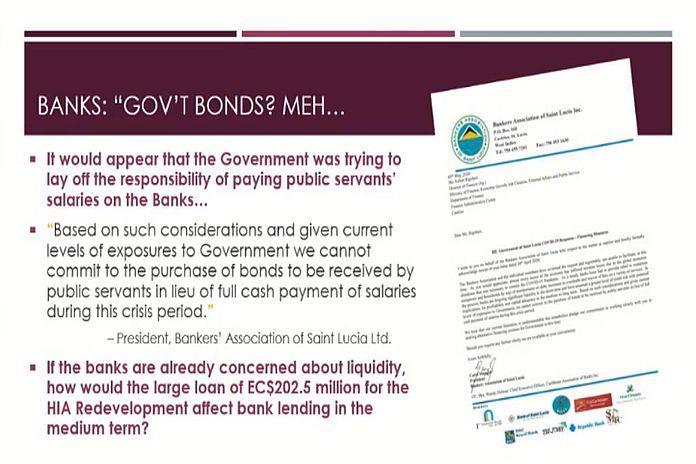

Government of Saint Lucia proposal to commercial banks

The general role of commercial banks is to provide financial services to the general public, business, and government institutions thereby ensuring economic and social stability and sustainable growth of the national economy. Earlier this month, the Bankers Association turned down a similar proposal from the government indicating that 'the banks have had to provide relief to several companies and households by way of a moratorium on debt, increases in overdrafts and waiver of fees on a variety of services.' The Bankers Association also stated that 'given the levels of exposures to government, we cannot commit to the purchase of bonds to be received by public officers in lieu of full cash payment of salaries during this crisis.'

Government proposal to the Credit Unions

The letter from the director of finance to the Cooperative Credit Union League stated that the government of Saint Lucia is looking to raise up to $63 million over a period of three months. Two key parts of the terms outlined in the proposal to the League include a) a maturity period ranging from one to five years at an interest rate of three-six percent based on the tenor of the instrument.

Credit unions serve members in a defined common bond of association. They encourage members to develop a regular habit for savings and to engage in prudent borrowing for purchasing property, generate business (entrepreneurship) meet healthcare needs, educational and social needs.

The bye-laws of the Credit Unions provide for the investment of their funds in stock, debentures or securities issued by the government. However, such investments must be in keeping with the investment policy and portfolio approved by a majority of members at an AGM. This is paramount, especially, when its term in office is up and elections are due, the board of directors of any Credit Union is not empowered to commit the savings of members to any 'bond bailout scheme' developed by the government without the endorsement from the general membership.

Concerns of Credit Union members

Based on my discussions with other members of the Credit Union movement, several concerns need to be addressed. Under the Financial Services Regulatory Authority (FSRA) Act, the Authority is empowered to supervise Credit Unions to ensure safety, soundness, and sustainable growth of Credit Unions.

As the regulator of the Credit Unions movement, the FSRA should look into this proposal and make an authoritative statement on the risk implications as follows:

The latest report of the FSRA published in September 2018, contains a risk-based assessment of all 16 registered societies with ratings that include segments: one at low risk - three at medium-low risk - two with a moderate risk, three at medium-high risk - and seven at high risk; Many of the Credit Unions are already holding a significant amount of investment in government bonds and treasury bills and there is need to determine whether the current level of exposure allows them to invest further in such instruments; The FSRA must also be aware that the last review conducted by the Eastern Caribbean Central Bank (ECCB), the bank indicated that the largest Credit Unions had already invested too heavily in government bonds and treasury bills and recommended that these Credit Unions diversify their investment portfolios to reduce their concentration risk; In order to help members address some COVID-19 issues, the Credit Unions have already granting generous moratoria, waivers, reduction, and interest on the principal; administrative fees and charges. If the credit unions were to accede to the request made by the government of Saint Lucia, they would be hard-pressed to comply with the liquidity requirements stipulated in the Cooperative Societies Act. My assessment

It is important to note that the government has had a very poor record of financial management during the last four years. Four examples of the lack of prudence in managing the finances of the country are as follows:

- First, the government wasted millions of taxpayers funds on the financing of a dubious project like the Desert Star Holdings (DSH) in Vieux Fort;

- Next, the government agreed to have the so-called DSH investor to place millions of dollars of revenue generated from the 'sale of Saint Lucian passports in an escrow account overseas, under his control';

- Then, the political directorate decided to facilitate access to millions of dollars in funds from the contributions of employers and employees to the National Insurance Corporation (NIC) to Cabot, a private billionaire investor golf project in Cap Estate, against the expressed wishes of residents of that community, environmentalists and other interest groups;

- Recently, the government approached local commercial banks with a debt financing proposal which was promptly rejected;

- Now , the government is asking public officers many of whom are members of the Credit Union movement to 'lend me some of your savings so that I can pay you.'

Given the record of this government, and in light of the threat by the economic development minister, Guy Joseph, to reduce the size of the public service, any attempts by the Credit Unions to invest in bonds described as very high risk at this point.

It is also worthy of note that our Credit Unions operate on the principles of democratic control and good governance - Section 39 of the Act stipulates that all credit unions should convene their AGM no later than June 30, 2020. It is therefore imperative that the regulator clear the air on whether the current boards still have the authority and mandate to make such a decision or need to present the proposal to members and shareholders for consideration.

To my mind, the government of Saint Lucia and minister for finance proposal is a preposterous request which all members should reject outright ; because, if any of the Credit Union members were to be made redundant, it is those savings that will help you cushion the blow.

The Credit Unions are the last wall of financial safety for close to 100,000 working class and poor Saint Lucians and their families.

MENAFN3005202002320000ID1100245520

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.