(MENAFN- DailyFX) Crude Oil Prices, US Dollar, Japanese Yen, Swiss Franc – TALKING POINTS US Dollar , Yen,Swiss Francmay rise on risk aversion Saudi Aramco drone strike over weekend was catalyst Iran risks likely to escalate as EU is put in a hard spot

Learn how touse political-risk analysis in your trading strategy !

The US Dollar,Japanese Yenand Swiss Franc may rise in the upcoming session as result of a premium being placed on anti-risk assets in an environment of market-wide uncertainty.Crude oil pricessurged over 18 percent early into Monday's trading session after news broke over the weekend thatSaudi Arabia's Aramco oil processing facility was hit by drone strikes over the weekend .

US officials have blamed Iran for ordering the attack via a proxy in Yemen. This comes as the EU is attempting to negotiate with officials in Tehran to not abandon the 2015 nuclear agreement after the US recently shredded the deal and reimposed sanctions. European officials have attempted to incentivize Iran to adhere to the stipulated guidelines through employing a non-US Dollar denominated trade mechanism known as INSTEX.

The Special Purpose Vehicle (SPV) was created with the intention of stoking economic activity in Iran to counter the growth-impeding affect of US sanctions. However, it appears these efforts have not only been in vain but have caused a further deterioration in US-EU diplomatic relations. Iran's alleged involvement the attack against Saudi Arabia makes Brussels-Tehran negotiations that much more difficult.

Learn how to strategize around political risk here!

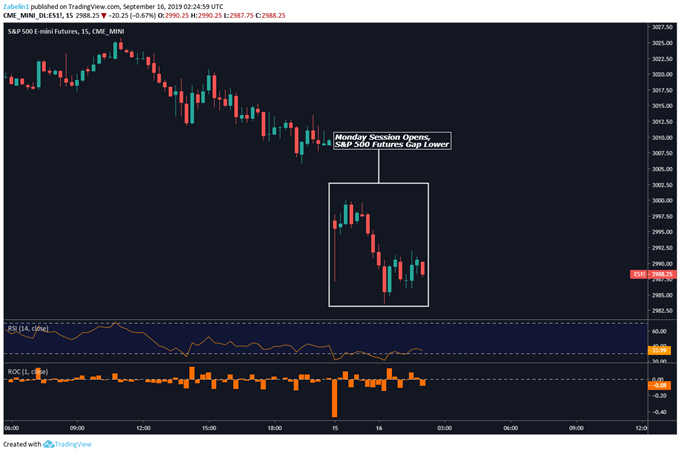

Chart of the Day:S & P 500Futures Gap Lower on Saudi Aramco Attack – Will it Echo into European Equity Markets?

S & P 500 futures charted created usingTradingView

FX TRADING RESOURCESJoin a free webinar andhave your trading questions answered Just getting started?See our beginners' guide for FX traders Having trouble with your strategy?Here's the #1 mistake that traders make

--- Written by Dimitri Zabelin, Jr Currency Analyst for DailyFX.com

To contact Dimitri, use the comments section below or@ZabelinDimitri on Twitter

DailyFX

MENAFN1609201900760000ID1099008841

Legal Disclaimer:

MENAFN provides the information “as is” without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the provider above.