Virus Pushes Global Economy Toward First Contraction Since 2009 | Daily Outlook

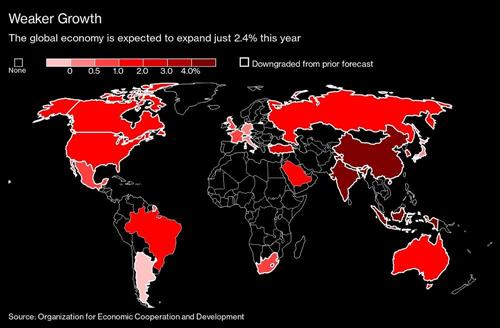

(MENAFN- FxPro) Global economic growth will sink to levels not seen in over a decade as the coronavirus outbreak hammers demand and supply, challenging central banks and governments to respond to a fast-changing situation, according to the OECD. As central banks around the world try to calm a market panic, the Paris-based group also warned of possible global contraction this quarter. It cut its full-year growth to just 2.4% from 2.9%, which would be the weakest since 2009.

Things could get a lot worse, the OECD said in its report, 'Coronavirus: The World at Risk.' The cover of the outlook featured a picture of an empty airport baggage hall, an emblem of the outbreak that's led to widespread travel restrictions, and shut businesses and schools. The forecast assumes the China-centered epidemic peaks this quarter and outbreaks in other areas 'remain mild and contained.' If it proves longer lasting and spreads through Asia, Europe and the U.S., the economic impact would be severe. Global growth in that case would be just 1.5%, with the possibility of recessions in economies including Japan and the euro area.

The extent of the hit makes it particularly difficult for policy makers to react. In many countries, central banks have a depleted arsenal after already cutting rates to record lows and spending billions in asset purchases. The nature of the challenge also means that monetary policy may not be the most appropriate tool, as targeted spending and economic policy are needed, OECD chief economist Laurence Boone said.

There are some measures governments can and must take immediately, the OECD said. Those could include fiscal support for health services, flexible work regimes with guarantees on take-home pay, providing liquidity to the financial sector, targeted support for affected industries like tourism, and looser state aid and fiscal rules. Beyond Coronavirus, other significant risks continue to weigh on the global economic outlook. Those include trade and investment tensions that 'remain high and could spread further,' and uncertainty over Brexit. The recent slump on financial markets also adds to vulnerabilities from high debt levels and deteriorating credit quality, the OECD said.

Virus Pushes Global Economy Toward First Contraction Since 2009, Bloomberg, Mar 2

Legal Disclaimer:

MENAFN provides the

information “as is” without warranty of any kind. We do not accept

any responsibility or liability for the accuracy, content, images,

videos, licenses, completeness, legality, or reliability of the information

contained in this article. If you have any complaints or copyright

issues related to this article, kindly contact the provider above.

Comments

No comment